1. 引言

传统经济理论认为,经济运行具有周期性,经济会经历复苏,繁荣、衰退、萧条、接着复苏阶段,如此周而复始地不断循环。那么通货膨胀是否也存在周期性?物价的上涨速度在持续地上升之后会转向持续地下降,接着上涨速度又持续上升,表现出周期性和惯性特征。当前缺乏对中国通胀周期性进行研究的相关文献。这种周期性如果存在,把握通货膨胀周期性特征,分析影响通胀周期的因素,预测通货膨胀未来的发展趋势,对于政府部门制定经济调控政策以及居民的决策都具有重要意义。

在国外的文献中,关于通胀周期的理论可以追溯到Scarfe (1975)的研究[1] ,Scarfe发现规模较小的开放型经济体通胀通常会呈现周期性。在Scarfe之后,通胀的周期性受到了众多学者的关注。Artis等(1995)是使用先行指标法研究通胀拐点的先驱[2] ,Artis等研究表明,英国在1958年到1993年间共经历了9个完整的通胀周期。Binner等(2005)将哈夫曼滤波技术应用到综合先行指标的构建[3] ,使用综合先行指标来预测欧洲地区的通胀周期。综合先行指标法对周期顶点的预测较好,但是对底点的预测难度较大。

本文对中国1990年以后通货膨胀的周期性及其特征进行探讨、分析影响中国通胀周期的因素,构建动态Probit模型对中国通胀周期的趋势进行预测。

2. 中国通胀的周期性及其特征

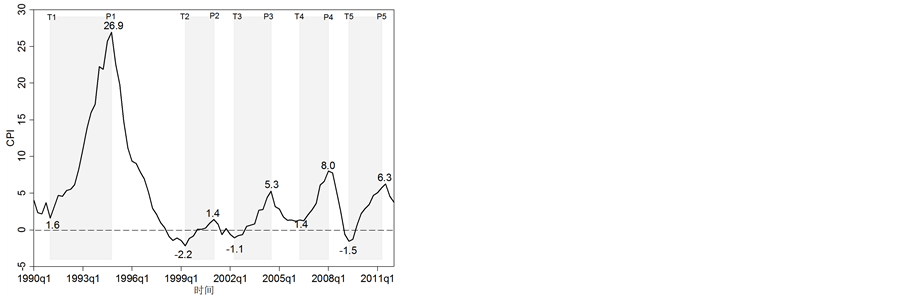

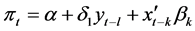

居民消费价格指数(Consumer Price Index, CPI)是反映物价水平的主要指标,它已成为各国央行控制通胀必须参考的指标之一。本文选取中国季度CPI作为衡量通胀水平指标,根据时间顺序构建CPI波动曲线,将CPI持续上升期定义为通胀期,CPI持续下降期定义为通缩期。确定通胀周期的原则参考Artis(1995)的做法,遵循如下基本原则:第一、上升期或下降的期至少要达到三个季度;第二、CPI波动曲线的顶点(底点)之后是底点(顶点);第三、拐点是在上升(或下降)趋势中相邻点中的极值点;第四、如果有两个或更多的点满足前三个条件,那么选择最近一期的点作为转折点。CPI从底点到顶点所经历的时期即是通胀期,从顶点到底点所对应的时期为通缩期。相邻的通胀期与通缩期一起构成一个完整的通货膨胀周期。根据以上原则建立的中国通胀周期如图1及表1所示。

从图1可见,中国的通胀呈现明显的周期波动性。从1991年1季度到2012年1季度,中国通胀共经历了4个完整周期,第5个周期从2009年2季度开始,截止2011年2季度,通胀期已经结束,2011年3季度开始进入了通缩期,截至2012年二季度,通缩期的底点尚未确定。

从表1可见,周期波动的平均振幅(每个周期的CPI顶点与底点的差)为12.2。T1周期发生在上世纪1990年代,周期经历了32个季度(1991年1季度至1999年2季度),振幅约为29个CPI基点。1999年以后,周期波动的幅度逐步减弱,每个周期持续的时间缩短了,平均每个周期持续13个季度。从表1的

Figure 1. China inflation cycles

图1. 中国通胀周期波动图

注:数据来源于万得数据库;阴影区域为通胀期,无阴影区域为通缩期;曲线为CPI季度均值

Table 1. China inflation and deflation cycles

表1. 中国通胀(CPI)周期表

第四列可见,2000年以后,每个通胀期明显长于通缩期,通胀期持续的时间大约是通缩期的两倍。

在确定中国通胀周期的基础上,下一步任务是预测未来的季度将是通胀期还是通缩期(即未来的通胀趋势)。在图1中,假设把通胀期定义为1,通缩期定义为0,即将阴影区域的点设置为1,无阴影区域的点设置为0,那么通胀周期的分析和预测问题转换为二元时间序列的分析和预测问题。对于周期的拐点,如何确定其为通胀期的终点还是通缩期的起点?即拐点应该确定为0还是1?本文对通胀期起点和终点约定如下:通胀期的起点是该季度的第一个月、上一季度的第二、第三个月中存在一个月是周期的底点;通胀终点是该季度的第二、第三个月、下一季度的第一个月中存在一个月是周期的顶点。通胀期的起点和终点确定以后通缩期的起点和终点也能确定下来。

3. 通胀周期影响因素检验及预测

3.1. 通货膨胀理论基础与数据选取

现有国内外文献认为通胀的影响因素主要有成本推动、需求拉动、货币的影响、通胀预期等方面,本文也从这几个方面来选取变量,通过变量组合及其滞后期的选择来确立预测通胀趋势模型。

对于数据的频度选择,考虑到年度数据模型时间跨越比较长,无法避免卢卡斯批判——政策环境和模型结构的变化导致参数估计的失灵,而月度数据也不是好的选择,因为月度数据存在较大的季节性波动,并且频率过高,难以刻画通胀的周期性。因此,本文选用中国季度数据进行实证研究。

影响价格涨跌的成本因素是多方面的,人力成本,固定资产成本、原材料以及辅助材料的成本等都会传导到最终产品和服务的价格当中。鉴于数据的可得性,本文选用成品汽油价格(Oil)的季度变动来代理成本因素,成品汽油是生产、生活必须的燃料,其价格变动对成本的影响具有广泛性。

使用国内生产总值(GDP)的同比季度增速表示需求拉动的影响。使用流通中的现金(M0)及狭义货币(M1)的同比季度增速表示货币对通胀周期的影响,同比季度增速根据同比月度增速的平均值计算。

通胀预期分为适应性预期与理性预期。适应性预期是利用过去预期与过去实际之间的差距来纠正对未来的预期,即根据上一期的价格以及对上一期预测的调整来形成新的预期。而理性预期的支持者认为,人们对于价格的预期并不是一成不变的,会根据新获得的信息集进行调整,因此公众对于未来的预期才是预期形成的主要方式。由于数据的可得性原因,本文参考胡坚(2010)的做法,仅考虑适应性预期的影响[4] 。使用通胀周期的滞后值(yt-1)来表示通胀适应性预期的影响。

已有的实证研究表明,利率的期限结构是预测经济周期的重要变量。利率的期限结构的表示方法很多[5] (陈红霞等,2011),而存款长期和短期利率人们最为熟悉,因此本文使用中国五年期与三个月存款利率的差额(SP)来表示期限结构,检验其与通胀周期的关系,SP季度取值根据中国央行历次利率的调整时间和调整幅度计算。

以上数据除了M0、M1来源于中国人民银行以外,其他数据来源于万得(WIND)宏观数据库。成品汽油价格的数据时期为2000年3季度至2012年1季度,其它数据时期为1990年1季度至2012年1季度。

3.2. 动态Probit模型

Kauppi和Saikkonen(2008)提出了动态Probit模型[6] ,并使用该模型对美国的经济周期进行预测。本文使用该模型对中国的通胀周期的特征进行分析和预测,现对动态Probit模型简要介绍如下。

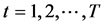

设 表示通胀周期所处的状态,

表示通胀周期所处的状态, ,,

,, 的取值作如下设定:

的取值作如下设定:

(1)

(1)

在已知信息集合为 的条件下,

的条件下, 以概率

以概率 服从贝努利分布,

服从贝努利分布, 取1的条件概率可以表示为:

取1的条件概率可以表示为:

(2)

(2)

是标准正态累积分布函数,

是标准正态累积分布函数, 是

是 的线性组合,公式(2)表示的模型称为Probit模型。根据

的线性组合,公式(2)表示的模型称为Probit模型。根据 的不同表达形式有不同形式的Probit模型。

的不同表达形式有不同形式的Probit模型。 根据公式(3)设定的模型称为静态Probit模型。

根据公式(3)设定的模型称为静态Probit模型。

(3)

(3)

是有n个解释变量组成的1 × n维向量,

是有n个解释变量组成的1 × n维向量, (

( > 0)为滞后期,

> 0)为滞后期, 为截距项,

为截距项, 为n × 1维向量。静态模型的动态扩展是在公式(3)的右边加入因变量的滞后项

为n × 1维向量。静态模型的动态扩展是在公式(3)的右边加入因变量的滞后项 ,

, (

( > 1)为滞后期,由此得到的模型称为动态Probit模型:

> 1)为滞后期,由此得到的模型称为动态Probit模型:

(4)

(4)

3.3. 影响因素检验及样本内预测

成品油价格(Oil)、国内生产总值增速(GDP)、通胀的适应性预期( )、流通中的现金(M0)、狭义货币(M1)、利率的期限(SP)这六个因素变动对中国的通胀周期是否具有显著影响,其对通胀趋势预测的准确度如何?以下将通过Probit模型来检验。根据变量及滞后期的不同选择,本文构建了以下三个模型:静态Probit模型;动态Probit模型;考虑成本因素的动态Probit模型。模型的设定如下。

)、流通中的现金(M0)、狭义货币(M1)、利率的期限(SP)这六个因素变动对中国的通胀周期是否具有显著影响,其对通胀趋势预测的准确度如何?以下将通过Probit模型来检验。根据变量及滞后期的不同选择,本文构建了以下三个模型:静态Probit模型;动态Probit模型;考虑成本因素的动态Probit模型。模型的设定如下。

模型1,静态Probit模型。静态Probit模型与动态Probit模型的主要区别在于前者不考虑通胀的适应性预期的影响,即模型不包含因变量的滞后期。模型的初始设定如公式(5)所示。

(5)

(5)

其中 是标准正态累积分布函数,

是标准正态累积分布函数, 为变量的滞后期,

为变量的滞后期, 的取值根据由公式(1)确定,向量

的取值根据由公式(1)确定,向量 的定义同公式(3),包括除了通胀的适应性预期(

的定义同公式(3),包括除了通胀的适应性预期( )和成品油价格(OIL)变动序列之外的四个序列。由于OIL序列只有2000年3季度以后的季度数据,加入该序列会导致损失较多的样本,包含OIL序列的分析将在动态Probit模型之中展开。

)和成品油价格(OIL)变动序列之外的四个序列。由于OIL序列只有2000年3季度以后的季度数据,加入该序列会导致损失较多的样本,包含OIL序列的分析将在动态Probit模型之中展开。

模型2,动态Probit模型。模型初始设定如公式(6)所示。

(6)

(6)

公式(6)中增加了因变量的滞后期 ,其他符号的设定同公式(5)。

,其他符号的设定同公式(5)。

模型3,考虑成本因素的动态Probit模型。模型的初始设定同公式(6),不同之处在于向量 增加了成品油价格变动序列,用以检验成品油价格变动对通胀周期的影响。

增加了成品油价格变动序列,用以检验成品油价格变动对通胀周期的影响。

以上三个模型所包含变量的滞后期通过信息准则AIC值(Akaike, 1974)来确定。模型及其系数的极大似然估计结果如表2所示。

在表2中,在5%水平下显著的变量认为对通胀周期的变动具有影响。存款利率的期限结构、通胀预期、货币增速对通胀周期具有显著影响,而GDP的增速在三个模型中对通胀周期均无显著影响。这些因素对通胀周期的影响可以从以下理论视角来解释。

名义利率期限结构包含了实际利率变动的重要信息。根据费雪效应(Fisher Effect),名义利率等于实际利率与预期通胀率之和( Fisher, 1930),长短期(名义)利差反映了市场参与者对未来实际利率和通货膨胀的看法,因此,利率的期限结构是预测通胀周期的有效变量,这与李宏瑾等(2010)的研究结论一致[7] 。

适应性预期对通胀周期有显著影响。在模型2中适应性预期( )在1%的水平下显著。加入了适应性预期明显提高了模型的拟合与预测能力。适应性预期不同于理性预期,它反映应的是经济主体在设定价格过程中对经济信息实施的后向搜索行为,适应性预期从另一个角度反映了通胀周期惯性的存在。

)在1%的水平下显著。加入了适应性预期明显提高了模型的拟合与预测能力。适应性预期不同于理性预期,它反映应的是经济主体在设定价格过程中对经济信息实施的后向搜索行为,适应性预期从另一个角度反映了通胀周期惯性的存在。

流通中的现金及狭义货币的增速对通胀周期有较强的解释能力。货币的增速与通胀周期呈现明显的正相关性,这验证了众多文献认为货币是影响中国通胀的主要因素的结论,同时证明了货币增量对通胀周期也有显著的影响。从CPI周期波形图与狭义货币(M1)增速的波形图比较来看,M1均先于CPI达到波形的顶点,货币供应量增速具有先行指标的特点,可见货币政策是有效的通胀调控工具。但是,近年来中国货币政策调控的难度在加大,由于人民币升值预期的存在,外汇通过各种形式流入中国,外汇占款快速增长,央行不得不向市场增加货币以兑换外汇,央行货币调控的独立性在降低,央行需要面对汇率与通胀两个方面的权衡,因此,人民币是否应快速升值到位以消除升值预期,减少外汇过快流入,是值得思考的问题。

汽油价格作为成本的影响因素,对中国通胀周期无显著影响。由于中国的汽油价格受到管制,国际原油价格上涨会在石油加工环节被阻滞或冻结,不能顺畅和全传导到产业链后端的产品价格上,进而不能顺畅和完全传导到一般价格水上,模型3的实证结果证实了这一点。

由于所有变量都滞后于因变量,以上三个模型可以用来对通胀趋势进行预测。根据模型系数计算的因变量值 即为

即为 时间点CPI可能处于通胀期的概率,如果该概率值不小于0.5,将该时间点判别为通胀期,否则判别为通缩期,由此可以得到除了最初两期样本点之外的所有样本点的预测(自变量滞后两期),由于模型参数的估计包含了待预测的样本点,这种预测通常被称为样本内预测。预测的准确率可以通过对比预测结果与实际情况的对比得到。由表2可见,动态Probit模型的样本内预测效果达到了89.61%。

时间点CPI可能处于通胀期的概率,如果该概率值不小于0.5,将该时间点判别为通胀期,否则判别为通缩期,由此可以得到除了最初两期样本点之外的所有样本点的预测(自变量滞后两期),由于模型参数的估计包含了待预测的样本点,这种预测通常被称为样本内预测。预测的准确率可以通过对比预测结果与实际情况的对比得到。由表2可见,动态Probit模型的样本内预测效果达到了89.61%。

Table 2. Factors influencing inflation cycle and prediction results

表2. 通胀周期影响因素检验及样本内预测

注:变量名称之前的L表示变量的滞后期数,L1表示之后一期,L2表示滞后2期;括号内为稳健的标准误;“***”、“**”和“*”分别表示估计量在1%、5%和10%的显著性水平下显著;调整的准R2根据Estrella(1998)公式1-(1-ps.R2)(T-1)/(T-K-1)计算;AIC为模型信息准则值;CR50%表示阈值P为0.5时模型正确预测的比例。

3.4. 通胀周期样本外预测

以上三个模型使用全部样本来估计模型参数,这对考察哪些因素对通胀周期具有影响是有好处的,这样使用了尽可能多的样本信息。但是这对通胀周期的预测会有一些问题,一是可能导致模型的过拟合,二是现实预测中不可能使用未来的样本来估计现在的模型。因此,本文当前样本划分为两个子集,一个子集用来估计模型参数,另一个子集用来检验模型的预测效果,即样本外预测准确率。样本外预测使用10重交叉检验法(10 fold cross validation)。交叉检验的基本思想是将总样本分成训练集与测试集,使用训练集来估计模型的参数,使用测试集来检验模型的预测效果。具体做法是:

1) 将全部样本分成样本数近似相等的子集 ,

, 通过不重复随机抽样产生,各子集之间没有交集;

通过不重复随机抽样产生,各子集之间没有交集;

2) 每次预测实验使用一个子集作为测试集,剩余的九个子集作为训练集,使用训练集估计模型,用估计出来的模型对试集进行预测并记录预测的准确率;

3) 对于每个子集 ,重复步骤二,由于共有十个子集,步骤二会被重复十遍,模型预测能力为所有测试集的平均预测准确率。

,重复步骤二,由于共有十个子集,步骤二会被重复十遍,模型预测能力为所有测试集的平均预测准确率。

上一节设定的三个模型的样本外预测效果如表3所示。从表3的预测结果来看,模型2的样本外预测的准确度达到88.3%,效果好于模型1和模型3。表3中第一类错误均高于第二类错误,表明通缩期比通胀期更难预测。

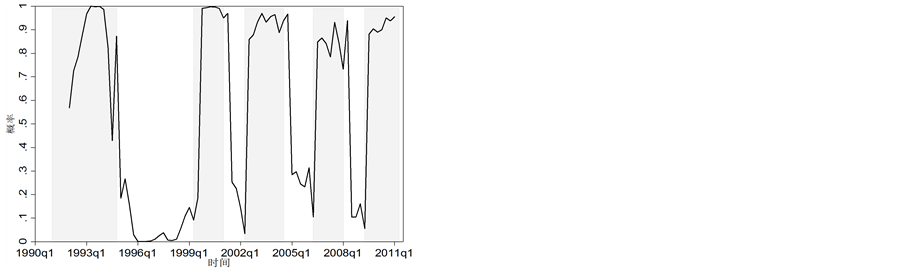

图2为模型2样本外预测的概率与实际通胀周期的对比图,曲线为预测的概率,概率大于等于0.5阈值时预测为通胀期,小于0.5时预测为通缩期,阴影部分所在的时间段为真实的通胀期,非阴影部分为真实的通缩期。从图2可见模型2较好的预测了实际的通胀周期。

4. 结论

本文在建立中国1990年以后通胀周期图表的基础上,对通胀期和通缩期进行了样本内和样本外的分析和预测,通过理论与实证分析,得到的结论总结如下:

1) 中国长期与短期的存款利率的差作为期限结构,对通胀周期有显著的影响与预测能力。利差水平

Table 3. Comparisons of prediction effects

表3. 样本外预测效果比较

注:第一类错误为将通缩期预测为通胀期的比例,第二类错误为将通胀期预测为通缩期的比例。

Figure 2. Predicted probability of model 2

图2. 模型2样本外预测概率图

与通胀期呈现负相关,即长期与短期的存款利率的差额越小,通胀期将会持续的时间越长,因此,除了利率水平以外,利率的期限结构也是央行可以用来调控通胀的有效工具。

2) 货币增速是影响通胀周期的重要因素,与通胀周期高度正相关。目前中国货币的调控面临新的问题,一方面外汇占款的增加逐渐成为导致货币增加的重要原因之一;另一方面,中国经济同时面临增速放缓以及通胀的双重压力,货币调控的空间在缩小,难度在增大。

3) 通胀预期对通胀周期具有显著影响。通过静态Probit模型与动态Probit模型通胀趋势预测能力的比较可见,加入了通胀适应预期的动态Probit模型的预测准确度明显提高,这表明通胀预期对通胀周期具有显著影响,通胀期或通缩期都存在很强的惯性,上一期的价格水平对本期的价格水平具有显著的影响。

4) 中国GDP的增速与通胀周期在实证中并没有表现出相关性。由于中国的汽油价格受到管制,汽油价格的波动对通胀周期的关系也不显著。

5) 从研究方法来看,在确定了中国通胀周期的基础上,将通胀周期的分析与预测问题转化为二元时间序列的分析和预测问题,为通胀周期的研究开辟了新的视角。支持向量机、神经网络、决策树等数据挖掘方法都适用于离散变量的分析及预测,这些方法可以成为后续研究的方向。

基金项目

本文获北京石油化工学院大学生URT项目(2014J00076; 2014J00056)及北京市优秀人才资助项目(2013D005005000001)。