1. 引言

在传统的金融分析中[1] [2] ,将不确定资产的价格用随机变量或随机过程分析,利用概率理论,分析了单期及多期金融市场中的资产定价、投资组合、效用优化、风险管理等问题。

然而,在现实金融背景下,信息的不完善使得资产的价格更复杂,各种不确定因素导致市场的发展不能简单地用随机变量描述股票价格,如S. Muzzioli等[3] 探究的市场可以判断是牛市还是熊市,但却不能精确地给出两个状态下的价格。由不确定性理论[4] ,可用区间数、模糊数、随机区间等来描述.具有随机区间收益的市场是传统随机市场模型的推广,同时又能涵盖传统金融市场模型。将随机区间、模糊随机变量引入金融市场分析,已有许多研究,如K. K. Lai等(2002) [5] [6] 研究了区间收益的投资组合选择问题;Y. Yoshida (2006) [7] 研究了具有模糊收益的期权定价问题及其应用;You, S.,Le, J. (2008) [8] 将股票价格作为模糊随机变量,讨论了未定权益定价问题,给出了未定权益价格的上下界;在有限状态概率空间的随机区间市场框架下,Lei, Q. 等(2011) [9] 考虑了具有模糊收益的效用优化问题,证明了最优解的存在性;Shi, J.等(2013) [10] 讨论了具有随机区间收益的未定权益的公平定价问题,在效用函数最优的情况下给出了未定权益的公平价格;You, S. (2013) [11] 给出了强套利机会的定义,探讨了单期随机区间市场的无强套利分析;魏康(2015) [12] 构造了多期随机区间金融市场,分析了无强套利及无差别定价问题。

本文在经典随机市场的占优策略分析[13] 的基础上,探究了具有随机区间收益的单期金融市场的强占优策略,结合You, S.对强套利机会讨论的方法[11] ,在一般概率空间的框架下,给出强占优策略、线性定价测度的定义,证明了随机区间市场无强占优策略与存在线性定价测度等价的定理。

2. 区间数、随机区间的基本概念

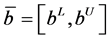

定义1:称闭区间 为一个区间数,其中

为一个区间数,其中 分别称为

分别称为 的上、下边界。若

的上、下边界。若 ,则

,则 是一个确定的数,即实数

是一个确定的数,即实数 可以认为是一个特殊的区间数。

可以认为是一个特殊的区间数。

定义2:任意两个区间数 和

和 ,区间数之间的代数运算定义如下:

,区间数之间的代数运算定义如下:

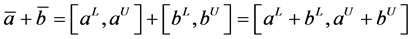

1) ;

;

2) ;

;

3) ;

;

4) 对实数 ,有

,有 。

。

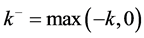

其中 ,

, 。

。

定义3:给定一个概率空间 ,映射

,映射

称 是

是 中的一个随机区间。如果

中的一个随机区间。如果 都是给定空间的随机变量。

都是给定空间的随机变量。

3. 强占优策略及线性定价测度

3.1. 随机区间收益单期金融市场的建立

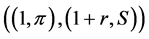

在单时段金融市场模型中,市场有两个交易日: 时刻(现在)和

时刻(现在)和 时刻(将来),其中

时刻(将来),其中 时刻用概率空间

时刻用概率空间 来描述其不确定性,其中

来描述其不确定性,其中 为状态集,

为状态集, 表示当前拥有的市场信息集合。

表示当前拥有的市场信息集合。

假设该市场共有 种基本证券,包括一种无风险证券(债券)和

种基本证券,包括一种无风险证券(债券)和 种风险证券(股票)。

种风险证券(股票)。

在 时刻,债券的价格为1,

时刻,债券的价格为1, 种股票的价格为

种股票的价格为 ;在

;在 时刻,债券的价格为

时刻,债券的价格为 ,由于市场信息不完整,只能预测股票未来的变化范围,则第

,由于市场信息不完整,只能预测股票未来的变化范围,则第 种股票的价格表示为随机区间

种股票的价格表示为随机区间 ,

, ;其中

;其中 均为F-可测随机变量。则

均为F-可测随机变量。则 时刻

时刻 种基本证券的价格向量为

种基本证券的价格向量为 ,

, 时刻

时刻 种基本证券的价格向量为

种基本证券的价格向量为 ,称这

,称这 种基本证券构成的金融市场为具有随机区间损益的金融市场,记作

种基本证券构成的金融市场为具有随机区间损益的金融市场,记作 ,随机区间型金融市场是经典金融市场的推广,当价格的随机区间退化为一个点时,随机区间型市场即为经典金融市场。

,随机区间型金融市场是经典金融市场的推广,当价格的随机区间退化为一个点时,随机区间型市场即为经典金融市场。

在本文对该市场的讨论中,给出以下假设:

假设1:任意证券的价格 都是有界随机变量。

都是有界随机变量。

假设2:市场允许卖空操作。

假设3:市场无摩擦,证券无限可分,无交易费用和税收要求。

假设4:对任意一种证券i, 与

与 可积。

可积。

用 上的向量

上的向量 表示证券投资策略,其中

表示证券投资策略,其中 表示债券的持有量,

表示债券的持有量, 表示由

表示由 种股票的持有量构成的向量,

种股票的持有量构成的向量, 表示投资者卖空

表示投资者卖空 单位的第

单位的第 种证券,

种证券, 表示从银行贷款。

表示从银行贷款。

对于投资策略 ,

, 时刻的价值为

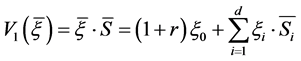

时刻的价值为

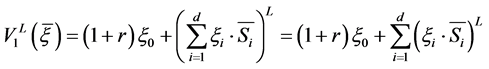

(1)

(1)

时刻的价值为

时刻的价值为

(2)

(2)

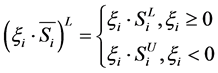

为随机区间,其两端点为

其中对

,

,

则有 ,

,

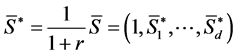

第 种证券的贴现价格为

种证券的贴现价格为

则 种基本证券在

种基本证券在 时刻的贴现价格向量为

时刻的贴现价格向量为 ,在

,在 时刻的贴现价格向量为

时刻的贴现价格向量为

第 种证券的贴现净收益为

种证券的贴现净收益为

表现为随机区间,其中

,

,

交易策略 的贴现增益为

的贴现增益为

表现为随机区间,其中

,

,

则有 ,

, 。

。

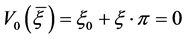

3.2. 无强占优市场分析

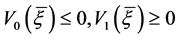

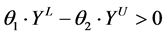

定义4:一个交易策略 称为强占优策略.若存在另一个交易策略

称为强占优策略.若存在另一个交易策略 ,使得

,使得

(3)

(3)

命题1:下列命题是等价的:

(1) 市场存在强占优策略;

(2) 存在交易策略 ,使得;

,使得;

(4)

(4)

(3) 存在交易策略 ,使得

,使得 。

。

证明:先证明 :

:

设 是一强占优策略,则存在

是一强占优策略,则存在 ,使得(3)式成立。

,使得(3)式成立。

令

则

即(2)成立。

下证 :

:

设存在交易策略 ,使得(4)式成立,即

,使得(4)式成立,即 。

。

则

则

.

.

再证 :

:

设存在交易策略 ,使得

,使得 。

。

即

令

则

将每个 表示为

表示为 ,

, ,

, 分别表示的

分别表示的 正部和负部,

正部和负部,

则

即

,

, .

.

即市场存在强占优策略。

定义5 [9] :一个交易策略 称为强套利机会。若满足

称为强套利机会。若满足

且

且

命题2:若具有随机区间收益的金融市场 存在强占优策略,则该市场存在强套利机会。

存在强占优策略,则该市场存在强套利机会。

证明:由命题1可知,若具有随机区间收益的金融市场 存在强占优策略,则存在交易策略

存在强占优策略,则存在交易策略 ,使得

,使得 ,由强套利定义可知,该市场存在强套利机会。

,由强套利定义可知,该市场存在强套利机会。

注:该命题的逆命题不一定成立。在3.3中的实例即为反例,该市场存在强套利机会,但不存在强占优策略。

在经典随机金融市场分析中,市场 无占优等价于存在线性定价测度

无占优等价于存在线性定价测度 ,使得

,使得 成立。该结论不适合于具有随机区间收益的金融市场,为讨论随机区间收益金融市场的无强占优的性质,首先定义新的线性定价测度。

成立。该结论不适合于具有随机区间收益的金融市场,为讨论随机区间收益金融市场的无强占优的性质,首先定义新的线性定价测度。

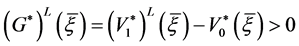

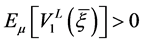

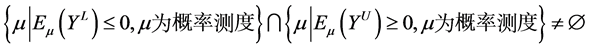

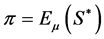

定义6:集合 上的概率测度

上的概率测度 称为线性定价测度,若满足

称为线性定价测度,若满足

注:上述定义可由贴现净收益描述为 为一概率测度,且满足

为一概率测度,且满足

令

定理1:随机区间收益金融市场无强占优当且仅当 。

。

证明:首先证明若 ,则随机区间收益金融市场无强占优。

,则随机区间收益金融市场无强占优。

设 为一线性定价测度,则

为一线性定价测度,则

对

若 ,则必有

,则必有 。

。

将每个 表示为

表示为 ,

, ,

, 分别表示的

分别表示的 正部和负部,

正部和负部,

则

又因为

则

即 。

。

故随机区间收益金融市场不存在强占优策略。

其次,证明若随机区间收益金融市场无强占优,则 ,即存在线性定价测度。

,即存在线性定价测度。

证明存在线性定价测度等价于证明

令

下面需要证明若随机区间收益金融市场无强占优,则 。

。

(反证法)假设 ,

,

对 ,则

,则

也是概率测度。

也是概率测度。

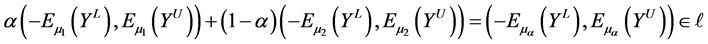

同时,

则 是凸集。

是凸集。

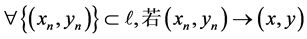

则存在概率测度序列 ,使得

,使得 。

。

又由于概率测度序列 一致有界,

一致有界,

则存在子列 ,使得

,使得 为概率测度。

为概率测度。

又因为 为有界可测函数且关于概率测度序列

为有界可测函数且关于概率测度序列 可积,

可积,

则 关于概率测度序列

关于概率测度序列 一致可积且积分有界。

一致可积且积分有界。

则有

.

.

则

.

.

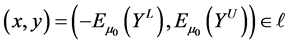

所以 是有界闭集。

是有界闭集。

又因为 是闭凸集,

是闭凸集,

则由凸集分离定理可得,存在向量 ,使得对任意

,使得对任意 ,有

,有

.

.

由 的任意性可得:

的任意性可得:

(否则,若 ,则存在

,则存在 ,使得

,使得 ,令

,令 ,则有

,则有 矛盾!则

矛盾!则 ;同理可得

;同理可得 )

)

则有

即

则

由于 是任意概率测度,

是任意概率测度,

则有

定义新的交易策略 ,将每个分量

,将每个分量 表示为

表示为

,

, ,

, 分别表示的

分别表示的 正部和负部,其中

正部和负部,其中

则对任意 ,有

,有

.

.

所以

则

则由命题1可知:市场存在强占优策略,与已知矛盾!

所以假设不成立,市场存在线性定价测度,即 。

。

命题3:随机区间收益金融市场 不存在强占优策略当且仅当存在

不存在强占优策略当且仅当存在 ,使得由

,使得由 描述的传统随机金融市场无占优。

描述的传统随机金融市场无占优。

证明:先证“ ”

”

(反证法)假设对任意 ,传统随机金融市场

,传统随机金融市场 都存在占优策略

都存在占优策略 。

。

即满足

则对于随机区间收益金融市场 来说,

来说,

即投资策略 为金融市场

为金融市场 中的强占优策略,与题设矛盾!

中的强占优策略,与题设矛盾!

故假设不成立,即存在 ,使得由

,使得由 描述的传统随机金融市场无占优。

描述的传统随机金融市场无占优。

再证“ ”

”

若存在 ,使得由

,使得由 描述的传统随机金融市场无占优。

描述的传统随机金融市场无占优。

则由经典占优理论可知,存在概率测度 ,使得

,使得 成立。

成立。

又因为 ,

,

则有

即

则 为随机区间收益金融市场

为随机区间收益金融市场 的线性定价测度。

的线性定价测度。

即该市场不存在强占优策略。

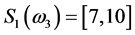

3.3. 举例

假设在市场 中,有无风险证券

中,有无风险证券 ,当前价格为1,无风险利率

,当前价格为1,无风险利率 ;及一个风险证券

;及一个风险证券 ,它们在0时刻的价格

,它们在0时刻的价格 ;在1时刻,有三种可能的状态

;在1时刻,有三种可能的状态 ,价格分别为

,价格分别为 ,

, ,

, 。

。

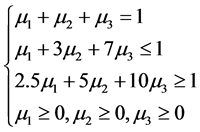

则由线性定价测度的定义可知,线性定价测度 需满足以下条件:

需满足以下条件:

注意到 满足此条件,即

满足此条件,即 为该市场的线性定价测度。

为该市场的线性定价测度。

则该市场不存在强占优策略。

4. 结论

本文将研究的空间从有限维拓展为了一般概率空间,提出了强占优和无强占优策略的概念,利用区间数理论、概率测度理论等对单期随机区间收益市场无强占优分析进行了研究,并且讨论了市场无强占优与存在线性定价测度等价的定理,并且研究了随机区间收益市场无强占优与经典市场无占优的关系。将经典市场中的无占优的理论推广到了随机区间收益金融市场中,当随机区间两个端点相等时,随机区间收益金融市场则退化为了经典市场。

在受国际影响越来越多、金融市场不稳定现象越来越频繁的大环境下,证券的表现将不能再用简单地随机变量描述,用随机区间描述资产收益更能反映实际市场的不确定性,对随机区间收益市场中的相关问题的研究将能为投资者提供更有意义的投资决策。本文的内容还比较初步,还有很多潜在的研究方向,如单期随机区间收益市场的完备性的研究、利用集值理论研究随机区间收益证券的效用优化等问题。