1. 引言

小额信贷作为信贷市场的重要组成部分,它是一种以城乡低收入阶层为服务对象的小规模的金融服务方式,小额信贷旨在为社会提供获得就业和发展的机会。它既是一种金融服务的创新,又是一种扶贫的重要方式[1] 。

小额信贷最早出现于上个世纪70年代的孟加拉国,随后被许多发展中国家和地区为摆脱贫困而借鉴兴起。我国的小额贷款最早开始于20世纪90年代中期,自2005年小额贷款公司试点以来发展迅猛,截止2013年底,全国已成立8000多家初具规模的公司。Morduch (1997)认为小额信贷是一种主要面向贫困农民,为其提供低额度、无担保、高利率的信贷模式[2] [3] ;Liza Calenzuela (2001)认为正规金融机构进入小额信贷领域存在的非常多的优势,比如在提供存款和支付业务两个方面经验等[4] ;Nimal A. Fermando (2003)认为,小额信贷非政府组织转变成正规的金融机构既可以确保其机构的可持续性,还通过扩展业务增加收益[5] ;二是转变成正规金融机构以后如何开展小额信贷业务;曾翰文(2011)探索并成功构建了信用评分审批系统,很好的解决的小额信贷机构面对大量的个体工商户进行高效、量化的识别其信用风险难的问题[6] ;谢金楼(2012)在经过对江苏省小额贷款公司的调查研究过程中发现:制约其发展因素主要有后续资金供给不足、保障体系不完善、法律地位不明确和经营管理水平低等[7] 。

2. 理论模型

对小额信贷的分析关键在于在贷款履约与否的判断,贷款履约与否可以描述为一个典型的Bernoulli实验,它是一个有两个结果的实验,成功的概率为 ,失败的概率为

,失败的概率为 。我们构建简单的理论模型来对贷款还款与否进行分析,我们的分析思路为首先构建Logistic回归模型,再根据最小误判代价准则来分析小额贷款公司的贷款决策。

。我们构建简单的理论模型来对贷款还款与否进行分析,我们的分析思路为首先构建Logistic回归模型,再根据最小误判代价准则来分析小额贷款公司的贷款决策。

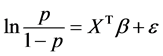

Logistic模型可以被定义为:

(1)

(1)

式中 是系数矩阵,

是系数矩阵, 是观测矩阵,

是观测矩阵, 是服从正态分布的随机向量,即

是服从正态分布的随机向量,即 。

。

根据Logistic回归的结果,我们可以获得每个贷款申请企业的还款概率,而对贷款申请企业进行贷款决策时需要确定一个合适的阈值,接受还款概率高于阈值的贷款申请,拒绝还款概率低于阈值的贷款申请,许多小额信贷公司对阈值的设定大都采取主观设定,或直接确定为50%。在这里,我们将最小误判代价准则引入Logistic回归,确定模型中的阈值。

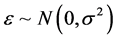

在一个两分类的问题中,我们的目的是最小化由于误判带来的损失的期望(expected cost of misclassification,即ECM),ECM可以表示为:

(2)

(2)

式中, 为将第1类数据判别为第2类数据的代价,

为将第1类数据判别为第2类数据的代价, 为将第2类数据判别为第1类数据的代价,

为将第2类数据判别为第1类数据的代价, 为第

为第 类的先验概率,

类的先验概率, 是第

是第 中的样本

中的样本 误判到第

误判到第 类的条件概率。

类的条件概率。

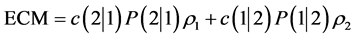

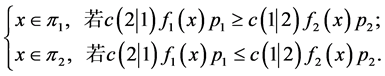

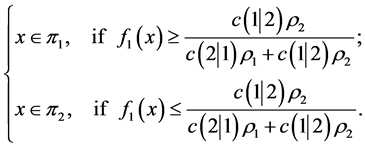

最小平均判别代价准则是使ECM达到最小的判别规则。即为:

(3)

(3)

又因为 所以可得:

所以可得:

(4)

(4)

根据式(4),我们可以通过样本的密度函数,误判代价比和先验概率比来判断样本应该属于哪一类。

3. 实证分析

根据上述理论,我们将利用Logistic回归和最小误判代价准则来分析企业的贷款决策。我们实证分析采用的数据来源于XY小额信贷公司的149个贷款数据,其中履约客户数据127个,违约客户数据22个,贷款总金额为38,730万元,其中履约客户贷款金额32,280、违约客户总金额为6450万元,违约客户贷款金额占比为16.65%。

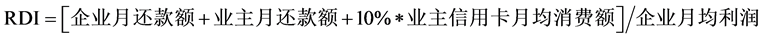

3.1. 收入贷款比(RDI)模型的预测结果

XY小额信贷公司采用的是RDI分析模型,即通过分析贷款企业的利润和贷款利率来进行贷款决策,企业RDI的计算公式为:

(5)

(5)

根据式(5)对149个样本进行分析,并将RDI的阈值设定为90%,即当计算出的RDI > 0.9时,对客户不进行贷款;RDI < 0.9时,进行贷款。RDI模型的预测结果如表1所示。可以发现,RDI模型的预测结果较为一般,不仅将超过1半的履约客户判断成为违约客户,同时也有55%的违约客户被判断成为履约客户,因此,无论是从企业经营所承受风险还是获得的收益的角度看,RDI模型都不是最优模型。

3.2. Logistic回归

利用Logistic回归对149个数据进行分析,并根据AIC原则筛选模型,可以得出下列分析模型:

(6)

(6)

其中, 代表前年度期末流动负债总额,

代表前年度期末流动负债总额, 代表前年度主营业务收入,

代表前年度主营业务收入, 代表前年度主营业务成本,

代表前年度主营业务成本, 代表前年度管理费用,

代表前年度管理费用, 代表申请的贷款金额。可以发现,模型当中参数大都显著。

代表申请的贷款金额。可以发现,模型当中参数大都显著。

3.3. 最小误判代价(MMC)模型

根据式(6) logistic回归分析的结果,通过调整误判代价比,即 和

和 的比值来确定合适的阈值,从而做出是否的贷款决策。根据历史经验数据,1份违约贷款的损失大致等于40份履约贷款的收益,但这个比值,每年都略有不同。为处理不同的风险水平,我们将提出以下三种模型:中等风险模型、高风险模型和低风险模型。

的比值来确定合适的阈值,从而做出是否的贷款决策。根据历史经验数据,1份违约贷款的损失大致等于40份履约贷款的收益,但这个比值,每年都略有不同。为处理不同的风险水平,我们将提出以下三种模型:中等风险模型、高风险模型和低风险模型。

在中等风险模型中,我们采用的误判代价比为40比1,对还款概率大于87.38%的客户进行贷款,对还款概率小于87.38%的客户不进行贷款;在高风险模型中,我们采用的误判代价比为30比1,对还款概率大于83.86%的客户进行贷款,对还款概率小于83.86%的客户不进行贷款;在低风险模型中,我们采用的误判代价比为50比1,对还款概率大于89.64%的客户进行贷款,对还款概率小于89.64%的客户不进行贷款。

MMC模型的预测情况如表2所示,高风险模型向客户提供了更多的贷款,与此同时更多的违约客户也被误判成为了履约客户,而低风险模型的情况正好相反,中等风险模型的预测情况位于二者之间。

3.4. 改进的最小误判代价(AMMC)模型

过去学者对贷款决策的分析主要是通过是否贷款来进行贷款决策,然而在现实生活中,我通常要面对贷款金额的确定的问题。因此,我们进一步提出改进的最小误判代价模型,通过对式(6)中 的调整来修正贷款金额。

的调整来修正贷款金额。

表3为改进的最小误判代价模型的预测结果,其中可能违约客户是指根据历史数据对该类客户全额贷款时该类客户违约,而对该类客户进行部分贷款时,其还款状况无法判断。可以发现,在AMMC模型中,除了全额贷款这一结果外,相对其他模型还多出了部分贷款这一情况,这就使得小额贷款公司能够对部分企业的贷款金额进行调整,而不是单单只进行贷款与不贷款的决策。通过部分贷款的形式,小额信贷公司能够进行更多的贷款,从而获得更高的收益,其中部分贷款就是AMMC模型相对MMC模型多发放的贷款,在中等模型条件下,贷款客户数增加了46个,发放贷款金额提高了43.35%,在高风险模

Table 1. Prediction performance of RDI model

表1. RDI模型预测数据结果

Table 2. Prediction performance of MMC model

表2. 最小误判代价模型的预测情况

型条件下,贷款客户数增加了30个,发放贷款金额提高了25.11%,在低风险模型条件下,贷款客户数增加了54个,贷款发放金额提高了58.57%。

表3中,违约贷款和可能违约贷款指的是发放的全部贷款和部分贷款中可能存在风险的情况,可能违约贷款指的是指根据历史数据对该类客户全额贷款时该类客户违约,而对该类客户进行部分贷款时,其还款状况无法判断。

贷款增加后,违约贷款和可能违约贷款占总体贷款的比例依然较小,在中等风险模型中,违约贷款比例为4.62%,可能违约贷款比例为4.21%;在高风险模型中,违约贷款比例为7.06%,可能违约贷款比例为3.16%;在低风险模型中,违约贷款比例为3.34%,可能违约贷款比例为3.92%。

在表4中我们考虑了可能违约客户转变成违约客户的概率分别为25%、50%、100%时,AMMC模型与MMC模型的盈利能力和风险控制能力的比较。在盈利能力上,即使可能违约客户转变成违约客户的概率达到100%时,AMMC模型的收益率都显著优于MMC模型;在风险控制上,可能违约客户转变成违约客户的概率达到50%时,AMMC模型的违约客户贷款占比与MMC模型较为接近。

因此,不难看出AMMC模型相对于初始的MMC模型有了较大的改进,以中等风险模型为例,可能违约客户转变成违约客户的概率为25%时,AMMC模型的净收益为MMC模型的1.51倍,违约贷款的比例为MMC模型的85.52%;可能违约客户转变成违约客户的概率为50%时,AMMC模型的净收益为MMC模型的1.43倍,违约贷款的比例为MMC模型的101.51%;可能违约客户转变成违约客户的概率为100%时,AMMC模型的净收益为MMC模型的1.27倍,违约贷款的比例为MMC模型的133.18%。

4. 模型比较

AMMC模型相对其他模型来说,存在着许多优势,具体来看,主要包括以下几个方面。

Table 3. Prediction performance of AMMC model

表3. 改进最小误判代价模型的预测情况

Table 4. The comparison of AMMC model and MMC model

表4. AMMC模型与MMC模型的比较结果

注:()中内容代表可能违约客户转变成违约客户的概率。

4.1. 较强的盈利能力

如表5所示,改进的最小误判代价模型的盈利能力大幅高于其他模型,从净收益来看,AMMC模型的净收益大约是RDI模型的3.27倍,MMC模型的1.43倍,AMMC模型的净收益大幅高于其他模型;从收益率看,AMMC模型的收益率较RDI模型提高了5.03%,较MMC模型降低了0.05%,虽然MMC模型的收益率较高,但AMMC模型与它的差距不大。综合考虑净收益和收益率两个指标,不难看出,AMMC模型较其他两个模型来说在盈利能力上有了较大的提高。

4.2. 良好的风险控制能力

如表6所示,AMMC模型的风险控制能力与MMC模型相当,都大幅优于RDI模型,从违约贷款金额看,AMMC模型的违约客户贷款金额为RDI模型的52.28%,MMC模型145.48%,MMC模型的违约贷款金额最小;从违约贷款比率看,AMMC模型较RDI模型下降了10.9%,较MMC模型提高了0.1%,AMMC模型与MMC模型差距不大。综合来看,MMC模型的风险控制能力最好,但AMMC模型与MMC模型的差距较小。

4.3. 良好的适应性

从模型是硬性角度看,AMMC模型和MMC模型都能针对不同风险状况,调整模型面临的风险水平,所以二者相对RDI模型都具有了更广泛的适应性。但是,相对MMC模型,AMMC模型还能根据不同客户自身的风险来调整贷款的金额,通过对低风险客户增加贷款金额,高风险客户减少贷款金额来增加贷款收益,因此,改进的最小误判代价模型有更好的适应性。

5. 结论

本文通过将最小误判代价准则引入Logistic回归,完善了过去学者对于Logistic回归中,还款概率阈值设定的问题,提出了基于Logistic回归和最小误判代价准则的MMC模型和AMMC模型,并针对不同风险调整模型的参数,相相继得出中等风险模型、高风险模型和低风险模型。通过分析可以发现,AMMC模型相对其他模型具有许多优势。

1) AMMC模型可以为小贷公司带来更多的收益,通过Logistic回归和最小误判代价准则得出的

Table 5. The comparison of AMMC model and other models in profitability

表5. AMMC模型与其他模型的盈利能力比较

注:AMMC模型中所采用的可能违约客户转变成违约客户的概率为50%,MMC模型和AMMC模型采用的风险水平均为中等风险水平,历史经验决策模型是XY小额信贷公司自己根据历史经验进行决策后的结果。

Table 6. The comparison of AMMCM and other models in risk control ability

表6. AMMC模型与其他模型的风险控制能力比较

注:AMMC模型中所采用的可能违约客户转变成违约客户的概率为50%,MMC模型和AMMC模型采用的风险水平均为中等风险水平,历史经验决策模型是XY小额信贷公司自己根据历史经验进行决策后的结果。

MMC模型相对于XY小额信贷公司采用的RDI模型有了较大的提升和进步。通过对贷款金额进一步调整得到AMMC模型,AMMC模型通过向部分客户提供部分贷款的形式,在企业经营风险并未显著增加的情况下增加企业的收益,因而AMMC模型拥有较强的盈利能力。

2) AMMC模型可以降低小贷公司的经营风险,无论是在违约贷款总金额还是违约贷款占总贷款比例角度看,AMMC模型相对RDI模型都有了较大的进步和提升,虽然AMMC模型较MMC模型有一定的差距,但差距并不显著。

3) AMMC模型有了更进一步的适应性,相对RDI模型来说,AMMC模型可以通过中等风险模型、高风险模型和低风险模型三种方式来适应不同的风险状况。相对MMC模型来说,AMMC模型也可以针对不同客户调整贷款金额,从而使得模型的适应性更强。

基金项目

云南省省院省校教育合作咨询共建重点学科——统计学(云教科[2013]24号),云南财经大学研究生创新基金项目,云财研创[2014]10。