1. 引言与文献回顾

近年来频频爆发的主权债务评级下调危机,如美国债务危机、希腊债务危机等,导致全球股票市场暴跌、外汇市场大幅波动以及国际资本的非正常流动,使这些国家乃至全球经济发展受阻,借债成本大幅提高,严重威胁经济安全。反思近20年以来,从东南亚危机到墨西哥危机,从美国次贷危机到当前欧洲主权债务危机,全球金融危机一再重演,且爆发频率不断增加,使得各国政府的宏观经济管理面临巨大挑战,迫使人们对主权信用评级下调与一国经济和金融体系安全的关系进行深入思考。正是由于主权信用评级的下调导致全球股市暴跌,给全球经济复苏蒙上了一层阴影。

当前,欧元区国家正深陷严重的主权债务危机,而这场危机从2009年12月全球三大评级公司惠誉、标普和穆迪先后下调希腊的主权信用评级开始,接着欧洲意大利、西班牙、爱尔兰以及葡萄牙等四国主权信用评级也被大幅度下调,

导致以上五国金融市场出现动荡,并最终引发欧洲主权债务危机。在这样的现实背景下,研究主权信用评级变动对股票市场的冲击,度量评级下调冲击下股票市场的偏离均衡的波动大小,检验股票市场是否偏离均衡,波动与均衡的偏离程度具有重要的现实意义。

近几年来众多学者对主权信用评级变动冲击全球经济稳定做了大量的研究。也有众多学者对影响股票市场均衡做了大量研究。但在欧债危机这个大背景下,这样的突发事件对于股票市场的波动的影响是非常显著的。所以有必要针对评级变动对股票市场均衡及波动的影响。国外对于主权信用评级变动对其它国家的影响的研究主要集中在风险的溢出效应方面及影响的不对称性方面。如:Li等人(2008) [1] 研究了外币主权信用评级变动对亚洲五国国内和国家间的股票市场回报率的影响。面板估计的结果表明主权信用评级的改变不仅影响本国的股票收益率,还对样本内其他国家的股票收益率存在影响。Lee (2010) [2] 等人研究了主权信用评级变动对股票市场波动性的影响。他们发现评级的变动对流动性的影响是显著并稳健并且是非线性的,且在不同股票不同国家间还存在着差异。他们还发现当评级下调至投资级以下时对股票流动性的负面影响更大。也有一些学者针对评级变动对不同金融市场的影响进行比较。Rachel Christopher, Suk-Joong Kim和Eliza Wu (2012) [3] 通过对主权信用评级背景下,19个新兴市场国家的股票市场和债券市场之间的动态相关系数的短期和长期影响效应的探究,得出一国信用评级上调,对区域国家股票市场的联动性有正的影响,区域内国家的股票市场将产生正的收益,然而一国主权信用评级下调,将导致投资者从该国向周围区域国家转移资产,而且发现信用评级下调带来的负向影响主要集中在债务水平高于区域平均水平的国家。Afonso, Gomes, Taamouti (2014) [4] 使用EGARCH定义的参数化波动率估算,通过比较在股票和债券市场的不同等级类别的平均波动幅度,在波动性方面的排名。对于债券市场,AAA级和AA-级的波动幅度并没有显著;评级为投机级国家的统计结果相比于AAA级国家波动率有3至4倍的剧烈波动差异。但是统计分析和回归模型只能从静态的角度分析评级与股票债券市场的关系,并不能去衡量金融市场具体的波动。Gomes (2013) [5] ,Ferreira和Gama (2010) [6] 这些学者都运用VAR模型方法研究了次贷危机冲击下时,CDOS市场风险通过流动性和风险溢价渠道对其他金融市场的影响。脉冲响应使用滞后期的股票和债券市场评级变动消息估计,给出了脉冲响应函数的影响升级和降级公告对股票和债券市场波动。但是利用VAR模型进行分析,仅仅建立固定参数模型,并没有考虑到动态效应。所以本文使用动态面板协整模型,就可以将动态效应包含进去。Grammatikos, Vermeulen (2012) [7] 通过构建有阶跃的随机波动性模型,分析了美国股票市场对欧元区股票市场波动的溢出效应。Luliana Ismailescu (2010) [8] 评估了主权评级变动公示后主权CDS利差的波动效应。Arezki, Candelon, Sy (2011) [9] 通过建立包含亚洲国家和美国股票市场同生关系的联立方程组,发现存在波动的溢出效应。

近年来我国也有不少学者探究欧债危机背景下,关于评级的影响因素,以及评级对经济系统产生的冲击;还有也有一些学者针对突发事件或者政策变动对股票市场风险波动的研究。如:田益祥,陆留存(2012) [10] [11] 研究表明,通过面板有序概率模型研究主要的影响评级因素的长短期效应,及评级下调导致的非对称效应。谢世清,邵宇平(2011) [12] 运用GARCH模型分析了股权分置改革对市场波动性影响的长短期效应及波动的有效性。柳会珍,顾岚(2014) [13] 基于跳跃扩散波动理论,利用非参数方法估计波动中跳跃成份,研究我国股市波动中跳跃的动态演变特征,将跳跃作为股市波幼的重要因素纳入模型,建立我国股指收益率的非齐次自回归已实现波动率模型,利用条件极值方法对我国股市的波动风险进行动态预测。王明涛(2012) [14] 检验政策因素针对不同的行情市场对中国股票市场波动的非对称影响。从以上学者的研究过程来看,都仅仅是研究评级变动导致的波动,几乎很少学者针对评级冲击对股票市场的均衡与波动进行研究。没有去挖掘波动所偏离经济均衡的程度。误差修正模型,是一种很好的可以刻画变量偏离长期均衡的一个调整力度。在研究对于均衡的偏离程度方向,借鉴谷雨,高铁梅,付学文(2008) [15] 利用误差修正模型分析了宏观基本面对人民币汇率的影响,以及测算人民币汇率相对于均衡状态的错位程度。刘金全(2005) [16] 运用误差修正模型分析货币供给增长率与通货膨胀之间的短期波动与长期均衡的关系。所以本文测度主权信用评级对股票市场冲击导致对于均衡的偏离时用误差修正模型。在利用误差修正计量模型方面,欧阳敏华,雷钦礼(2013) [17] 考虑到在不同的政策环境下经济变量也会具有不同的误差修正速度,将通常的门限非对称误差修正模型进行了拓展,在门限变量为一般平稳变量情形下,建立了对协和向量和门限参数联合估计的条件最小二乘估计法。关于针对危机政府救市效果的检验方面,程棵等(2012) [18] 通过跳-扩散模型,数值模拟对比政府是否实施救助金融机构结果来看,政府对于金融机构的注资,可以使金融机构在保证不违约前提下的最优债务/资产比率达到和危机发生前的水平,便于金融机构通过自身的杠杆经营恢复活力。本文首先分析主权信用评级变动对股票市场冲击的波动,考虑到冲击产生的效果可能存在的非对称效应,使用广义自回归条件异方差性的模型EGARCH来过滤古银评级变动导致的波动。将随时间和国家都变化的影响因素分解为长期因素和短期控制变量。建立动态面板协整回归模型,得到实际有效的均衡收益率。在协整方程的基础上进一步建立误差修正模型,找到影响金融市场的长短期波动影响因素,通过误差修正模型的输出结果来衡量相对于长期均衡的短期偏离程度。针对性结论,提出长期政策维护和提升评级等级、短期调控政策抑制短期非正常冲击。

2. 主权信用评级变动对股票市场冲击的波动

2.1. 股票市场波动的衡量方法

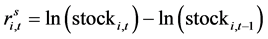

由于股票指数的波动,主要表现在收益率序列的波动,因而本文用股票指数的日收盘价来计算股票指数的收益率,计算公式下(1)式

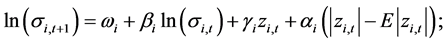

波动性与反映证券市场质量和效率的其他指标如流动性、交易成本、市场信息流动等密切相关,因此波动性是综合反映股票市场的价格行为、质量和效率的最简洁和最有效的指标之一。由于不可以直接获取到波动率数据,我们通过使用参数波动模型来估计波动率。具体应用指数广义自回归条件异方差性的模型来描述市场收益率对于评级机构信息披露的波动。这个模型通过具体的条件边缘分布来过滤条件波动率的过程。随后对于稳健型的检验,使用含绝对值和平方项替代收益的波动性。

(1)

(1)

(2)

(2)

(3)

(3)

(4)

(4)

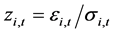

根据Asai, McAleer (2011) [19] 的分类,上面的(3)式是一个EGARCH模型,用来检验和刻画对于正项与负向冲击的非对称性模型。 定义了标准化的残差,

定义了标准化的残差, 刻画了非对称效应的波动性,相比于同等程度的正向冲击,负向冲击产生更高的波动。对于上面的式子来说,正向的冲击斜率系数就是

刻画了非对称效应的波动性,相比于同等程度的正向冲击,负向冲击产生更高的波动。对于上面的式子来说,正向的冲击斜率系数就是 。负向的冲击斜率系数就是

。负向的冲击斜率系数就是 。如果

。如果 是正的,

是正的, 是负的,那么负向冲击产生的波动大于正向冲击的波动。因为

是负的,那么负向冲击产生的波动大于正向冲击的波动。因为 。

。

数据选取包含欧盟国家、亚洲市场国家和美国等国家的股票指数数据:奥地利、法国、德国、希腊、爱尔兰、意大利,拉脱维亚,立陶宛、荷兰、葡萄牙、西班牙、英国、美国、中国、日本。数据的选择为各国股票指数。

分别是欧猪五国,包括希腊ASE指数,西班牙IBEX35指数,米兰SP/MIB指数,爱尔兰ISEQ指数,葡萄牙PSI20指数代表早期的危机国家,北欧交易所OMX里加(OMXR)指数(拉脱维亚),维尔纽斯(OMXV)指数(立陶宛),法国,德国及英国这些发达国家,即是巴黎CAC40指数,德国法兰克福DAX30,伦敦金融时报100指数,奥地利ATX指数,中国沪深300指数,美国标普500指数,日经225指数(I01021)。为保持样本数据时间跨度的一致性,时间区间从2008年1月到2013年10月。样本数据部分来源于RESSET金融研究数据库,部分来源于STOCKQ国际股市指数行情。由于各个国家节假日等的不同,使得股票交易日期存在差异,因而各个股票指数所包含的样本数据均不同,经过时间匹配后,有效数据有4060个。

从表1估计结果来看,在10%的显著性水平下,参数估计系数基本都是显著的,说明EARCH模型能较好地拟合样本序列。高β值说明波动是持久的。系数 均大于零,说明股票指数收益率的波动具有明显的杠杆效应:利空消息比等量的利好消息可以产生更大的波动。当出现利空消息时,该消息会对股票价格指数收益率带来

均大于零,说明股票指数收益率的波动具有明显的杠杆效应:利空消息比等量的利好消息可以产生更大的波动。当出现利空消息时,该消息会对股票价格指数收益率带来 倍的冲击,但是当出现利好消息时,该消息只会对股票指数收益率带来

倍的冲击,但是当出现利好消息时,该消息只会对股票指数收益率带来 倍的冲击。也就是说,各国股票市场上的投资者对坏消息的敏感度较高,源于心理预期给股票指数带来了更大的波动,这也进一步说明了股票市场是需要信心维持的。在欧洲的十个国家中,利空消息对希腊股票市场的冲击效果最大,其次为爱尔兰和葡萄牙的股票市场,最后为英国的股票市场,这说明了在危机时代,希腊,爱尔兰,葡萄牙等严重危机国家较英国等发达国家股票市场的波动性显著大。另

倍的冲击。也就是说,各国股票市场上的投资者对坏消息的敏感度较高,源于心理预期给股票指数带来了更大的波动,这也进一步说明了股票市场是需要信心维持的。在欧洲的十个国家中,利空消息对希腊股票市场的冲击效果最大,其次为爱尔兰和葡萄牙的股票市场,最后为英国的股票市场,这说明了在危机时代,希腊,爱尔兰,葡萄牙等严重危机国家较英国等发达国家股票市场的波动性显著大。另

Table 1. The estimation results of EGARCH (1,1) model

表1. EGARCH (1,1)模型估计结果

注:***代表在1%的水平下显著。D.F.是表明方程(2)中的t-统计量的自由度。

外,由于系数之和接近1,表示过去波动和外界的冲击对波动率的影响持久,且持续性强,即冲击对未来所有的预测都具有重要的作用。D.F.代表t分布残差项的自由度。通过结果可以看到,波动存在尖峰后尾特征。

对于股市波动,这种模式是比较不显著,具有AAA级的国家的股市波动性与BBB国家和地区持平,而投机级评级的国家也只有约50%以上的波动幅度,见表2。

2.2. 波动率对升级和降级的反应

在本节中,我们研究股票市场波动对欧洲国家主权评级升级和降级的反应。因此,我们通过借鉴Gomes, Taamouti (2014) [4] 提出的国家固定效应面板回归模型来进行估计:

用指数函数过程代表条件波动性来保证它是正的, 使用EGARCH条件波动性替代。

使用EGARCH条件波动性替代。 代表方程的固定效应,X代表控制变量。数据依然是上文罗列的各国股票指数。

代表方程的固定效应,X代表控制变量。数据依然是上文罗列的各国股票指数。

表3说明了利用两个滞后项的方程的估计结果。我们测试了若干个滞后项,一般来说,两个滞后项足以捕捉动态的股票市场收益波动性。如表所示,我们注意到关于波动率的主权信用评级的发展有着不对称性的存在。主权的升级对波动性没有显著影响。另一方面,股票市场的主权信用评级下调以一个滞后增加了波动性。这些回归的 很高,高于0.95,可以解释为持久性的波动(滞后波动)。我们已经运行附加回归,这个回归不包括滞后波动。这些替代的

很高,高于0.95,可以解释为持久性的波动(滞后波动)。我们已经运行附加回归,这个回归不包括滞后波动。这些替代的 回归也披露在表3中,在方括号内,约为0.3。

回归也披露在表3中,在方括号内,约为0.3。

2.3. 稳健性检验

我们估计三种替代波动模型,允许残差项服从不同的分布的不对称波动性。对于时变的预期收益率

Table 2. The average volatility of different credit rating countries

表2. 不同信用等级国家的波动率平均值

Table 3. The volatility reaction to upgrade and downgrade

表3. 波动率对升级和降级的反应

注:表格中R2后面中括号里面的数字,代表着没有滞后因变量时方程的拟合度。***代表在1%的水平下显著。

序列,应用GJR-GARCH model (Glosten et al., 1993),高斯分布EGARCH模型,和自相关收益率的EGARCH模型来进行检验。使用过滤的波动性来得到的回归结果。

我们依然发现两个滞后项足以捕捉动态的股票市场收益波动性。如表4所示,我们注意到关于波动率的主权信用评级的发展有着不对称性的存在。主权的升级对波动性没有显著影响。另一方面,股票市场的主权信用评级下调以一个滞后增加了波动性。说明上面的结果是稳定的。

3. 股票市场长期均衡及偏离测度

3.1. 误差修正模型理论介绍

由协整理论的中格兰杰表达式定理可知,变量序列之间的协整关系意味着误差修正机制的存在。也就是说,如果经济系统中的各个变量之间存在协整关系,如果当其中某些经济变量在受到各种随机冲击而偏离其长期均衡轨道后,经济系统内部将会有一种内在机制导致其向长期均衡轨道回归。在经典协整

Table 4. The robustness test of stock market to volatility of rating time

表4. 股票市场对评级时间波动率的稳健性检验

注:***、**代表在1%、5%的水平下显著。

理论中,不论经济变量所受到的冲击是正向还是负向,都假定经济变量不论正的方向还是负的方向偏离了长期均衡轨道,其向长期均衡轨道回归的速度都相同。然而,欧阳敏华,雷钦礼(2013) [17] 认为这种回归速度同一性的假定往往并不符合实际。例如,我们看到由于经济过热和经济衰退导致的经济变量对长期均衡轨道的偏离的回复过程往往很不相同,回复所需的时间长度也往往相差很大。因此,考虑到不同方向的非均衡误差可能具有不同的修正速度,以及在不同的政策环境下经济变量也会具有不同的误差修正速度,就需要将经典的误差修正模型扩展,构造出可以描述不同政策环境下或不同方向的非均衡误差具有不同修正速度的模型,这种误差修正模型就是非对称误差修正模型 [17] 。

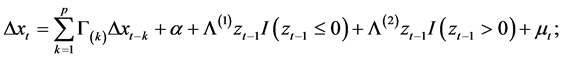

则线性非对称误差修正模型就可表示为:

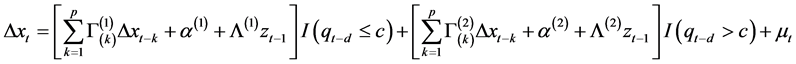

更一般地,考虑到不同的政策环境下经济变量本身的短期动态运行结构和非均衡误差修正速度的可能不同,可将该经济系统的误差修正机制拓展设定为:

3.2. 变量选择及描述性统计分析

3.2.1. 变量及数据的选择

由于Cooper, Day和Lewis (2001) [20] 的研究表明标准普尔发布的评级的事件总体上领先与穆迪和惠誉国际,并且领先发布的评级信息对市场的冲击最大。所以本文评级数据采用了标准普尔长期主权信用评级。本文数据来源于标准普尔官方网站。将标准普尔官方网站上的评级符号以附表中的方式进行转化。

股票市场的变化采用股票市值占GDP比率这一指标来衡量。此外,为防止遗漏重要变量而对估计结果的准确性产生影响,本文还加入了如下控制变量:GDP增长率、通货膨胀以及广义货币存量M2。数据来源于世界银行(Word Bank) WDI数据库、国际清算银行(The Bank For International Settlements)。

3.2.2. 描述性统计

GDP增长率代表了一国经济增长速率,较高的GDP增速表明一国正处于经济增长的轨道,未来前景良好,也会刺激股票市场的发展,对股票市场应具有正影响;通货膨胀对股票市场的影响较为复杂,一方面它表明资产价格的上升,社会资金较为充裕,对股票市场利好,另一方面较高的通货膨胀也说明一国经济存在一定的问题,尤其是恶性通货膨胀,严重冲击一国经济的增长;广义货币存量作为政府的货币政策,起着调控市场流动性的作用,尤其对于我国股票,由于受政策影响较大,广义货币存量的增减直接影响着股市的涨跌。因此,预期也对股票市场具有正影响。

表5列出了最近几年股票市值占GDP比率的描述统计,从均值来看,所选新兴经济体的股票市值比率在40%左右,且在2008年牛市中达到峰值54.93%,随后全球金融危机爆发,股票市值也逐渐缩水,09年股票市值占GDP比率低于了50%。从各国股票市值比率差异中分析,金融自由化程度最高的我国香港地区08年股票市值占GDP比率一度达到了775.8%,远远高过其他新兴经济体。而另外一些国家这一比率1%都不到,发展程度极为低下。因此,本文的分析考虑到了国家间的差异,具有一般性。

从均值来看,伦敦金融时报100指数最大,德国法兰克福DAX指数紧随其后,希腊ASE指数最小,西班牙IBEX35指数,米兰SP/MIB指数,爱尔兰指数,葡萄牙PSI20指数居中。从标准差来看,希腊ASE指数最大,伦敦金融时报100指数最小。结合均值和标准差,可以看出西班牙,意大利,爱尔兰,葡萄牙股市收益与风险相匹配;希腊和英国股市收益与风险不相匹配。从偏度来看,八个股票指数绕其均值具有非对称性,负的偏度值意味着左偏。从峰度和J-B统计量来看,八个股票指数收益率序列均不服从正态分布。根据表6,样本数据具有典型的金融数据特征,即尖峰和厚尾。因而,在模型估计之前,需要对样本数据的平稳性进行检验,以防止出现“伪回归”现象。此处采用的方法是ADF (Augmen-Dickey-Fuller)检验,即检验样本序列是否服从单位根过程。

3.3. 构建动态面板数据协整模型

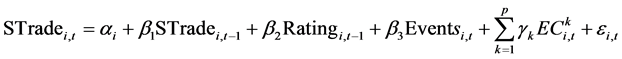

为检验主权信用评级变动对股票市场的冲击,本文构建了如下动态面板数据协整模型:

其中,STrade表示股票市值占GDP比率,Rating为评级数据,Events分别代表评级上升事件和评级下降事件。为得到评级上升事件和评级下调事件是否对股票市场的不同影响,对评级上升事件和下降事件将分开估计。EC为经济控制变量。 为个体效应。

为个体效应。 为前文通过GARCH模型过滤的收益率的波动。

为前文通过GARCH模型过滤的收益率的波动。 分别代表了国家和时间。在进行动态面板数据回归之前,为防止数据非平稳导致伪回归问题,有必要对

分别代表了国家和时间。在进行动态面板数据回归之前,为防止数据非平稳导致伪回归问题,有必要对

Table 5. The descriptive statistics of the ratio of stock market value to GDP

表5. 股票市值占GDP比率描述统计

股票市值占GDP比例进行单位根检验。股票市值比率的面板单位根检验结果如表7所示。

从上表中看到,股票市值占GDP比率即不存在普通单位根也不存在个体单位根问题,数据是平稳的,可以进行动态面板回归。

表8结果表明,各变量的水平值都存在着单位根,要么是普通单位根(Common Unit Root)要么是个体单位根(Individual Unit Root)或者两者都存在。而变量的一阶差分均不存在单位根。

如表9所示,分析以上结果,我们发现各系数的符号符合预期,股票市值比率存在滞后效应。主权信用评级滞后项的符号也符合预期,对股票市值比率具有正向影响。评级符号改变对股票市值比率的影响也符合预期。当评级机构提高一国主权信用评级时,该国的股票市值比率将会上升,然而这种影响并不显著,投资者对利好的刺激反应较为平静。而当评级机构下调一国主权信用评级时,股票市值比率将大幅下降,各类资本撤离股市,而且模型中评级下调事件的系数在1%水平显著。通过比较系数还可以发现,评级的下调带来的股票市值比率的下降幅度远大于评级上升带来的股票市值比率上升幅度。也即主权信用评级对股票市值的影响存在着显著的非对称效应。

此外,控制变量的符号也符合预期,GDP的增长坚定了投资者的信心,促进股票市场的上涨,且涨幅高于GDP增幅;广义货币存量对股票市场也具有正影响,广义货币存量的提高增加了股票市场的资金来源,进而推动股市的上涨;通货膨胀对股票市场的影响十分复杂,即有可能推高股市也有可能引起股市下跌,模型中结果表明通货膨胀对股票市场比率的影响不显著,不是简单的单向刺激。

Table 6. The descriptive statistics of stock index returns

表6. 股指收益率的描述性统计量

注:1%临界值:−3.44515%临界值:−2.867910%临界值:−2.5702%。注:此处采用的检验类型为(c,0,O),ADF检验中的滞后阶数的选取依据是SIC信息准则,在最大滞后阶数为l8的情况下选取最优的滞后阶数。

Table 7. The unit root tests of ratio of stock market value to GDP

表7. 股票市值占GDP比率单位根检验

Table 8. The unit root tests of sovereign credit rating and control variables

表8. 主权信用评级和控制变量的单位根检验

注:***代表在1%的水平下显著。

注:***、**、*代表在1%、5%、10%的水平下显著。

3.4. 误差修正模型回归结果及错位水平测度

在误差修正模型中,差分项反映了长期非均衡误差对短期波动的影响,短期波动相对于长期均衡的偏离程度。误差修正项的系数大小反映了将非均衡状态拉回到均衡状态时对偏离长期均衡的调整力度。负的误差修正项的系数,表示下一个时期,研究对象回落并恢复均衡。确定滞后阶数,再用一般到特殊的建模方法,去掉不显著的解释变量。确定股票市场收益率的误差修正模型:

分析误差修正项的系数大小,反映了将非均衡状态拉回到均衡状态时对偏离长期均衡的调整力度。剔除掉不显著的控制变量。由于考虑到波动率的特殊性,e为前文通过GARCH模型过滤的收益率的波动。考虑到评级变动次数比较多,选择评级变动前后每4个月数据作为一组。应用面板数据得到如下结果:

表10中误差项的修正系数为−0.68,说明股票市场股指收益率自身具有误差修正机制。并且其自身

Table 10. The estimation results of VECM

表10. 误差修正模型估计结果

的滞后项系数为0.711,意味着,股票市场处于连续上升或者连续下降的过程中。评级下调事件发生的系数是0.95,对股票价格的波动影响显著。意味着当有突发事件的冲击下,短期会有大幅度波动。股票市场的变动在短期对评级变动的冲击方向是相同的。当有正向冲击条件下,股票市场收益率的变动呈现非显著的增长,对与负向冲击,信用等级高的股票市场收益率会出现不显著的小幅度增长;对于信用等级高的国家股票市场而言,会出现显著地大幅度下降。对外债务在当期的系数是0.05,相比于滞后期的0.004而言非常显著;说明当期对外债务过高对于股票市场波动产生的影响是显著的,滞后期并没有显著影响,从而说明对外债务仅仅呈现出短期影响;经济含义解释为对外债务越多,到期的流动性风险越大,偿还能力就会减弱,对评级具有负面影响,它的均衡状态与评级的等级之间没有显著的影响,只有当债务存量增加达到很难持续的状态时(由量变到质变),即短期严重偏离时,评级机构才会下调其评级,进而在股票市场上呈现剧烈的波动。当期实际GDP增长率,以及滞后期都对股票市场显著影响而且相对于其他系数而言,0.24比较高,说明短期内呈现出积极信号对股票市场的有上升的影响;因为实际GDP增长表示一国的发展速度,对股票市场的稳定具有促进作用,长期稳定的GDP增长是未来有能力偿还到期债务的最终保证,而短期财政政策刺激的GDP不具备可持续性,仅仅只有短期内对股价有影响,且影响作用随着时间的推移会降低。实际有效汇率对股市具有负向的影响,但此影响不显著。可能存在的原因是汇率的变动表现在外部冲击效应,美元凭借其国际货币地位使其具有明显的溢出效应。尤其是在欧洲主权债务危机期间,一旦市场对欧元区信心不足,出于避险考虑资金往往回流美国,导致美元走强,欧洲股市齐跌。

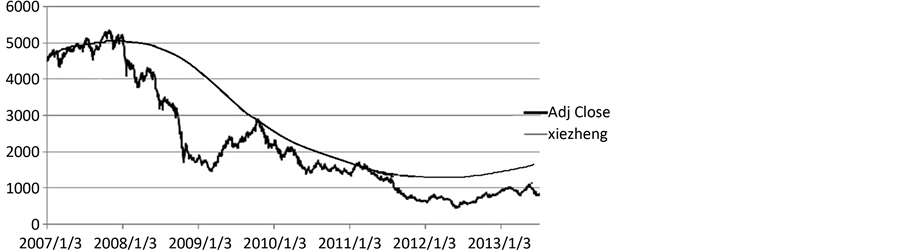

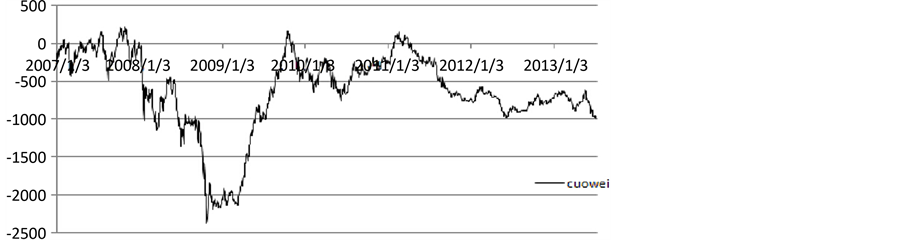

如图1,股票市场错位水平的估算:

结合协整模型以及股票市场的实际值,进一步得到股票市场短期波动相对于长期均衡的错位水平。

由图2可以看出在2008年金融危机爆发之前,股票市场实际表现与均衡拟合,处于均衡状态。金融危机爆发波及欧洲市场,股票市场出现大幅下跌。2009年欧盟统计局公布希腊财政赤字占国内生产总值的比例15.6%加之外汇储备过低,短期对外债务过高,导致2009年1月评级机构首次下调主权信用评级。直到2009年2月23日,股票市场一直处于下跌状态。在2009年内实际GDP,以及实际GDP的增长率都大幅下降,财政赤字居高不下,投资者将资金撤离股市等等2009年12月标准普尔将希腊主权评级首次由A调至BBB+,欧洲债务危机正式爆发。希腊政府不得不实施严厉的紧缩政策,以换取欧盟和国际货币基金组织1100亿欧元的资金支持。2010年5月,欧盟和国际货币基金组织决定对希腊提供1100亿欧元的第一轮救助贷款,2010年股票市场整体下降较为平缓。希腊2011年的财政赤字总额为196亿欧元,其占国内生产总值的比例低于2010年的10.3%和2009年的15.6%,但仍然没有达到欧盟和国际货币

Figure 1. The level of dislocation to stock market

图1. 股票市场错位水平

Figure 2. The stock market actual performance in 2007-2013

图2. 2007~2013年股票市场实际表现

基金组织向希腊提供援助贷款时规定的目标。同时2011年7月21日欧元区领导人21日就希腊新一轮救助方案达成一致,同意再为希腊提供1090亿欧元的贷款,通过现有的临时救助机制——欧洲金融稳定工具筹集;并对希腊提供的贷款的还款期限将从现在的7年半延长到最少15年,最多30年。同时新贷款的利率也将由目前的4.5%降低到3.5%左右。但又由于2011年11月10日,因希腊总理宣布将举行全面公投,以决定是否实施财政紧缩和结构性改革的计划。由于此举可能将导致希腊违约,令欧债危机的不确定性再度加大。2012年6月希腊股市却在连续下跌5年之后迎来了反转,12月也出现了大幅的反弹,股指已经较今年6月5日上涨了71.92%。欧盟统计局(Eurostat)公布,希腊2013年赤字与国内生产总值(GDP)之比降至2.1%,该数值较2012年6.2%大幅下滑,股市表现为上涨。从长期来看,希腊实际GDP在增长,财政赤字在缩减,长期趋于均衡。

4. 结论及建议

主权信用评级变动的短期效应主要是指评级变动冲击发生时对市场波动性立即产生的影响。尤其是评级下调,它会使得股票市场的波动性上升,也即提高了市场的整体风险。本文通过主权信用评级变动对股票市场冲击的短期波动,以及长期均衡的研究,得出以下结论:

1) 通过使用多种GARCH模型进行分析及检验,我们发现主权信用评级的变动对股票市场的波动存在显著非对称效应,当评级下调时才会导致股票市场出现大幅下跌。

2) 通过对数据的检验分析,使用误差修正模型来反映长期非均衡误差对短期波动的影响,以及评级下调冲击的短期波动相对于长期均衡的偏离程度。由于最后得到的显著的负的误差修正项的系数,说明非均衡状态拉回到均衡状态时对偏离长期均衡的调整力度,股票市场自身具有误差修正机制。

3) 在欧债危机的背景下,检验宏观经济基本因素当期以及滞后期在评级变动的冲击下对股票市场的影响,得出对外债务、评级下调、实际GDP的增长率等在当期对股票市场有显著的影响。然而有些因素如:实际GDP的增长率、实际有效汇率等对于股票市场的长期均衡稳定发展具有影响。

针对上面的结论,我们得到的政策建议如下:

1) 长期稳定的GDP增长是未来有能力偿还到期债务的最终保证,对股票市场的稳定具有促进作用,所以必须保持GDP的均衡稳定增长,同时控制好人口,稳步提高人均GDP。

2) 在短期内政府积极的干预所实施的财政政策和货币政策能够调节和控制对外债务,财政赤字,GDP的增长率等宏观经济基本面状况。吸取危机发生国的经验教训,从长远角度规划外汇储备、对外债务和政府赤字的规模,保证外汇储备对债务的支付能力以及对外债务规模期限与财政收入的匹配,合理规划政府支出,缩减赤字规模。尽可能避免违约。因为违约对于评级下调的发生是致命的冲击。毕竟经济的长期稳定发展依赖于技术进步创新等生产要素的综合推动作用。

基金项目

国家社会科学基金一般项目(14BJY174)。

附录

主权信用评级的分类

评级机构的主权信用评级一般划分为本币债务长期信用评级、本币债务短期信用评级、外币债务长期信用评级和外币债务短期信用评级四大类。不同的评级等级对应着不同的风险水平,表列出了标准普尔和穆迪外币长期主权信用评级体系,评级最高等级为AAA (或Aaa),往下依次递减,直至违约,不同的等级都有相应的等级说明,BBB-(或Baa3)及以上等级为投资级,以下为投机级。此外,S&P会以正号、负号(穆迪以数字1、2、3)来表示增强或减弱某等级的评级,见附表1。

Table A1. The sovereign credit rating systems of the standard & poor and Moody

附表1. 标准普尔和穆迪主权信用评级体系