1. 引言

传统的金融市场中大量的资产定价模型被引进强调了信念的异质性,不同的交易者关于未来价格具有不同的预期信念。在大多数的资产定价模型中主要有两类交易者即基本面交易者和图表分析者,早期的异质代理模型有Zeeman (1974) [1] ,Haltiwanger and Waldmann (1985) [2] ,Frankel and Froot (1988) [3] ,DeLong et al. (1990) [4] ,Dacorogna et al. (1995) [5] 。这些关于异质信念的模型为后期发展做了坚实的基础。例如,在Brock and Hommes (1997, 1998) [6] [7] 文中建立一个ABS系统,也称为自适应信念系统,代理们会更新他们的信念随着时间的变化,他们会通过选择不同的期望和预测函数基于过去的表现,并且能够产生复杂的行为;从局部稳定到高次循环甚至会产生复杂的混沌现象,所以这个转化策略机制在后期信念当中起到很重要的作用,在这个模型中参数的不同取值描绘了真实市场中一些显著的特点。Brock and Hommes (2002) [8] 中建立了一个简单的自适应非线性模型,能够解释真实市场序列的一些重要的经验特点(尖峰后尾,波动聚集性,长记忆)这个自适应信念系统提供了一个个人水平和市场水平行为的联系,尤其,一个人获利不仅观察的是最新价格消息,至少应该有一部分是被市场心理所驱使,在非线性资产定价模型的的影响下Westerhoff (2004) [9] ,Chiarella et al. (2005) [10] 和Westerhoff and Dieci (2006) [11] 建立了多维的框架产生了更复杂的动态,这更向真实市场迈进。

经验的调查在平等的外国交易市场的金融时间序列,展现了一些共同的金融特征,所谓的固定事实包括尖峰,厚尾(分布的尾部的密度高于预测的正态分布列的尾部),波动聚集性(高或低的波动跟随高或低的波动),和长范围独立波动(通常被描述为平方或者绝对回报自相关的缓慢延迟),还有多样的冥律行为,Pagan (1996) [12] 全面的讨论了金融时间序列固定事实的特征,Lux (2008) [13] 关于一个近期调查了多样冥律行为的经验证据.这些事实不完全与带有代表代理和理性期望的传统金融经济理论相悖,但是这些理论不能提供有说服力的解释这些固定事实,He and Li (2007, 2008) [14] [15] 考虑了个简单的市场分数模型,MF模型是个简单的随机定价模型,卷入两类交易者,He and Li (2007) [14] 学习了MF模型的产生机制,在这个模型中假定三类市场参与者,基本面分析者(信息提供者),趋势追随者(少量信息供应者),做市商,主要的目的是展示,在MF模型中资产价格的长远行为和随机系统能够被决定系统系统描述的自相关结构,交易行为和市场分数,在趋势追随者期望中一个历史学习过程,通过学习历史价格来预期未来价格.He and Li (2008) [15] 展现了市场一定时间段内会偏离基本价值,但最终会回归于基本价值,基本和图表分析者的近期和远期回报,图表分析者的存活指数,市场主导并且用确定系统的动态模型去描述数据的性质和特征,包括自相关结构和有限分布,用Momte Carlo模拟这些性质。

Chiarella et al. (2009) [16] 和Chen et al. (2012) [17] 中描述了异质代理对于风险有不同的态度以及关于未来价格进化有不同期望,这些交互产生了市场资产价格。对于这些模型一个关键的方面是对期望的反馈-代理的期望是基于未来内生变量价值的预测,这个预测的实际值是由均衡方程所决定的,Chiarella and He (2014) [18] 建立了同质固定风险厌恶下的异质预期定价模型,估计模型参数并与S\&P500对比说明基本面交易者和图表交易者的存在性并为两者之间的相互转换提供了证据。李娜(2015) [19] 在图表分析者的期望函数中讨论了一般函数的情形,在实证中把一般函数变为一个具体函数,分析了时间序列价格的一些统计特征,Chiarella and He (2015) [20] 中检验了一个简单是MF模型,通过选择一组结构参数展示了自相关性(回报,绝对回报,平方回报)与DAX30指数作对比展现出类似的固定事实,刘慧选(2016) [21] 中在图表分析者的预期信念中加入了一个含低阶可微的一般函数,考虑了均衡价格偏差对图表分析者预期信念的影响,把这一般函数选择一低阶可微的具体函数,讨论了初始值在平衡点的局部稳定区域范围内,收益时序的自相关检验,正态性检验还有一些统计特征,说明了均衡价格偏差对图表分析者预期信念的分支稳定性的影响。

本文分析了在基本面分析者中关于风险态度受到价格偏差的扰动,关于学习过程中的几何衰减参数变为一个一般函数参数,建立一个5维资产定价动态模型,对此非线性动态模型进行相关的稳定性分析和相关的实证讨论。

2. 模型建立

一般函数参数的引入

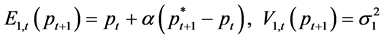

模型根据文献 [20] 。同样的,我们考虑含有一支风险资产和无风险资产的金融市场模型。假定市场中存在两类投资者:基本面分析者和图表分析者,基本面分析者一致相信市场价格近时段内可能会偏离基本价值,但是很快时段内股票价格会向基本价值回复,于是基本面分析者在( )时点的价格的预期函数为

)时点的价格的预期函数为

(1)

(1)

其中 表示基本价值的一个常数方差,

表示基本价值的一个常数方差, 为基本面分析者的价格调整速率,通常情况下,一个

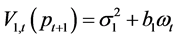

为基本面分析者的价格调整速率,通常情况下,一个 速度的高或者低会致使期望价格向基本价值回复速度快慢,为了更贴切的说明真实市场,这里图表分析者的价格波动主要由两部分组成,一部分是不受时间约束的常数项方差,另一部分是受当前价格和基本价值偏差影响的量有关,这里加权参数取为一个一般函数,则在本模型中基本面分析者的价格波动为;

速度的高或者低会致使期望价格向基本价值回复速度快慢,为了更贴切的说明真实市场,这里图表分析者的价格波动主要由两部分组成,一部分是不受时间约束的常数项方差,另一部分是受当前价格和基本价值偏差影响的量有关,这里加权参数取为一个一般函数,则在本模型中基本面分析者的价格波动为;

(2)

(2)

其中 ,

, 为常数,

为常数, 为价格相对于基准价格偏差的一个加权平均形式,这里的加权参数满足一个一般函数的形式,我们设为

为价格相对于基准价格偏差的一个加权平均形式,这里的加权参数满足一个一般函数的形式,我们设为 ,其中

,其中 满足

满足 ,当

,当 比较大(小)时,关于价格偏差的历史信息对交易者预期价格波动的影响就大(小),可表示

比较大(小)时,关于价格偏差的历史信息对交易者预期价格波动的影响就大(小),可表示 为:

为:

(3)

(3)

上述式子表明,当前价格与基本价格偏差和预期价格波动呈现正相关,偏差越大波动就越强烈,基本面分析者存在的风险就越大,基本面分析者就不容易回复到基准价值。

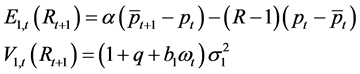

而对于技术分析者他们相信未来的价格是和历史价格学习过程有关系,通过历史学习推算下时点的价格,我们有对于图表分析者的信念可表示为:

(4)

(4)

其中 代表外推率,Chiarella and He (2015) [20] 文中引入的学习过程是一个有限的几何衰减过程:

代表外推率,Chiarella and He (2015) [20] 文中引入的学习过程是一个有限的几何衰减过程:

(5)

(5)

引入一个一般函数形式的参数,考虑了一类持有非线性价格预期的图表分析者:

(6)

(6)

为了简化计算原文假定 服从正态分布,均值为

服从正态分布,均值为 ,方差为

,方差为 ,且

,且 ,则基本面回报的预期函数为:

,则基本面回报的预期函数为:

(7)

(7)

因此基本面分析者的最优需求为

(8)

(8)

图表分析者的回报的预期函数为

(9)

(9)

因此图表分析者的最优需求为

(10)

(10)

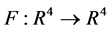

3. 非线性确定系统研究及其分析

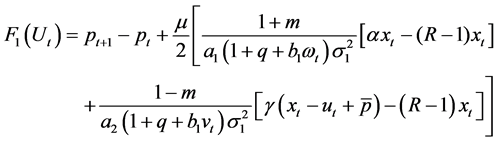

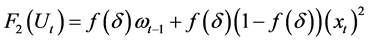

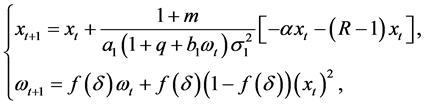

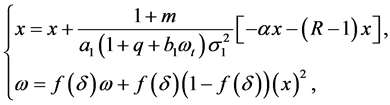

从而,我们可以得到下面一个五维随机差分系统

该模型中我们假定基本价值等于长期基准价值,得 ,两类投资者具有相同的风险偏好,即

,两类投资者具有相同的风险偏好,即 ,

, ,为当前价格和基本价格偏差,扰动项目

,为当前价格和基本价格偏差,扰动项目 ,且令

,且令 ,该模型的确定系统可以定义

,该模型的确定系统可以定义

, (11)

, (11)

其中 ,

, 函数可描述为下面式子:

函数可描述为下面式子:

,

,

,

,

,

,

则 为

为 的非线性算子。

的非线性算子。

3.1. 特殊情况下基本平衡解的存在性及稳定性分析

下面阐述确定模型平衡点的存在性和稳定性。当市场分数 时模型(16)转化为:

时模型(16)转化为:

(12)

(12)

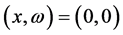

定理3.1 (1)系统(17)存在唯一的基本平衡解 ,并且均衡价值是全局渐

,并且均衡价值是全局渐

进稳定当且仅当参数函数 且

且

当 ,这个二维模型会出现flip分支。

,这个二维模型会出现flip分支。

(2) 当函数参数是连续可微时,对任意的 ,当

,当 ,系统(17)的零解是指数渐进稳定的。

,系统(17)的零解是指数渐进稳定的。

证明首先我们证明(1)成立。设系统(17)的平衡解为 ,即

,即 ,则

,则

平衡解满足方程组

则平衡解满足 ,可得平衡解存在唯一,

,可得平衡解存在唯一, 为平衡点。

为平衡点。

,

,

,

,

,

,  ,

,

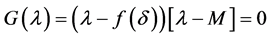

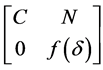

则Jacobi矩阵为

矩阵的特征方程为

由文献 [18] 中的Jury判据,可以查到平衡点稳定的充要条件为:

,

,  ,

,

则可以得到如下关系

,

,  ,

,

,

,

则联立上述两式子可得 且

且

参照文献 [23] 中的定理,而系统对每一个解都有 ,故方程在零解是全局渐进稳定的,由Flip分支定义可以得到在

,故方程在零解是全局渐进稳定的,由Flip分支定义可以得到在 ,即

,即 处会出现反转分支。

处会出现反转分支。

接下来我们证明系统指数渐近稳定。首先将该二维模型线性化,在平衡点 处的Jacobi矩阵形式为

处的Jacobi矩阵形式为

其中

,

, .

.

记

则根据文献 [22] 中的系统线性化方法,有 ,其中

,其中 ,计算可得

,计算可得

当 连续可微时可以得到,

连续可微时可以得到, 时,

时, 是无穷小的,运用文献 [22] 中的定理3.4.5,要证明差分方程组的零解是指数渐近稳定的,就要使得

是无穷小的,运用文献 [22] 中的定理3.4.5,要证明差分方程组的零解是指数渐近稳定的,就要使得 是无穷小的对所有的

是无穷小的对所有的 一致成立,即

一致成立,即

,

,

其中 。当

。当 时,我们有

时,我们有 。

。

下证 一致渐近稳定,则满足

一致渐近稳定,则满足 的所有列和小于1。已知,线性方程是

的所有列和小于1。已知,线性方程是

渐进稳定的则

,

, .

.

由文献 [22] 中的定理3.4.3可得 是一致渐近稳定,而连续可微的参数,

是一致渐近稳定,而连续可微的参数,

则方程组的零解是指数渐近稳定的。 定理3.1证毕。

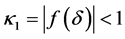

3.2. 一般情况下基本平衡解的存在性及稳定性分析

定理3.2当参数 ,基本平衡解是稳定的,关于

,基本平衡解是稳定的,关于 ,这里

,这里

于且关于价格调整速率 ,这里

,这里

其中 ,另外当

,另外当 时,一个flip分支会发生在

时,一个flip分支会发生在 上。

上。

4. 数值模拟

这一部分我们将对比分析本文模型与Chiarella and He (2015) [20] 所建的模型(分别用PM和BM表示)得到的仿真数据,以及真实市场所呈现的统计特征市场,本文模型选取 ,当

,当 和

和 取零时候,所得到的模型和文献 [20] 一样。

取零时候,所得到的模型和文献 [20] 一样。

原文模型Chiarella and He(2015) [20] 参数的选取如表1、表2所示,本文模型选取a表示对参数平方项的反应强度,参数的选取的初始值是在平衡点的全局渐近稳定区域内。

为了进行数据对比,我们选取两只股票数据,上证指数(999999)日收盘价作为数据集,样本有5356个观测值,周期是从1993年7月22日到2017年3月13日,深证综指(399106)日收盘价作为数据集,样本有5051个观测值,周期是从1996年5月10日到2017年3月17日,数据取自齐鲁证券通达信,通过选取数据来比较本文模型与Chiarella and He (2015) [23] 中模型哪个能更好的反映真实市场的特点。

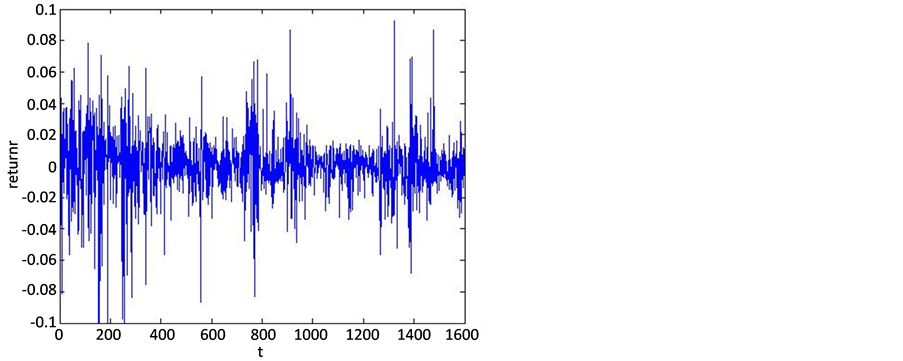

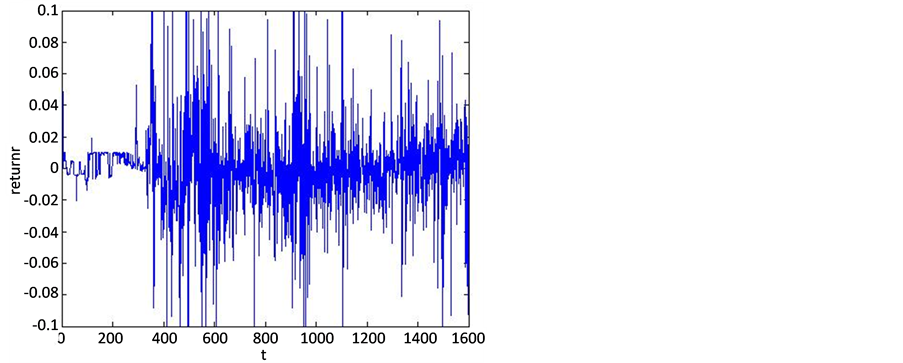

图1~4分别展示了模型PM、BM与深圳指数和上证指数的收益时间序列图,从收益的时间序列图可观察到收益具有波动聚集特点。可知,模型PM和BM均能模拟出真实市场资产收益序列的波动特点。

接下来,对模型PM、BM与工业指数的收益序列进行分布检验。表3、表4展示了显著性水平为0.05时,Kolmogo-rov-Smirnov检验及Lilliefors检验两种统计检验的结果,对Lilliefors检验来说,当P值小于0.001时返回0.001。对Kolmogorov-Smirnov检验及Lilliefors检验来说,H = 1表示在置信度0.05下不接受原假设,P值越小表明接受原假设的概率也很小,且检验统计量的观测值大于或等于临界值,所以不接受原假设,即不接受收益服从正态分布这一假设。由以上两种统计检验结果可得,三种收益序列均拒绝分布服从正态分布的原假设,而本模型检验统计量及观测值本模型大于原模型,因此从图检验和统计检验表明模型BM能很好的模拟出金融数据的非正态性。

Table 1. The initial parameters of the model PM

表1. 模型PM的初始参数

Table 2. The initial parameters of the model BM

表2. 模型BM的初始参数

表3. Kolmogorov-Smirnov检验

表4. Lilliefor检验

Figure 3. The proceeds of the Shanghai Composite Index

图3. 上证综指的收益序列图

Figure4. The proceeds of the Shanghai securities composite index

图4. 上证指数的收益序列图

5. 结论

在传统金融模型背景之上,对趋势追随者的预期信念进行更新,建立在预期信念中含有一般函数参数的资产定价模型。利用熟知的差分方程方面的相关理论知识,首先,计算了此模型的平衡解的存在条件。将一般函数具体化,分析了包含具体函数的三个不同模型下非线性系统的稳定性及分支情况,说明本文模型在一定程度上对原模型进行了推广。对比分析含有一般函数参数资产定价模型与上证指数和深证综指的时间序列图,统计检验(Kolmogorov-Smirnov检验、Lilliefors检验),说明建立的模型能更好地刻画收益的非正态性、收益波动聚集性等真实市场的特征。