1. 引言

奈斯比特和阿伯丹(Naisbitt & Aburdene)曾经预言,21世纪收藏投资将取代证券投资和房地产投资,成为人类主要的投资方式;虽然到目前为止,他们的预言仍然缺乏实证研究的支持,但可以肯定的是,收藏品已经成为了继证券和房地产之后的第三大投资热点[1] 。艺术品收藏不仅仅是因为它给人们带来感官上的享受,更是一个投资工具,随着经济发展、个人财富的增长,人们有更多的多余资金用于股票、房产和艺术品投资。如果说几年前的中国艺术品市场还可以偏安一隅,对经济走势不必过多理会的话,2007年以后的中国艺术品市场则无法再对外部经济环境保持漠视。危机的破坏、流动性的复苏、财富的增长以及投资热点的转移,无一不影响着中国艺术品市场近几年的起伏。随着我国艺术品市场持续升温,中国艺术品市场更是成了全球关注的焦点,雅昌的《中国艺术品拍卖市场调查报告》显示,2009年中国艺术品拍卖市场成交记录为225亿人民币,2010年迅速上升为573亿,2011年更是达到了968亿的成交额新纪录,2012年为616亿[2] 。

Anderson(1974)和Stein(1977)两人对艺术品的研究为这一领域提供了非常重要且有效的贡献。Baumol(1986)的研究结论申明艺术品投资收益率远低于无风险的债券市场利率,展开了艺术品是是否值得投资的激烈讨论,研究成果不断涌现[3] -[5] 。

相较而言,我国收藏历史悠久,也有不少关于收藏品研究的专著和文献,但已有的研究更多的是关注艺术品本身的特性、它的美学价值以及其历史价值等,对艺术品收藏的投资收益问题和其他投资市场的关系却很少触及。

本文将对国内外学者在艺术品投资方面的研究做一个系统性的归纳总结,让读者熟悉现有研究的进展与困境,为该领域的研究者提供后续思考。此外,本文还对国外学者常用的研究方法进行了归纳,可供国内该领域学者参考。

2. 国内外研究进展

以英美为首的西方国家艺术品市场起步较早,其蓬勃发展的态势仍在持续,相对应的是,国外关于艺术品投资的研究也很丰富,包括亚当斯密和凯恩斯在内的很多经济学家都对视觉艺术投入极大的兴趣。从二十世纪七十年代开始,就有不少学者开始从经济学的角度来研究艺术品。这些研究多集中于绘画市场,研究成果主要发表于《The American Economic Review》《European Economic Review》《Accounting and Finance》等期刊,在这方面研究最多的是Worthington & Higgs。

相较之下,收藏在我国历史悠久,但对收藏投资的研究却一直没有得到重视,已有关于收藏方面的研究一般都将重点放在艺术品鉴赏方面。极少关于收藏投资的文献大多只关注藏品市场表面现象、或对市场走势和投资收益的估计比较主观、或是缺少数据支撑,仅有一两篇文章的研究比较有现实意义,但都存在样本量少、考虑不够完善等问题。

研究视角或研究范围不同,得出的研究结论也不尽相同,这些研究一般就艺术品投资的收益风险情况、艺术品加入资产投资组合可能性和和艺术品市场与股票市场之间的联系这三个方面的一到两点进行讨论,笔者将从这三个方面对国内外学者在该领域的重要研究做一个系统的回顾。

2.1. 艺术品的投资收益性

绝大多数的研究主要涉及到的问题都是与其他投资性资产性比,艺术品的市场表现如何,能否将艺术品看作普通投资性商品。最早从投资学的角度去研究艺术品的是Anderson和Stein。Anderson(1974)以1780~1970年油画的拍卖记录为基础,利用hedonic和RSR两种方法建立价格指数,利用两种方法得到的指数进一步得出的油画投资实际收益率分别为3.3%和3.7%,不论以何种方法计算,收益表现均差于其他资产,因此,Anderson认为人们购买艺术品的主要动机是在于艺术品的精神价值[3] 。Stein(1977)利用CAPM模型研究进行相似的研究,得出油画投资的年度名义收益率在10.5%~13.1%之间(绘画的产地和销售地不同而有所区别),低于相同时间段股票市场的年度名义收益率14.3%,因此Stein也认为只能将艺术品认为是普通的资产[4] 。

尽管Anderson(1974)和Stein(1977)两人的研究开创了从投资学角度研究艺术品的先锋,做出了非常重要的贡献,但是直到Baumol(1986)的研究申明艺术品投资收益率远低于无风险的债券市场利率,才展开了是该以投资为目的持有艺术品还是仅仅为其精神收益而持有的争论[5] 。

以Baumol为首的一批学者认为通过在某一特定时间购买艺术品来获得比机会成本还高的回报是不可能的,只有充分认可艺术品带来的精神享受或者明显的降低税率才可能从艺术品投资中获益。Baumol(1986)估算了1650~1960年间在英国和美国被重复交易两次以上的640幅油画交易的年度收益,得出油画投资的平均年收益率为0.55%,远低于政府债券的2%,Baumol将这1.5%的差异归因于收藏者们从藏品所获得的美学价值;同时,他发现大收益或大损失主要发生于那些持有时间较短(一般低于50年)便转手的画作,说明投机的风险是很大的[5] 。Frey et al.(1989)在Baumol (1986)的基础上,做了一个覆盖整个欧洲绘画市场的研究,油画投资实际年度收益率和标准差分别为1.5%和5%,与Baumol结论大致相同[6] 。Andrew & Higgs(2004)的研究中,尽管不同流派油画的市场表现相差很大,但结果依旧是艺术品市场比传统投资市场收益低风险高[7] 。Gawrisch(2008)在他的学位论文中也得出艺术品的平均收益远低于标普500、富时100和DAX300等普通股票市场收益,而风险却相对较高[8] 。Pesando (1993)对版画市场的研究中,版画投资平均收益仅为1.51%,远低于传统股票市场8.14%的收益率[9] 。赵宇和黄治斌(2008)研究我国艺术品市场,发现无论是否考虑通胀因素,艺术品投资的期望收益都高于股票市场,同时风险还相对较低[10] 。赵景东、孙文婷等(2013)利用综合加权法计算邮票的月度价格指数,统计结果显示,邮票的月度平均回报为3%,高于股票市场收益(同期上证180、上证综指和深证综指月度回报各自只有1%、0%和2%)[11] 。

其他学者的研究则对艺术品投资持积极的态度。Buelens & Ginsburgh (1993)重新审视了Baumol (1986)的研究,他们认为Baumol (1986)和Frey et al. (1989)的研究,时间跨度长并且样本囊括了各个流派,而艺术品的收益表现在会因人们审美趋势或经济环境变化而有很大差异,他们指出Baumol (1986)的研究得出如此消极结论的主要原因是各流派画作在样本中分布不均衡,加之50%的销售都发生在二战期间;为此,Buelens & Ginsburgh将原数据按流派和时间段进行细分,发现不同时段收益差距是很大的,除了1914~1950这一时间段外,其他时间区间的收益率基本上都大于零,不同流派在同一时间段内的收益不同但它们的价格走势却趋于一致,在1950~1961年间,这些油画的实际投资收益率为9.6%,印象派画作收益率高达23.8%,说明某一类型的艺术品在特定时段内是能够带来高额回报的[12] 。同样的,Goetzmann (1993)对收藏品市场的研究结果显示,20世纪以来(1900年-1986年)收藏品投资的平均收益率为17.5%,远远高于债券4.8%和股票4.9%[13] 。

继Buelens & Ginsburgh(1993)之后,关于艺术品投资的研究逐渐摒弃了以往一概而论的做法,开始根据地区、流派、作家知名度来细分样本数据,或利用hedonic方法确定拍卖行等因素对拍卖价格的影响,试图提供更加精细化的投资指导。Pesando(1993)指出投资名家作品并不能获得超额收益,拍卖行或拍卖地域的不同都会影响拍卖价格[9] 。Barre et al.(1994)将样本分成“Great Masters”、“Other Painters”两组,结果显示 “Great Masters”的年度名义收益率为12%,比“Other Painters”高了4%,相同情况下佳士得纽约和苏富比纽约能拍出比其他拍卖行更高的价格[14] 。Mei & Moses(2002)将市场细分为美国画家、印象派、古典派等,单独研究它们的高价销售记录,发现这些高价值巨作的收益表现事实上还比不上它们各自所处的细分市场平均水平,并指出这种差别可以用K.C. Chan & Nai-Fu Chen (1988)提出的“小公司效应”来解释(利用单因素市场模型分析时,一些市值较低的小公司更容易获得没有进行风险调整的超额收益) [15] 。

对于艺术品是否值得投资这一问题始终褒贬不一,主要原因可能是研究对象不同。不同地区不同文化人们对于艺术品的热爱程度不同,购买艺术品的积极性和艺术品价格升值空间都有很大差异。不同的经济发展时期,人们的购买力不同,对艺术品价格的促进作用也各不相同。此外,流行趋势不断变化,不同流派的作品在不同时段受追捧程度亦不相同,Baumol和赵宇等人的研究相对而言就不够精细。因此,要想真正得出比较精确的结论并提出可行的指导性意见,还应该就某一细分市场进行深入研究。

这些研究共同的不足之处在于,所有的研究都忽略了一些会影响最终收益率的因素,如艺术品带来的精神收益、交易成本和税费等。但由于目前艺术品租赁市场还没有发展起来,艺术品的精神收益是没有办法进行衡量的;而各国、各个拍卖行甚至个人交易者收取的佣金差别也非常大,要想得到这些数据非常困难;税费的计算需要考虑艺术品原来持有人是否是作者,不是作者的话还需要知道他购买价格,而这些个人信息一般很难获得,所以在研究中税费也是没有办法去掉的。基于以上原因,这些研究都存在一定的不足,但这些费用毕竟只占艺术品销售价格的小部分,而且我们不妨假设这些费用在艺术品销售价格中占固定比例,那么艺术品市场的发展趋势和收益情况并不会受太大影响。

2.2. 艺术品加入资产投资组合

不少研究中得出艺术品相比股票市场收益高风险低,即艺术品值得投资结论,艺术品在投资组合中的最佳比例就成了下一步要考虑的问题。这些研究在明确了艺术品的收益风险特性后,进一步利用投资组合理论或CAPM模型探讨艺术品加入投资组合的问题。

Chanel et al.(1994)利用CAPM模型对艺术品系统风险进行检验,将艺术品指数与某一特定的股票市场指数进行组合,发现不管与哪一种股票指数组合,艺术品市场的β指数均小于1,说明艺术品加入投资组合一定会降低投资组合风险[16] 。Tucker & Hlawischka(1995)研究艺术品加入投资组合问题,发现艺术品指数与除黄金市场以外的其他资本市场(普通市场股票、小盘股、长期债券、中期债券、短期国库券)成负相关关系,收益仅次于普通股票市场、风险却低于国库券以外的其他资产,说明艺术品应该在资产组合中占较大的比例,并且最佳投资组合中艺术品占比为55.62%[17] 。Mei & Moses(2002)的研究显示艺术品市场与标准普尔500和道琼斯的相关系数很低,为0.04和0.03,说明艺术品能够在投资组合中体现出很大的作用[15] 。Campbell(2002)在Mei & Moses(2002)研究的基础上讨论艺术品投资在较短时间内的收益和投资组合问题,结果显示艺术品指数在整个样本期内相对股票市场收益低风险高,在投资组合中加入23.11%比例的艺术品以后,期望收益提高了0.55%(8.3%到8.85%)而风险系数相对降低了1%,在用实际收益率计算最优投资组合时发现艺术品的投资比例提高了,这暗示着艺术品还可以用来对冲通货膨胀[18] 。赵宇和黄治斌(2008)计算的投资组合中,艺术品占80%~90%,股票仅占10%~20%,这与国外学者的结论相差较大,可能是由以下原因造成的:1) 样本选取范围不同,近年正值我国艺术品投资高峰,艺术品的价值逐渐被人们所认同,比国外市场获得更高的收益是可能的;2) 样本的选取存在一定偏差,本研究中只有486的重复拍卖纪录用于构建指数,而且包含了艺术品的各个品类(国外研究一般只针对某一类别的艺术品,如绘画),结果很容易受到集中个别极端数据的影响[10] 。

但也有一些研究中会发现艺术品加入投资组合并不能带来多元化收益。Renneboog et al.(2002)对比利时绘画市场的研究中,认为不应该将艺术品加入资产投资组合,因为艺术品的加入并不能带来多元化收益[19] 。与之类似的是,Goetzmann (1993)、Andrew & Higgs (2004)等的研究也指出艺术品与股票的组合能够带来多元化收益[7] [13] 。

多数的研究认为艺术品加入现有投资组合是有利的,或是能够分散风险、或能够提高收益,只有少数学者认为将投资艺术品是不理智的行为,这一结论的差异可能是由于研究样本的差异或者样本选取本身的一些问题。这些研究同样存在以下几点:一是RSR回归中,能够重复交易艺术品其市场表现本就高于普通艺术品;二是没有考虑交易成本、税费和艺术品的精神价值等。真实情况和研究结论可能存在一定的偏差。

2.3. 艺术品市场与股票市场的联动关系

艺术品的价格受到人们财富多少的影响,而财富又是金融市场输出,因此,人们推断艺术品市场受金融市场影响。Chanel(1993)在研究中发现,除了London F.T.指数,S & P500、NKY、FTSE100、INSEE这4支国际主要股票指数似乎都会影响艺术品价格指数,而艺术品市场对股票市场却没有影响,他指出金融市场对经济冲击的反映很快,金融市场投资得到的利润很有可能被投入艺术品市场,因此,股票市场可以当作艺术品市场的一个指示器[20] 。

在研究艺术品市场与股票市场之间的相互影响关系中,最常用的是计量经济学中的向量自回归模型(VAR)和格兰杰因果关系检验。Chanel(1995)利用格兰杰因果关系检验研究艺术品指数和国际市场上4个重要股票指数(S & P500、NKY、FTSE 100、INSEE)的关系,发现在滞后期为1~4季度时,英国、日本和美国股票市场对艺术品市场有很明显的影响,可以利用向量自回归(VAR)模型对艺术品的价格进行短期预测[20] 。此外,Campbell(2002)利用格兰杰因果检验方法得出美国股票市场对艺术品市场有驱动作用的结论[18] ;Worthington & Higgs(2003)VAR模型研究艺术品市场与股票市场的关系,得出结论为艺术品市场和股票市场之间以及艺术品各子市场之间存在长期稳定的关系和显著的长短期因果联系[21] 。

在这些研究中,唯一持不同观点的是,Ginsburgh & Jeanfils(1995)在研究Great Masters、Other painters和US painters三各细分绘画市场与英美法三国股票市场之间的联动关系时指出,尽管短期内股票市场价格波动会影响艺术品价格,但从长期来看,股票市场对艺术品并没有什么影响,意味着一国的经济对艺术品的价格影响不是很大[22] 。

在研究艺术品价格与股票价格之间的价格联系时,主要应用格兰杰因果关系检验和VAR模型,这些方法能够判断艺术品市场与股票市场之间是否存在联系,但也存在一个问题,那就是不能清楚地描述出他们之间是如何相互影响的。

2.4. 其他方面

除了以上三方面的研究以外,部分学者还关注艺术品价格的决定因素以及艺术品与个人收入的关系等。如Agnello et al. (1996)对66位美国画家绘画的拍卖记录进行hedonic回归构建艺术品价格与各决定因子的关系模型,发现相同情况下有签名的绘画比没有签名的绘画价格高出45%,油画价格比其他材质的绘画价格高出将近3倍,油画的最佳尺寸是6.5平方米[23] 。Gawrisch(2008)在他的学位论文中也用同样方法指出艺术品价格是关于尺寸的二阶凹函数,最佳的画作尺寸为7.04平方米,画布材质的绘画比纸质有较高的溢价(纸不容易保存),收藏者们更看重的是完成画作的日期不是作家是否签名等[8] 。Petterson & Williams(2009)研究指出富裕人群的个人收入增加对艺术品市场有正向影响[24] 。

3. 艺术品研究常用方法

3.1. 价格指数构建方法

3.1.1. RSR (Repeat-Sales Regression)模型

RSR方法即重复交易回归方法,是指利用重复交易价格来估计某一特定时间段内的价格波动。Baumol (1986)、Goetzmann (1993)、Pesando (1993)、Mei & Moses (2002)对艺术品的研究都使用到了这种方法来建立价格指数[5] [13] [9] ……使用RSR方法的优点在于它得到的价格指数是以同一件艺术品的销售价格结算得来的,艺术品本身特性对价格的影响都不会影响到价格指数。缺点则在于样本量较小,由于艺术品流动性较差、持有时间一般都在10年以上,而且有些销售数据不可得或不能识别,这使得在一定的时间段内获得的重复交易数据有限,而且,重复交易的艺术品一般都是当前热门的艺术品,这使得样本的收益表现一般都会高于平均水平。

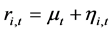

RSR中,艺术品收益率表示为:

(1)

(1)

:艺术品资产 在时间段 的收益率

:艺术品资产 在时间段 的收益率

:艺术品指数的连续性收益率,可以考虑为在时间段 内艺术品的平均收益率

:艺术品指数的连续性收益率,可以考虑为在时间段 内艺术品的平均收益率

:艺术品资产 在时间段 的随机误差项

:艺术品资产 在时间段 的随机误差项

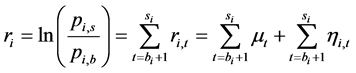

艺术品的买入价格 和卖出价格

和卖出价格 ,买入时间

,买入时间 和卖出时间

和卖出时间 ,则收益价格指数序列可表示为:

,则收益价格指数序列可表示为:

(2)

(2)

3.1.2. Hedonic回归模型

艺术品是异质商品,它们的价格和美学价值通过创作者的知名度、艺术品尺寸、材质、创作之间、拍卖时间和拍卖公司等一系列特性决定。Hedonic价格模型(Hedonic Price Model)是一种处理异质产品差异特征与产品价格间关系经常采用的模型,常用于房地产和艺术品的价格指数构建。Anderson (1974)、Barre et al.(1994)、Gawrisch (2008)等都将该方法用于艺术品投资研究中的指数构建[3] [8] [14] ……

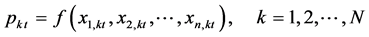

Hedonic的基本模型可表达为:

(3)

(3)

表示第

表示第 件艺术品在时间

件艺术品在时间 的价格;

的价格; 为函数关系;

为函数关系; 为影响该艺术品价格的各个特征。这一模型中,一般将函数关系

为影响该艺术品价格的各个特征。这一模型中,一般将函数关系 分为三部分,第一部分描述艺术品作为异质商品其本身特性对决定的价格;第二部分是由市场供求关系决定的价格;最后一部分为随机误差项,包括一些与艺术品价格有关的无法观察和测量的因素。

分为三部分,第一部分描述艺术品作为异质商品其本身特性对决定的价格;第二部分是由市场供求关系决定的价格;最后一部分为随机误差项,包括一些与艺术品价格有关的无法观察和测量的因素。

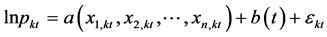

(4)

(4)

由于价格与特性之间一般不会是简单的线性关系,故一般情况下回使用如下半对数线性模型:

(5)

(5)

又可以表示为不同种类,如线性函数:

又可以表示为不同种类,如线性函数:

(6)

(6)

或者:

(7)

(7)

实际应用中,一般使用(6)式,由于艺术品持有时间较长,一般回个几年甚至几十年才会再次拍卖,这一等式用于刻画艺术品的时间价格更为贴切。其中, 代表年份,

代表年份, 为哑变量,当艺术品在

为哑变量,当艺术品在 年销售时,

年销售时, ,第

,第 年没有销售时,

年没有销售时, ,

, 和

和 分别为所研究时间段起始年份和最后一年,

分别为所研究时间段起始年份和最后一年, 为待估参数,通过它可以计算出年度价格指数序列。

为待估参数,通过它可以计算出年度价格指数序列。

3.1.3. 其他指数构建法

除了上面介绍的两种方法以外,还有简单加权平均、“市场篮子”法和综合指数构建法也是比较常用的艺术品指数构建方法,不过为了提高研究数据的准确性,很少有学者用这些方法,艺术品从业人员一般会用这些方法提供指数,如雅昌、AMR(Art Market Research)等。

简单加权平均法,一般通过简单的加权平均或者取中位数得出,这种方法的优点是可以将整个样本考虑进去,但由于艺术品是异质商品,每件艺术品的材质、大小尤其实际价值等都存在很大差异,如果每年拍卖的艺术品都是不一样的(事实也是如此,重复拍卖的总是少数),那么指数的变化更多的是艺术品的特点不同带来的而不是整个艺术品的价格。雅昌和AMR都是使用的这种方法。

“市场篮子”法,选择一组有代表性的艺术品,由专家每年对这些艺术品估价,然后计算价格指数。这一方法在某种程度上解决了艺术品异质商品特性带来的问题,但不论是选择代表性的艺术品还是价格估计都是带有人的主观性的,因此,使用这一方法构建艺术品指数自然也存在一定的偏差。

至于选择哪种方法构建指数,国外学者也有不少相关的讨论。如,Hansen(2009)对澳大利亚房地产的研究发现在样本量很大时hedonic方法和RSR得出的结论是相似的[25] ;Dorsey et al.(2010)研究洛杉矶和圣地亚哥的房地产市场,指出在追踪区域房产市场价格时,hedonic方法更有效。对艺术品市场的研究方面,Ginsburgh et al.(2006)的研究结果显示hedonic方法对小样本更有效,当样本量很大时,hedonic和RSR回归能得到相似的结论[22] [26] 。

3.2. 计量经济学方法

在研究艺术品市场和股票市场之间关系时,国外学者多使用计量经济学方法。根据Engle & Granger (1987)提出的方法,假设我们有一组数据共 个指数序列

个指数序列 ,它们都是一阶单整序列

,它们都是一阶单整序列 并且

并且 ,其中

,其中 为平稳序列

为平稳序列 ,那么

,那么 就称为协整向量,

就称为协整向量, 为协整回归方程。一般的,如果:1)

为协整回归方程。一般的,如果:1) 的每一个分量都是

的每一个分量都是 阶单整序列和2)至少存在一个向量

阶单整序列和2)至少存在一个向量 ,使得线性组合是

,使得线性组合是 阶单整,那么

阶单整,那么 维向量

维向量 的分量间就存在

的分量间就存在 阶协整,表示为

阶协整,表示为 ,这里

,这里 。根据Granger的理论,如果指数之间是协整的,那么就可以使用误差修正模型(ECM)来围绕长期均衡关系的概念进行讨论并且将过去变量之间的不均衡关系作为当前变量动态变化的解释变量。因此,这一模型不仅可以检验指数之间的长期均衡关系,也可以检验它们之间的短期联系。

。根据Granger的理论,如果指数之间是协整的,那么就可以使用误差修正模型(ECM)来围绕长期均衡关系的概念进行讨论并且将过去变量之间的不均衡关系作为当前变量动态变化的解释变量。因此,这一模型不仅可以检验指数之间的长期均衡关系,也可以检验它们之间的短期联系。

要真正使用ECM模型,就需要先确定指数序列的协整秩,最常用的方法为Johansen检验。协整检验用于检验艺术品市场与股票市场、每个细分市场之间以及它们和股票市场之间的长期因果联系;为了检验它们的短期因果联系,一般使用格兰杰因果关系检验。具体的模型和使用方法本文不再赘述,读者可参考计量经济学相关书籍[27] 。

3.3. 投资组合理论

在讨论艺术品加入资产投资组合的可行性和最佳投资比例时,最常使用的方法是马克维茨投资组合理论。给定一个投资组合 ,它的预期收益率

,它的预期收益率 和标准差

和标准差 确定了一个点对

确定了一个点对 ,当这个证券组合权重发生变化时,我们得到一条曲线:

,当这个证券组合权重发生变化时,我们得到一条曲线:

(8)

(8)

为投资组合的方差,

为投资组合的方差, 为

为 个不同资产间的协方差矩阵。我们将该曲线称为组合线。组合线上的每一点表示一个权数不同的证券组合。因此,组合线告诉我们的预期收益率与风险怎样随着证券组合权重的变化而变化。在给定预期收益率

个不同资产间的协方差矩阵。我们将该曲线称为组合线。组合线上的每一点表示一个权数不同的证券组合。因此,组合线告诉我们的预期收益率与风险怎样随着证券组合权重的变化而变化。在给定预期收益率 之下,如何选择证券组合权重

之下,如何选择证券组合权重 ,使证券组合

,使证券组合 具有最小方差成为我们所要考虑的问题。美国经济学家马克维茨在其1952年发表的《Portfolio Selection》中阐述了再具有不确定性的经济系统中资产组合如何最优配置的问题,成为现代资产组合管理理论的分析基础。模型假设和方法等可参考投资学相关资料[28] 。

具有最小方差成为我们所要考虑的问题。美国经济学家马克维茨在其1952年发表的《Portfolio Selection》中阐述了再具有不确定性的经济系统中资产组合如何最优配置的问题,成为现代资产组合管理理论的分析基础。模型假设和方法等可参考投资学相关资料[28] 。

4. 结语

国外(主要为美国和欧洲)对艺术品投资的研究已经比较成熟,他们多用RSR或hedonic回归得出艺术品指数,然后分析艺术品投资的收益和风险,并与股票、债券等其他权益市场进行对比分析,探讨某一类或总体艺术品是否值得投资。但这些研究主要集中于绘画市场,对其他类别的艺术品讨论依旧很少,主要原因是当前投资热门的艺术品多为绘画,其次绘画是二维的,相比其他艺术品而言,其价值更容易衡量。另一个角度则是用计量经济学的相关方法检验艺术品市场与股票市场之间的联动关系,研究艺术品市场走势的预测问题。这些研究存在的共同问题是,没有将艺术品的交易成本、税费、持有成本等考虑进去,最终得出的研究结论可能并不如他们所说的那样乐观,但这些成本一般无法计量而且占比较小,只能忽略不计。最后,艺术品本身是很美的东西,持有者能够从中获得包括审美和社会地位等在内的精神收益,但由于目前艺术品租赁市场还没有发展起来,美学价值没有办法用金钱来衡量。这两个问题都有待进一步解决以为艺术品投资提供更为精确的研究结论和投资建议。

相比之下,国内相关的研究非常少,已有的研究选取的数据都比较粗糙,结论可能并不能真实的反应我国艺术品市场现状。一方面,我们可以借鉴外国学者的研究方法来对我国艺术品市场进行研究分析,为投资者提供一些可行建议;另一方面,我国的古董文化古已有之,艺术品种类更是丰富多样,除了绘画,我们还需积极探索新的价值衡量方法来研究其他品类的艺术品市场。

基金项目

国家自然科学基金资助项目(项目编号:71173023)。

NOTES

*通讯作者。