1. 引言

QFII (Qualified Foreign Institutional Investors)即合格境外机构投资者。QFII制度是在货币未实现完全可自由兑换资本项目也尚未开放的背景下,一个国家有限度地引入外资、打开本国资本市场的一种制度安排。我国于2003年引入了QFII制度,随后QFII在我国证券市场上取得了长足的发展,现已成为我国证券市场上第二大机构投资者,仅次于本土证券投资基金。截至2014年第三季度,我国QFII机构总数达260家,持股总市值规模超过了650亿元。表1显示了2003~2014年度QFII在我国证券市场上的增长情况。

近年来,QFII依靠其优质的价值投资理念获得了较好的业绩,而且其投资行为对我国证券市场也产生了不容忽视的影响,完全超过了其市值规模和持股比例的范围。由于QFII成立时间比较短,国内相关研究仍处在起步阶段,关于QFII对证券市场的影响目前观点不一。对QFII交易策略和行为特征的进一步研究分析,不仅有助于帮助我们更为具体地了解QFII投资行为的特征,同时也有利于更有效的监督和引导QFII,完善我国的QFII制度,推动证券市场的稳健运行。

传统金融学将投资者看作是“完全理性”的,而行为金融学则认为投资者是“有限理性”的。按照有限理性的人性假说,行为金融学揭示了包括羊群效应、规模效应、惯性和反转策略在内的多种投资行

Table 1. Approved quota and number for QFII from 2003

表1. 2003年以来QFII的审批额度及数量

数据来源:国家外汇统计局(统计时间截止2014年11月28日)。

为,并且逐渐发展出了具有一定影响力的投资者行为理论。基于惯性或反转策略的投资行为隐藏着丰富的套利机会,有着重要的理论和实践价值。

本文将从行为金融学的角度出发,来考察QFII在我国证券市场上的交易行为及其对股票收益的影响,主要着眼于其惯性或反转策略行为。

2. 研究方法

2.1. 惯性与反转策略的内涵

惯性策略或反转策略表现在投资者针对股价信息的“非理性”反应,起源于股票收益率的惯性现象或反转现象。惯性现象是指短期内股价朝着相同方向变动,即收益率较高的股票会在其后一段时间仍高于收益率较低的股票;反转现象则指收益率较低的股票在其后一段时间将会发生逆转,从而超过收益率较高的股票。由此,投资者可按照股票以前的价格预测其未来的变化,相应的投资策略为惯性策略或反转策略。前者指买进过去表现较好的股票,卖出过去较差的股票。后者则正好相反,即卖出过去较好的股票,买进过去较差的股票。依据行为金融学,反转交易策略是一种逆向思维方式,为了纠正对股市的过度反应;惯性交易策略则正好相反,为了纠正股市的反应不足。

国外学者率先验证了惯性和反转现象的存在性,并且发现采取惯性或反转交易略可获得显著的超额收益。对这些现象最早的研究起源于De Bondt和Thaler (1985) [1] ,他们以1926年1月至1982年2月的普通股为研究对象,采用赢家–输家组合的套利策略,发现采用反转交易策略能够取得超额利润。之后,许多学者相继发现了类似的“异常现象”,其中Jegadeesh 和Titman (1993) [2] 的研究最为著名。通过对1965~1989年在美国证券交易所和纽约证券交易所上市交易的股票回报率进行研究,Jegadeesh和Titman (1993) [2] 发现了中短期内存在惯性效应。

国内学者对惯性和反转策略的研究起步较晚,关于惯性和反转策略对股票收益的影响的结论也并不一致。高飞和黄静(2005) [3] 发现我国基金的交易频率较高,将近百分之九十的基金采取了惯性交易策略;并且惯性程度越强,收益就越高;禹湘和谢赤等(2007) [4] 等对1999年1月至2006年3月的投资行为展开研究,发现我国证券投资基金普遍采取惯性交易策略,并且组合收益随惯性程度同方向变动;李学峰和文茜等(2011) [5] 的研究发现基金的惯性投资行为不利于自身的投资绩效,而反转投资行为对投资绩效的改良也不显著,表明反转效应也并非理性。

2.2. 惯性与反转策略的研究角度

根据不同惯性或反转投资行为的特点,将其概括成两种类型:一是基于历史收益率的惯性或反转投资行为;二是基于股票特征的惯性或反转投资行为。

2.2.1. 基于历史收益率的惯性/反转投资行为研究

基于历史收益率的惯性/反转投资行为把股票过去的表现作为投资参考指标。首先需要根据历史收益率的大小确定赢家组合和输家组合。其中,确定赢家输家组合的方法有两种:

一种是以De Bondt和Thaler (1985) [1] 为代表,Jegadeesh 和Titman (1993) [2] 采用的,根据形成期内个股收益率的大小进行排序,将股票分成相同权重的组合,并确定赢家和输家组合。其中,收益率最高的是赢家组合,收益率最低的是输家组合。然后执行惯性或反转交易策略,并持有一段时间,计算其收益率。

另一种是Cnorad和Kaul (1994) [6] 使用的,将形成期内累积收益率大于同期市场累积收益率的股票归为赢家组合;小于同期市场累积收益率的股票则被归为输家组合。该方法依据个股收益率在市场平均收益率中比例的大小来确定股票的权重。

两种方法在定义赢家和输家组合时均将个股的历史收益率作为依据,区别主要在于赢家输家组合中的股票个数及个股权重大小的不同。

2.2.2. 基于股票特征的惯性/反转投资行为研究

基于股票特征的惯性/反转投资行为,简称“特征惯性/反转”。与前一种研究角度不同,投资者依据股票的某一特征组合而非个股的历史收益率这一指标,执行惯性或反转交易策略。股票特征包括股票所属行业类别、流通市值、换手率等。据此,将股票分成n个特征组合;然后,按照组合中股票历史收益率的大小排序,确定赢家和输家组合。其中,收益率最高的是赢家组合,最低的是输家组合;最后执行惯性或反转交易策略,并持有一段时间,计算其收益率。

如果收益率显著为正,表明基于股票特征的惯性交易策略具有超额利润;如果收益率显著为负,则表明基于股票特征的反转交易策略具有超额利润。

本文以基于历史收益率的惯性或反转投资行为为研究角度,采用Jegadeesh和Titman (1993)的研究方法来确定赢家组合和输家组合。

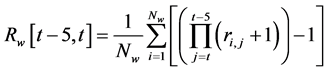

2.3. MT指标的构建

借鉴Shu (2007) [7] 的方法构建MT指标。MT值旨在检验投资者执行惯性或反转交易策略的数量,其计算公式如下:

(1)

(1)

其中,tradesit指机构投资者t季度末相对于上一季度末对股票i总持有量的变化与股票i在该季度末的流通市值之比。如果机构投资者在t季度这一考察期对股票i总体净买入,tradesit为正;如果机构投资者在t季度对股票i总体净卖出,tradesit为负。本文通过比较相邻两个季度内QFII对股票的总持股数量变化来判断QFII在考察期对股票的净买入和净卖出。

pindexit是股票i过去表现的离散指标(范围[−5, 5]),度量股票i在t季度之前六个月的表现。即以t季度为基准,按照股票在过去六个月平均收益率的大小将其分成十组,然后分别设定各组股票的pindexit值(具体见表2)。其中,月平均收益率的计算公式为:

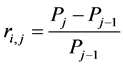

(2)

(2)

其中,ri,j指j期期末股票i的收益率,Pj指j期期末股票i的收盘价格,Pj−1是j − 1期期末股票i的收盘价格。

先计算系数与pindex之间的乘积,再累积求和,得出股票i的MT指标。对于前面的系数,其绝对值在机构投资者对股票总体大量买进时较大。由于pindexit对于过去的赢家组合为正,对于过去的输家组合为负,如果机构投资者买进过去的赢家或卖出过去的输家,则系数与pindex的乘积为正数。假定系数不变,则上述乘积的绝对值与pindexit绝对值正相关。因此,如果在度量期间,如果机构投资者大量买进

表2. Pindex的取值

过去的赢家或者大量卖出过去的输家,MT值较高。

MT指标依据投资者执行惯性或反转交易策略的数量大小,将不同股票分类。接着,我们通过比较不同MT值下惯性或反转交易策略的获利性,考察QFII的惯性或反转交易策略对股票惯性或反转收益的影响。

2.4. 交易策略对股票收益的影响

为考察QFII惯性或反转交易策略对股票收益的影响,本文根据MT值大小将股票分成5等份,按照Jegadeesh & Titman (1993) [2] 的研究方法,分别采用6个月形成期、6个月持有期的策略,计算每个等份在该策略下的股票收益。

有关形成期的选择,目前共有两种研究方向:一是不重叠持有;二是重叠持有。其中,Jegadeesh & Titman (1993) [2] 采用的是重叠持有的研究方法,该方法主要从最小化偏差、保证实证过程中有足够多的样本数量、增加实证结果解释力的角度考虑,是目前最常用,最具有说服力的研究方法。

用ri,j表示股票i在j时期的平均收益率(即考察期过去6个月的平均收益率)。根据ri,j的大小将股票分成3等分。其中,平均收益率最高的为赢家组合,最低的为输家组合。

赢家组合6个月的累积收益率的计算公式为:

(3)

(3)

输家组合6个月的累积收益率的计算公式为:

(4)

(4)

惯性交易策略就是买入赢家组合,卖出输家组合,形成零投资组合,并采用买入持有的方式,持有期的平均期望收益为:

(5)

(5)

若Rm的计算结果显著为正,则存在惯性收益。

类似地,反转交易策略就是卖出赢家组合,买入输家组合,并同样采用买入持有的方式,持有期的平均期望收益为:

(6)

(6)

若Rc的计算结果显著为正,则存在反转收益。

3. 实证分析

3.1. 样本的选择与数据来源

3.1.1. 样本的选择

为研究近几年来基于惯性或反转策略的QFII投资行为对股票收益的影响,本文以2010年年度报告为基准,将考察期按季度划分,取2010年第三季度至2014年第三季度共17个考察期。在选择样本QFII时,遵循以下原则:

1) 均为2008年之前获得资格批准的QFII,以保证考察期内,被选取机构投资者已完成建仓,投资过程连续并且投资策略成熟。

2) 被选取的QFII规模较大,以保证具有代表性。

3) 被选取的股票多为被3家以上QFII重仓1持有,且占流通市值20%以上。

4) 剔除ST,ST*,数据不全的股票。

最后,共挑选出包括淡马锡富敦投资公司、挪威中央银行、新加坡政府投资公司、美林国际、野村证券株式会社、富通银行等70家QFII重仓持有的120只股票作为研究样本。

3.1.2. 数据来源

样本数据主要取自wind数据库,包括QFII (成立时间、规模大小、持仓情况等)及其重仓持有股的股价信息(2009年12月底至2014年6月底),部分补充性的数据取自国泰安数据库。

3.2. 实证结果

3.2.1. MT的统计值

先根据120只样本股票每一考察期前6个月平均收益率的大小排序,并将其分为10等分,分别为10组股票设定pindex值,然后,将其与对应系数的乘积进行累加,算出每只样本股票对应的MT值,并利用Eviews截面数据回归模型进行显著性检验。最后,对样本股票MT值的均值、标准差、t检验值等进行了统计,统计见表3。

实证结果表明,MT均值在5%的置信水平下显著为正(0.351953),表明绝大部分QFII采取了强烈的惯性交易策略。MT的统计标准差(1.865463)较大,说明不同QFII分别采取了不同程度的惯性交易策略。MT的1/4等分数值为负数(−2.043018),说明有少部分QFII采取反向投资策略。

3.2.2. MT值与惯性收益

根据MT值大小将股票分成5等分,按照Jegadeesh & Titman (1993) [2] 的研究方法,计算每组股票考察期前六个月的平均收益率。根据组合形成期内个股收益率的大小排序,组成权重相等的组合,并规定收益率最高的为赢家组合,收益率最低的为输家组合。然后,分别计算每等分在惯性策略下持有期的股票收益。投资者的惯性投资行为与股票惯性收益的相关性统计如表4所示。

从表4可以看出,股票的惯性收益随着MT值的增长而单调增加。当MT值较低时,惯性收益普遍较低,随着MT值的增加,惯性收益增加较快。表4所显示结果表明,对应最低MT值的惯性收益为0.067476,T-统计值为2.149311;对应最高MT值的惯性收益为0.473802,T-统计值为6.232913。对应两个极端MT值的惯性收益之差为0.406326,T-统计值为4.083602,说明其在5%的置信水平上强烈显著。实证结果为我们提供了有力的证据,表明股票的惯性收益随QFII惯性交易行为的增加而增加。

3.3. 结果分析

实证结果表明,QFII普遍倾向于追涨杀跌的惯性交易策略,并且股票的惯性收益随着惯性交易行为的增加而增加。究其原因,主要有:

表3. MT的统计值

注:T-检验值表明5%的置信水平下显著。

Table 4. Value of MT and return of inertia trading

表4. MT值与惯性收益

注:T-检验值表明5%的置信水平下显著。

1) 大部分QFII投资理念一元化、投资策略单一化。由于市场的不成熟以及部分上市公司质量的问题等因素导致了投资者投资模式的单一化,再加上市场上严重的跟风现象,大量相同重仓股的买卖行为将加剧市场的波动。基金重仓股将出现持续上涨或者连续大幅度下挫的局面,这将进一步助长市场上的追涨杀跌行为,不利于保障市场均衡、长远的发展。

2) “信息不对称”打击了QFII长期价值投资的积极性。由于上市公司的股权结构相对集中,一些大股东为赢取更多的超额回报往往会结成利益同体,通过制造虚假财务信息等手段来误导投资者。这种行为严重打击了投资者长期持有该上市公司相关股票的积极性,造成了普遍进行短期操作的现象。

4. 结论

通过构建MT指标考察QFII惯性或反转交易行为的存在性极其特点,分析惯性或反转交易行为与股票收益的相关性,以及QFII惯性或反转交易行为对股票收益的影响。研究发现,QFII普遍倾向于惯性交易策略,该策略对股票的惯性收益具有显著影响。不论市场行情处于上涨或者下跌的情况,机构投资者追涨杀跌的惯性交易行为都会加剧市场的波动,致使股票价格进一步偏离其正常价值。可见,QFII并不能成为维护我国证券市场持续、稳健发展的中坚力量。证券市场的稳健发展主要在于良好的业绩水平、健全的信息披露及完善的市场监管。

NOTES

1本文将QFII公告中按市值占资产净值比例大小排序在前10名的股票定义为“重仓股”。