1. 引言

2009年8月14日,国务院正式批复《横琴总体发展规划》,横琴成为探索粤港澳紧密合作新模式的新载体。2009年12月16日,横琴新区正式成立,实行比经济特区更加特殊的政策,横琴开发全面启动。横琴新区以合作、创新和服务为主题,充分发挥横琴地处粤港澳结合部的优势,推进与港澳紧密合作、融合发展,逐步把横琴建设成为带动珠三角、服务港澳、率先发展的粤港澳紧密合作示范区 [1] 。在过去的6年期间,横琴新区的经济经历了高速、全面发展的阶段,包括但不局限于金融(银行)、环境、旅游、投资等。比如,根据珠海统计局的数据 [2] ,2015年横琴新区的地区生产总值高达91.867亿人民币,相比于2011年的8.1243亿人民币,在4年期间实现了高达10倍的增长。为了分析横琴新区经济高速发展的背后驱动力,除了政策因素之外,从不同的经济相关因素进行分析也是非常重要的,包括地区生产总值(GRP)、进出口总额(TEIV)、工业增加值(IAV)和固定资产投资额(IFA)等。

特别地,由于固定资产投资额在经济增长中扮演着重要的经济动力作用,从固定资产投资额的角度进行经济发展分析以及预测显得举足轻重 [3] [4] 。更重要的是,对固定资产投资额进行预测不仅仅能为决策者提供相应的数据分析支持,同时也为即将在横琴投资的投资者提供相应的参考。经过数十年的发展,学者提出了若干重要的时间序列分析与预测的方法,包括马尔可夫决策过程 [5] 、GARCH模型 [6] 和灰度预测系统 [7] 。作为马尔可夫链的一个扩展,马尔可夫决策过程为对输出是部分随机受控的场景进行建模提供了一个基本数学框架 [8] 。广义自回归条件异方差(GARCH)模型是另一个用于估计随机波动的模型 [6] ,是专门针对金融数据量体订做的回归模型,除去和普通回归模型相同的之处,GARCH对误差的方差进行了进一步的建模,特别适用于波动性的分析和预测,这样的分析对投资者的决策能起到非常重要的指导作用 [9] 。灰度预测系统,最早期是1982年由邓聚龙教授提出来的 [7] 。在现实应用系统中,通常无法提取学习系统中的隐藏结构、参数和特征等 [10] [11] 。为了解决这个问题,邓教授提出了灰度系统,广泛应用于条件分析、预测和决策等。特别地,对于预测任务,将隐性的动态特征当成灰度系统,通过建模连续不断预测这些特征。在本文研究中,鉴于灰度预测系统使用累积生成操作来生成差分方程,将有助于分析不同时间窗的隐变量相关性,从而我们通过使用灰度预测系统预测珠海横琴新区的固定资产投资额。

特别地,我们使用GM(1,1)模型,从月度、季度、年度三个不同的尺度分析珠海横琴新区的固定资产投资额。我们的研究得到三个有意义的发现:1) 相比于2010年至2011年的月度累积值的预测结果,2013年至2015年的月度累积值的预测结果准确率更高;2) 随着时间的推移,年度预测值的准确率也是不断增加;3) GM(1,1)模型在长期(比如年度)数据预测方面,比短期(比如月度)数据预测更佳准确。最后,我们也使用灰度预测系统预测下一个五年计划(2016年至2020年)的年度固定资产投资额。研究发现,在下一个年度计划,以固定资产投资额为代表,横琴新区将经历一个更加快速的经济发展。

2. 灰度预测模型

一个代表性的灰度预测模型是GM(1,1)模型,是一个一阶并且仅包含一个变量的模型 [7] 。GM(1,1)模型被广泛应用于动态预测,并且获得了相当好的研究成果 [12] [13] 。所以,本文的研究拟采用GM(1,1)模型,它的基本流程如下所述。

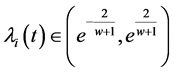

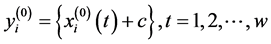

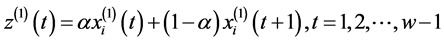

第一步:为了保证模型的可靠性,首先要对原始时间序列进行如下的预处理。假设原始的时间序列是 ,则

,则

(1)

(1)

其中 是时间t的隐向量的第i维,w是时间序列的长度。从公式(1),我们可以计算得到原始时间序列的水平比值序列如下

是时间t的隐向量的第i维,w是时间序列的长度。从公式(1),我们可以计算得到原始时间序列的水平比值序列如下

(2)

(2)

其中

(3)

(3)

若对所有的 ,满足

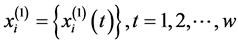

,满足 ,则原始的时间序列可以直接用于GM(1,1)模型,否则,首先需要对原始时间序列进行如下的平移变换

,则原始的时间序列可以直接用于GM(1,1)模型,否则,首先需要对原始时间序列进行如下的平移变换

(4)

(4)

从而结果序列的水平比值序列能满足位于 。

。

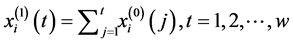

第二步:通过如下的累积生成操作生成新的时间序列

(5)

(5)

其中

(6)

(6)

第三步:生成如下的一阶差分方程

(7)

(7)

其中

(8)

(8)

其中 表示一个水平发展系数。在我们的实验分析中,我们设置

表示一个水平发展系数。在我们的实验分析中,我们设置 。

。

第四步:解方程(7),我们便得到预测模型,如下

(9)

(9)

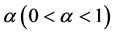

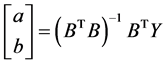

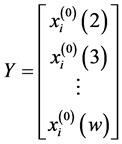

其中a是发展系数,b是灰度行为,分别通过如下公式计算所得

(10)

(10)

其中

(11)

(11)

以及

(12)

(12)

第五步:最后通过相反累积生成操作,将累积生成操作得到的数据转化为原始数据域

(13)

(13)

则这个值就作为新的(t + 1)时刻点的预测值。

3. 实验分析

3.1. 数据选取与描述

在本文的研究中,我们从珠海统计局网站收集了珠海横琴新区的固定资产投资额数据 [2] 作为我们实证分析数据。具体地,我们收集了从2010年3月到2015年12月的,除了2014年9月份和2014年10月份(这两个月的数据未公布在网站上)的月度累积值。原始数据如表1所示。

为了从不同的尺度对固定资产投资额进行分析,原始的月度累积数据经过预处理之后得到季度累积数据和年度数据,如表1中的黑体和斜体所示。注意到,与月度累积和季度累积不同的是,在年度数据中,不存在累积这个值而是一整年的值。

3.2. 模型评估和讨论

首先我们从三个角度,即采用不同尺度的时间窗对模型进行评估,分别是月度、季度和年度,分别能得到有意义的结果。为了评估在(t + 1)时间窗, 的预测性能,原始的1至t时间窗的数据用于做训练。所预测得到(t + 1)时间窗的数值将与原始的(t + 1)时间窗的数值进行比较,若所得到的预测数值与原始的数值很相近,则证明了本模型的有效性。

的预测性能,原始的1至t时间窗的数据用于做训练。所预测得到(t + 1)时间窗的数值将与原始的(t + 1)时间窗的数值进行比较,若所得到的预测数值与原始的数值很相近,则证明了本模型的有效性。

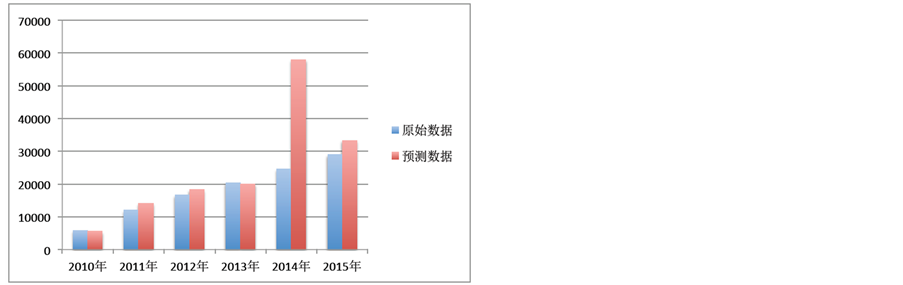

3.2.1. 月度累积数据预测性能评估

首先,我们从月度累积数据预测方面评估模型的性能。由于每一年的月季累积数据是从当年的2月份开始计算,为了保证训练数据中至少包含两个月份的时间窗,则起始的预测时间窗是从4月份开始。图1对比了2010年至2015年期间,从4月份到12月份的预测的月度累积数据(百万)与原始的月度累积

数据(百万)。注意到在图1(e)中,由于2014年9月和10月的原始数据缺失(见表1),我们将这两个月的原始数据列为0,并且根据2014年2月至8月的数据去预测这两个月的结果。从图1可以看出,GM(1,1)模型在月度累积数据预测方面具有较高的性能。特别是,随着时间的推移,除了2014年缺失数据之外,整个预测的准确性在不断的提高。也就是,2013年和2015年的月度累积数据预测准确性要高于2010年

Table 1. The original data (in million): Cumulative Monthly Value (CMV), Cumulative Quarterly Value (CQV) in bold, and Annual Value (AV) in italic bold

表1. 原始数据(百万为单位):月度累积数据、季度累积数据(黑体表示)、年度数据(黑体斜体表示)

和2011年的月度累积数据的预测准确性。这可能是由于经过3、4年的发展(从2009年开始算起),珠海横琴新区的发展进入正轨稳定,从而变得更加可预测。本文稍后对年度数据的预测结果也证实了这个观点。

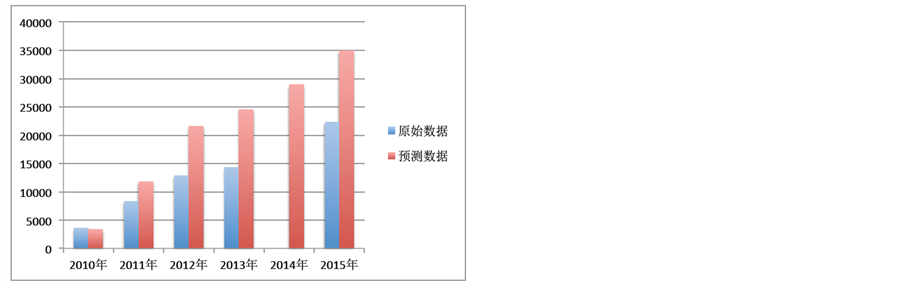

3.2.2. 季度累积数据预测性能评估

图2对季度累积数据预测能力进行了展示。特别地,对2010年至2015年的预测的第3、4季度累积数据值与原始的第3、4季度累积数据值(百万)进行了比较。注意到,在图2(a)中,由于原始的数据中,2014年第3季度的季度累积数据值缺失(如表1所示),则我们把它列为0(未展示),并且通过2014年的前两个季度的数值对该数值进行预测。从图2,我们可以看出,GM(1,1)模型无法对第3季度的季度累积数据做出准确的预测,但是却能准确地对第4季度的季度累积数据进行预测(除了2014年缺失数据的情况之外)。这可能是由于仅仅用前两个季度的数值无法得到充分的信息去预测第3个季度的数值。但是当使用前三个季度的数值时候,预测结果的准确性将大大提高。

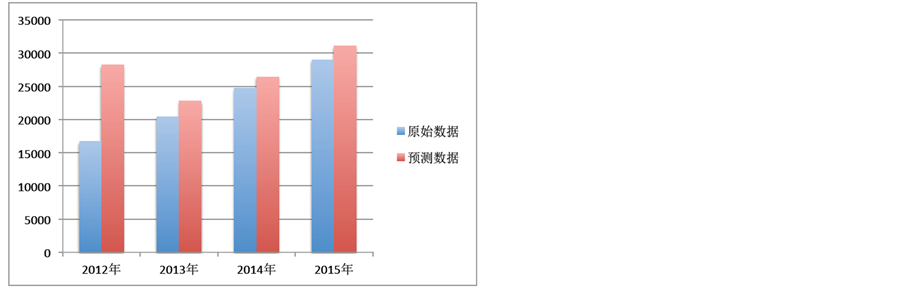

3.2.3. 年度数据预测性能评估

除了月度累积数据和季度累积数据的预测之外,我们还对年度数据预测的性能进行了测试,如图3所示。图3对从2012年至2015年的预测的年度数据值与原始的年度预测值进行了比较。从该图中可以看出,由于只用了2010年和2011年两年的数值,2012年的预测准确性是比较低的,但是从2013年开始,由于采用了更充足的数据,预测准确性不断提高。特别地,若我们定义预测误差率如下

(14)

(14)

则2012年至2015年的预测误差率分别是0.69、0.17、0.07和0.07,呈逐年急剧降低之势。另一个有意思的现象是,GM(1,1)模型对于长期尺度(比如年度)的预测能力远远高于短期尺度(比如月度)的预测能力。这可能是由于在更长期的尺度下,比如年份,一个区域,特别是横琴新区的发展将相对比较稳定和更具可预测性。相反,短期内可能会由于存在一系列的非经济因素和经济因素,影响着短期发展的稳定性。

3.3. 对下一个五年计划的预测和讨论

根据前面的分析讨论,我们可以得出这样一个结论:对年度数据的预测比对更短期(比如月度或季度)数据的预测更准确。所以,基于2010年至2015年的年度数据,我们将采用GM(1,1)模型,预测下一个

(a) 第3季度 (b) 第4季度

(a) 第3季度 (b) 第4季度

Figure 2. Evaluation of the model from the viewpoint of Cumulative Quarterly Value (CQV, in million) prediction

图2. 从季度累积数据(百万为单位)预测的角度评估模型

Figure 3. Evaluation of the model from the viewpoint of Annual Value (AV, in million) prediction

图3. 模型的年度数据(Annual Value,百万为单位)预测分析:预测值(Predicted)和原始值(Original)的比较

Table 2. Forecast of the annual value of investment in fixed assets (in million) of Hengqin new area from 2016 to 2020

表2. 横琴新区2016年至2020年的年度固定资产投资额(百万)预测

五年计划珠海横琴新区的固定资产投资额的年度数值,也就是预测2016年至2020年期间的年度数值,如表2所示。从该表可以看出,正如大家期待的,以固定资产投资额为代表,珠海横琴新区的经济发展将经历一个巨大的飞跃。特别地,到了2020年,珠海横琴新区的固定资产投资额预计将达到78,866.11百万人民币。

4. 结论

本文对珠海横琴新区的经济发展进行分析和预测,特别是采用了灰度预测模型从固定资产投资额的角度进行分析预测。具体地,我们用仅仅含有一个变量的一阶GM(1,1)模型分析从2010年到2015年的月度累积数据、季度累积数据和年度数据的固定资产投资额。本文的研究发现了若干有意义的规律。此外,我们还用GM(1,1)模型预测了下一个五年计划,也就是2016年至2020年的年度固定资产投资额。预测分析指出,在下一个五年计划,以固定资产投资额为代表,珠海横琴新区的经济发展将经历一个巨大的飞跃。从而,本文的研究不仅仅能为决策者提供相应的数据分析,同时也为即将在横琴投资的投资者提供相应的参考。

致谢

本项目是由北京理工大学珠海学院会计与金融学院资助。同时也感谢珠海市统计局提供相关的数据。