1. 绪论

人们普遍认为,股价尽管不断地上下波动,但从长期来说以其投资价值为中枢。与此观点相似,均值回归理论认为资产价格总是围绕其均值上下波动的。本文对1993年至2014年沪深股市的平均市盈率指标进行统计分析,研究中国股市波动中的均值回归规律性,并结合上市公司的业绩成长性,尝试预测沪深股市本轮牛市的上升目标。

2. 文献综述

Fama & French [1] 对美国纽交所上市公司的交易数据进行实证研究,发现股票收益率长期呈现均值回归的规律。Balvers & Gilliand [2] 对18个发达国家股市的数据研究后也得出结论:股票收益率长期呈现均值回归的规律性。黄勇、冯义涛和陈锦泉 [3] 考察中国股市自1993年~2000年的市盈率资料发现,并不像美国S&P500指数那样具有明显的周期性。他们认为这与中国股市市盈率较高有关,并且与中国资本流动的管制、利率上升以及股权分置等因素也有关。在过去十年里,中国股市的相关因素出现了重大的变化,市场化程度越来越高。因此以均值回归理论全面考察深沪股市变动的规律性具有现实的意义。如果均值回归的规律性在股市中起作用,就具有预测功能。蓝裕平[4] 运用均值回归理论,通过对1993年至2008年6月底共15.5年沪深股市市盈率的统计数据分析,在2008年8月份上海综合指数跌近2000点的时候,认为沪深股市的平均市盈率已经降至18倍左右,进入了历史性低位,因此预测当时的股市“跌势已是强弩之末”。上海综合指数此后在1678点开始反复上扬至2009年8月4日的3478点,升幅达到107%。这说明均值回归理论在进行长期趋势的研究时有参考价值。

本文从中国1993年至2014年沪深股市市盈率指标的统计分析,探讨中国股市估值的周期性特征,同时从历史峰值数据和上市公司业绩成长性指标,尝试测算下一轮牛市周期的上涨目标。

3. 市场估值水平的衡量方法

衡量股票投资价值通常不是看价格本身,而是比较价格与投资回报之间的关系。由于有业绩成长的因素,上海综合指数的曲线图从长期来说,呈现反复上升的态势,因此,看指数图的变化本身并不容易看出其是否符合均值回归的规律性。

市盈率是被广泛运用的估值指标。市盈率 = 价格/盈利,其倒数就是投资回报率。深圳和上海交易所定期公布其上市公司的平均市盈率,这在本研究中被用作两市总体估值的水平。

业绩成长率会影响到未来的盈利水平。尽管深沪交易所并没有公布市场的平均业绩成长率。本研究以上海股市的资料为例,以统计期的市盈率均值为基础,模拟计算期初和期末的指数水平,并以此来测算期间上市公司业绩的复利增长率。

4. 数据及分析

本研究选用1993年至2014年每年年底上交所[5] 和深交所[6] 公布的市盈率指标作为当年市盈率的代表,而深沪股市的平均市盈率则是以同期两市市盈率的算术平均数替代。

本研究对1993年至2014年沪深股市年均市盈率资料整理后发现:沪深两地股市市盈率均值是31.21倍,其倒数所显示的深沪股市同期投资回报率为3.2%。这个比率与2014年底的三个月期国债到期收益率类似,高于银行一年期的储蓄存款。显示从长期来说,沪深股市还属于理性的状态。这个比率作为市场的投资价值中枢有一定的合理性。

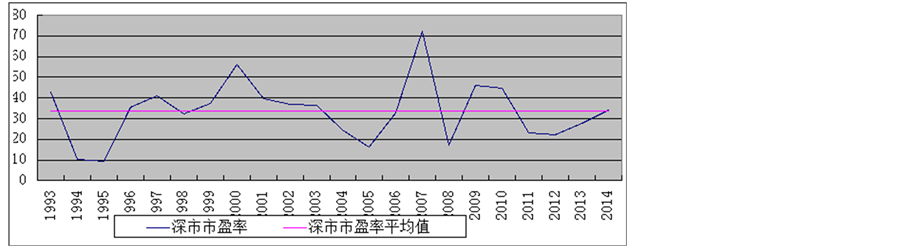

图1、图2、图3分别描绘了沪深股市、沪市和深市从1993年至2014年的市盈率波动情况和均值水平。沪深股市的平均市盈率在过去22年里,出现过四个低点,分别是1995年的12.58倍、2005年16.35倍、2008年的16.00倍和2012年的17.16倍;出现过两个高点,分别是2000年的57.13倍和2007年的65.68倍。从曲线的形状看,沪深股市确实符合均值回归的规律性:市盈率向上超过均值后尽管还在上涨,最终要见顶回落;而当市盈率下跌并低于均值之下以后尽管还继续下跌,终究要止跌回升。尽管在22个年份中有10年的市盈率指标分布在均值上下20%的区域(27.20倍~40.79倍),从图形上看,均值只是“驿站”而已——不是处于上升的过程中就是在下跌的过程中。股价上涨就是泡沫膨胀的过程,而股价下跌则就是泡沫爆破的过程。金融市场的历史表明,周期性是无法改变的。不过,股票市场的总市值已经超过30万亿元,并不是任何机构,包括政府可以左右的。过去这么多年的历史也告诉我们,政府的干预只能改变短期走势,不能改变长期的大趋势。因此,管理当局不要尝试去改变股市大趋势,政府可以通过一些指导性的措施减缓其过度波动对社会和经济的冲击力,使波动曲线平滑化:在泡沫过大的时候采取降温措施,以延缓股市繁荣的时间;而当股市泡沫爆破以后,采取一些“救市”措施,帮助股市实现“软着陆”。

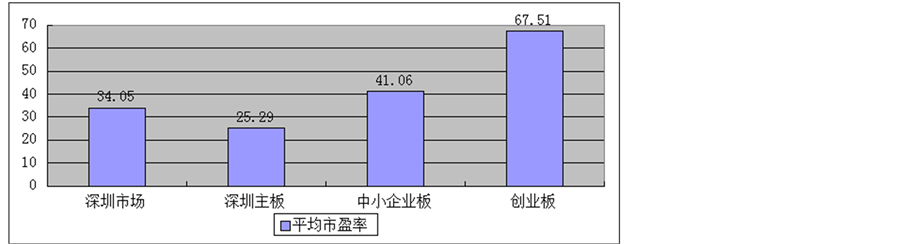

尽管从沪深两市的综合估值曲线图看,两市的估值变动中规中矩,但是仔细比较两市分别的估值曲线却可以明显看到两市近几年的背离情况;深圳股市在2008年的低点以后就没有再探低点,而上海股市却反复下行,屡创新低,2014年初平均市盈率甚至跌破10倍市盈率(因本研究只采集每年底的数据,因此曲线上不显示年中的变动);深圳股市在2012年就开始走强,到2014年底已经高过均值(33.57倍),而上海股市则是2014年底才发力上升,而且离均值还有约一倍的距离。

两市近两年的明显背离状态跟这段时间里深圳中小企业板和创业板上市公司异常活跃有关系。如图4所示,创业板和中小企业板较高的市盈率水平大大拉高了深圳股市的平均市盈率。背后的原因可能反映了这几年沿海地区国内产业转型、经济升级的情况下,市场资金追捧高新技术企业的倾向。不过,上市股市的市值大,集中了国内主要的大型上市公司,因此其走势对整个市场有举足轻重的重要性。

沪深两市综合以后的估值水平相当平稳,很耐人寻味。笔者认为,沪深两市分别都无法单独代表中国股市。同时让笔者想到道氏理论对于股市周期规律性的一个判断指引:当道琼斯工业平均指数出现转向时,需要得到另一个指数——道琼斯交通平均指数的确认才是有效的。在分析国内股市的周期规律性时,也需要注意两个市场指数互相确认的重要性。

5. 以均值回归理论测算股市未来趋势

从图1的沪深估值曲线图可以看到两市在2014年有见底上升的迹象,并且从趋势线分析等方法,可以较有把握的判断另一轮上升行情已经开始。既然沪深股市估值水平的波动符合均值回归的规律。下面尝试对未来股市的上升目标做一个预测。

资料来源:根据深交所和上交所公布的资料整理计算

资料来源:根据深交所和上交所公布的资料整理计算

Figure 1. Average PE ratio of Shanghai & Shenzhen stock markets and mean

图1. 沪深股市平均市盈率及均值

资料来源:根据上交所公布的资料整理计算

资料来源:根据上交所公布的资料整理计算

Figure 2. Average PE ratio of Shanghai stock market and mean

图2. 上海股市平均市盈率及均值

资料来源:根据深交所公布的资料整理计算

资料来源:根据深交所公布的资料整理计算

Figure 3. Average PE ratio of Shenzhen stock market and mean

图3. 深圳股市平均市盈率及均值

5.1. 以市盈率均值变化估算业绩成长性

由于市盈率水平与两个因素有关——股价和盈利。这两个指标都是动态。要预测未来股价的水平,需要先确定盈利的成长性。

本研究以上海股市的资料为例,来测算过往上市公司业绩成长率。在表1,笔者先按照1993年至2014年上海股市市盈率均值29.24倍,分别模拟计算统计期初和期末的上海综合指数:

资料来源:根据深圳交易所公布的资料整理。注释:虽然深圳中小企业板的上市条件跟主板一样,但在上市公司统计中,深圳主板不含中小企业版上市公司

资料来源:根据深圳交易所公布的资料整理。注释:虽然深圳中小企业板的上市条件跟主板一样,但在上市公司统计中,深圳主板不含中小企业版上市公司

Figure 4. Valuation comparison among different boards of Shenzhen stock market

图4. 深圳股市不同板块估值分析(2014年12月31日)

Table 1. Calculation on growth rate of listed companies of Shanghai stock market

表1. 上海股市上市公司业绩成长率估算表

资料来源:根据上海证券交易所统计资料整理计算。

然后,以期末值 = FV、期初值 = PV、年数(22年) = t,计算出期间上海股市上市公司的业绩成长率

5.2. 以历史峰值及成长率估算下一个牛市上升的目标

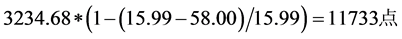

按照表1的数据做估算,假设本轮上升的行情能够持续并形成一个类似2000年前和2007年前的大牛市,上海股市平均市盈率达到当时峰值58倍,那么按照目前的静态市盈率水平计算,上海综合指数的上升目标可以达到

考虑到过去一轮大牛市的时间周期是3~5年,如果把以业绩成长率11.19%考虑进去,按动态市盈率计算3~5年内达到牛市峰值的话,上海综合指数的上升目标可以达到16,127点(三年内到达峰值)或者19,937点(五年内达到峰值)。

6. 结论与局限性

以上尝试运用均值回归理论测算国内股市周期变化规律并预测股市未来的上升目标。从数据分析看,沪深股市基本符合均值回归的规律性,结合上市公司业绩成长性的分析,相信对预测股市的大趋势和上升或者下跌的目标范围会有帮助。但是中国的股市历史还太短,过去只经历过大约两个较完整的周期,因此,股市循环周期在时间上的规律性还不明显,单独运用这个工具没法预测行情的时间要素。而在投资中,时间的把握经常是最关键的,正所谓“Timing is everything (准确地把握时机就是一切)!”因此,本项研究成果也仅供大家作参考,各位在做投资决策时还需要结合自己的判断并控制风险。