摘要:

党的第十八届中央委员会第五次全体会议提出了“十三五”时期新的发展理念,金融创新作为一个重要的发展方向却仍受到许多限制,主要原因是该领域存在的高风险和监管缺失等因素。以“高盛事件”为例可以看出在金融工具的交易当中存在着巨大的道德风险,使得金融精英们在利益的驱动下铤而走险。这让我们意识到,企业、监管者都应分别采取必要的手段,如调整薪酬设置、更新会计准则等,来降低甚至避免金融机构的道德风险、提高市场透明度;而个人投资者可以通过基金等机构投资者参与到交易中。

Abstract:

A new development idea was proposed on the fifth meeting of the Central Committee of the Communist Party of China, encouraging innovations in different aspects. Financial innovations, however, are still under strict restrictions, mainly because of the high risk and lack of effective control in this field. Take the fraud committed by GoldmanSachs as an example, we can see that there is significant ethical risk involved in the transactions of financial instruments, and many brokers violate laws, driven by financial interest. This helps us realize that both companies and authorities should take necessary actions, such as changing management remuneration package and introducing revised accounting standards, to lower or even avoid ethical risks, while individual investors can turn to institute investors, like funds, for help when participating in market activities.

1. 引言

2016年中国共产党第十八届中央委员会第五次全体会议审议通过了《中共中央关于制定国民经济和社会发展第十三个五年规划的建议》,并提出了“创新、协调、绿色、开放、共享”五大发展理念。会议提出要坚持创新发展,必须把创新放在国家发展全局的核心位置,不断推进理论、制度、科技、文化等各方面的创新 [1] 。自1992年党的十四大正式建立社会主义市场经济新体制以来,金融创新不断推动着金融业的发展,如国有商业银行的股份制改造和新的理财产品的推出等。我国金融市场日渐成熟,但金融衍生品的使用作为金融创新的一个重要组成部分,在我国却受到很大限制,其中重要的原因在于金融衍生品本身的复杂性、多样性和由于市场波动给衍生品交易带来的巨额损失。但随着国民经济的快速增长和证券市场的快速发展,市场投资者对金融衍生品交易的兴趣也日渐浓厚。

金融衍生品是指从原生资产,如货币、利率、汇率、股票等,派生出来的金融工具,其价值随着原生资产价值的波动而波动。由于所有的衍生品交易都是保证金交易,即只需支付一定比例的保证金就能进行全额交易,因此此类交易具有杠杆效应。这类产品在设计之初是作为一种避险工具,用于对冲交易时产生的各类风险,但由于杠杆效应能够放大收益,金融衍生品逐渐变成了企业和投资者的逐利工具。值得注意的是,杠杆效应在放大收益的同时也放大了风险,由于新的衍生品层出不穷,发生纠纷时往往会出现无先例可循的状况,使得衍生品合约条款因不具备法律效益而无法履约,造成损失。另外,衍生品交易也存在着很高的道德风险。在实现金融创新的同时,相应的监管常常不能及时到位,意味着政府监管跟不上金融创新的步伐。而金融业本身就存在着信息不对称的问题,尤其是涉及复杂的衍生品领域时,信息不对称显得更为严重,因此产生巨大的套利空间,埋下风险隐患 [2] 。

2. “高盛事件”概况及其原因解析

一个典型的例子是2010年发生的有名的高盛欺诈事件,这就是在担保债权权证(CDO)交易中由于信息不对称和投资公司的道德风险引发的。

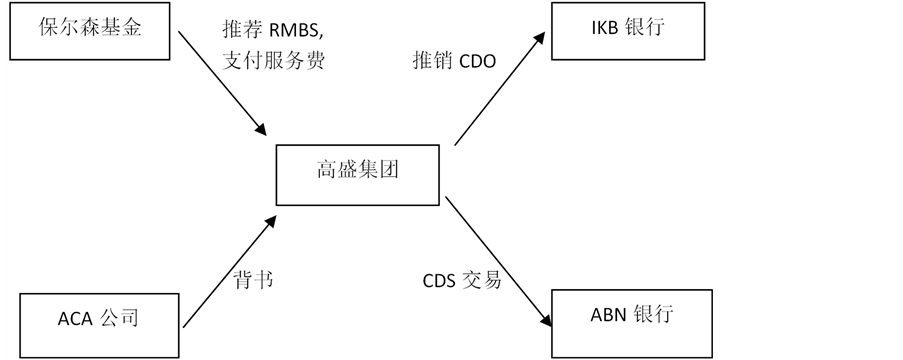

高盛集团在2007年初设计并销售了一款名为ABACUS 2007-AC1的债券,该债券是在RMBS的基础上再次打包而成的。在向投资者推销这款CDO的过程中,高盛集团隐瞒了保尔森基金参与了RMBS组合的挑选、并有意挑选了容易出现问题的次级房屋抵押贷款债券进入投资组合的关键信息。实际上,保尔森基金挑选的次级抵押贷款的借款人主要分布于前期房价出现大幅上涨的地区,如亚利桑那州、弗罗里达州和内华达州等,因为他认为房价在大幅上涨之后更有可能出现大幅下跌。随后保尔森基金公司进入信用违约互换(CDS),为组合中的RMBS购买保险,做空其挑选的RMBS组合(图1)。由于当时美国房市已显现疲态,以RMBS构造的CDO不容易得到市场投资者的青睐,于是高盛找到了ACA管理公司,

Figure 1. ABACUS 2007-AC1 trade chart

图1. ABACUS 2007-AC1交易图

为其设计证券背书,以获得投资者信任 [3] 。

在金融工具的层层衍生过程中,原生资产的风险被逐步转移到购买各级衍生品的投资者身上。这一过程设计许多金融机构,包括商业银行和其他抵押贷款公司、投资银行,以及评级机构。对于商业银行和贷款机构而言,“资产证券化”出现以后,银行不再承担贷款的最终信用风险,因为银行不再只能通过存贷利差赚取利润,而可以将次级贷款打包售出给机构投资者和投资银行,从而在获取收益的同时转移风险 [2] 。因此,商业银行可能为信用等级很低的贷款人提供贷款,并通过出售贷款迅速收回资金,扩大放贷能力,而不需要在意贷款者是否能及时偿清贷款。对于投资银行来说,他们把从商业银行购入的抵押贷款打包生成抵押担保债券(MBS)来增加流动性,又在此基础上设计出CDO和CDS等各类衍生品。我们必须注意到,贷款证券化只能分散和转移风险,而不能消灭风险。在投资银行不断创新设计衍生产品的同时,作为抵押的资产未来现金流变得越来越复杂,只能通过专业的金融模型来进行估计,所以不具备专业知识的普通投资者往往无法分辨一款产品是否值得投资。这样的信息不对称使得投资者向评级机构寻求帮助。投资银行为了获取投资者信任,可能邀请评级机构参与衍生品的设计,如由评级机构推荐原生资产,这其中便存在着自我利益和自我评价冲突,使得评级机构采取手段去影响产品的评估值,对投资者造成误导。各种金融机构作为信息的占优势方很容易在利益的诱惑下铤而走险。

3. 从高盛事件中获得的启示

我国金融衍生品市场发展时间较短,无论是企业、监管者,还是投资者,都应该从发达资本市场的经验中吸取教训、获得启示,以积极应对和有效管理金融衍生品带来的风险。

首先站在企业的角度,企业自身应当强化风险管理,建立有效的公司治理机制,如设置内部的风险管理委员会 [4] 和内审机制。企业的内审部门最好直接隶属于风险管理委员会、独立于企业自身的财务部门;同时风险管理委员会应该由非执行董事组成,独立于企业董事会,以提供一条独立的汇报渠道,保证任何违规和不道德的迹象和行为都能得到公正的调查和处理。大额交易应交由该委员会进行风险评估、复核和批准 [5] ;同时,该委员会应当由金融精英层来充实,以保证能对提交的交易的可行性和盈利性做出合理判断,提高风险管理委员会决策的权威度。另外,金融机构管理层的薪酬设置可能需要进行适当调整,尽管利益的一致性是避免代理问题的必要手段、高薪酬对于吸引和留住高端人才也是不可或缺的,但仍需警惕不恰当的奖励机制带来的高层道德风险。如果管理层的薪酬包裹中包含很高的与利润有关的报酬,那么我们有理由相信,管理层往往有更大的动机去进行一些高风险、高回报的金融衍生品交易或投机活动,尤其是在经济不景气或利润水平达不到预设目标的时候。

监管者需要不断完善法制建设对风险进行恰当监管,以跟上金融衍生品交易快速变化的步伐。为规范金融衍生品市场,我国证监会已经出台了《证券期货投资者适当性管理办法》,旨在将合适的产品销售给合适的投资者,并将于2017年7月1日开始实施。其中按照一定标准将投资者分为专业投资者和普通投资者,并规定普通投资者在信息告知、风险警示、适当性匹配等方面享有特别保护,同时明令禁止经营机构向普通投资者主动推介不符合其投资目的或高于其风险承受能力的产品,由此减少信息不对称和专业知识缺乏给投资者带来的损失。

此外,由于金融工具的交易往往只需要很少的初始投资、甚至不需要初始资金投入,此类交易一直是表外事项,往往在收益或损失实现的时候才计入报表,而不是在签署交易合同时就向投资者披露。这样许多的衍生品交易都被隐藏了起来,但仍然给投资者带来巨大的风险,因此财务报表也就无法向投资者公允地展现企业面临的风险,不利于投资者做出符合其偏好的投资决策。一旦损失实现,投资者们将措手不及。

为向投资者提供更为透明和准确的财务信息、保护投资者和债权人的利益,国际会计准则理事会要求在2018年1月1日起实施《国际财务报告准则第9号——金融工具》。准则要求,所有金融工具的使用必须在签署合同时就在财务报表中确认资产和负债,即使当时没有发生任何现金的流入和流出、其金额也无法合理估计(这是一般资产负债的确认标准)。在中国境内外同时上市的企业必须在同一时间开始实行这一准则,以免出现境内外报表适用准则的差异;对于在境内上市的企业,我国财政部也于今年4月发布了修订后的《企业会计准则第22号——金融工具的确认和计量》、《企业会计准则第23号——金融资产转移》和《企业会计准则第24号——套期会计》,并将于2019年1月1日起开始实施。这些新准则的实施不仅有利于企业加强金融资产和负债管理、夯实资产质量、推动企业加强风险管理,也能让投资者和债权人及时预警企业面临的金融风险、有效防范和化解潜在损失,同时提高金融市场的透明度,强化监管。

最后,不具备相关财务和金融知识的个人投资者可以通过基金、银行等专业的机构投资者来参与交易。这个做法的优点在于,机构投资者的手中往往聚集了大量资金,不仅可以投资多种产品,甚至可能通过其巨大的体量影响原生资产的市场价格、或对企业本身施加影响,或通过反手做空来获得收益;而散户的资金通常比较少,在进行投资时很难做到分散化投资,因此难以将分散风险。同时,个人投资者也应当积极提升自身的知识储备、以获得对产品风险和经济发展形势做出合理判断的能力和阅读、分析财务报表的能力,降低对评级机构的依赖,获得主动性;同时需要明确自身在投资时的风险偏好,保持理性,不投资超过自身风险承受能力的产品。