1. 导论

1.1. 研究意义及目的

随着近几年我国经济的飞速发展,我国金融市场日益完善。我国期货市场在20世纪初初见雏形,经历孕育、试点、到清理、整顿,再到规范、发展,走过了一段不平凡的探索过程。

除了证券股票,另一类在中国新兴的金融产业也同样需要引起关注。期货交易在20世纪初首次进入我国,其发展之快让各界学者惊叹,我国之所以会出现虚体经济大于实体经济,也归因于期货市场的发展迅速。研究期货市场与货币流通的影响能更好的让我们看清如今金融市场与货币政策的关系,以及理清货币政策对金融资产市场的作用程度。

货币作为一种交易媒介,同样拥有贮藏手段的职能。因此商品流通必定会和货币流通息息相关。曾经,在国内有一个非常著名的“1:8”公式,其含义是每8元零售商品的供应需要1元人民币实现流通,即:

但是,随着我国经济的重新分配与再分配、生产力的提高以及全球化经济带来的种种发展,这个公式并没有将这些因素考虑进去,因此它无法在当代解释商品与货币的关系。但是,“1:8”这个比例是70年代初大量银行工作者根据多年经验总结出来的结论,意味着从实践中来看,商品流通和货币流通存在一定关系,那么,作为一种商品,期货交易与货币流通又存在着怎样的关系?

本文将着重研究期货交易量对我国货币流动性的影响,运用Eviews 8.0建立数理模型并进行实证分析。

1.2. 研究背景与创新

很早以前便有人已经发现商品市场与货币流通之间的关系,货币流动速度的波动,意味着经济增长与通货膨胀之间缺乏稳定,加之中国货币流通速度在20世纪末呈长期下降趋势,引起了更多人的关注。商品不仅仅是货币唯一的载体,随着虚体经济的发展,我国逐渐出现虚体经济大于实体经济的现象。因而,货币同样也是金融资产交易的媒介。如果假定其他条件不变,那么金融资产交易量的上升或下降同样也会导致货币需求的增加或下降。

近几十年来,由于资产价格的大幅波动,货币流通和资产价格的关系倍受瞩目。以股市为例。1988年,Friedman认为股价变动对货币需求的影响是多渠道的,这是当时研究股票市场对货币需求的影响的普遍看法——即股票价格对货币需求影响不确定。同样,放眼国内研究也没有固定的答案,结论各有不同,甚至有些结论截然相反。本文将着眼于期货市场交易,分析期货市场交易对我国货币流通的影响。

1.3. 文献综述

国际商品期货市场是资本市场中非常重要的一部分,国际商品期货价格也是一种资产的价格。关于货币流动性与资产价格变化的国外文献是比较多的,例如巴克拉和卡拉莫(Bark & Kramer)用数据证明了过渡的流动性会导致资产价格的升高;邵蔚在文中提及到,货币流动性的变化趋势反应了宽松活着紧缩的货币环境,货币流动性会作用于股票、期货、房地产等资产价格 [1] 。邵峥嵘在《货币流动性与资产价格关系探讨》中也提及到,2008年的金融危机造成的流动性不足与当年资本市场价格暴跌有着一定的相关性。关旭用VAR模型研究了中国国内生产总值、进出口、货币供应量等宏观经济变量分别对铝、铜、锡、铅、锌、镍期货价格的影响,结果发现,除了锌以外,货币供应量对其他商品的期货价格都有影响。管清友、魏政《全球流动性与大宗商品价格探析》中也谈到,发达国家以低利率为特征的宽松货币政策和新兴国家外汇储备增加而导致的基础货币发行将会增加市场的流动性,进而引发大宗商品价格的上涨。但是以上文献资料大多都着眼于商品期货与货币流通的关系,并且多为描述理论性文章,实证分析较少。本文将着重于我国期货市场交易对货币流通的影响,并且从实证角度出发进一步做量化分析。

2. 全球期货市场的发展变迁的历程

2.1. 全球期货市场的发展现状

在最近的十年里,全球期货市场的交易量年复一年地攀上一个又一个的高峰。但是,交易量创纪录的脚步在2009年戛然而止。由于信用危机所造成的损失,导致欧美主要交易所的交易量急剧下降利率相关品种受到的影响尤其剧烈,在2008年交易量出现井喷的股指产品,到了2009年交易量也出现了萎缩。

2008年全球金融危机对世界金融产业产生了不可逆转的巨大伤害,其对国际金融业的冲击,加快了全球经济结构的调整。全球经济结构的调整,同样带动了全球期货市场的发展。2008年金融危机爆发以后,2009年全球衍生产品交易速度明显加快,与2008年相比,整张了23.19%,而这个数据,在今后几年一直保持一定的增长。

图1为2006年至2015年全球衍生产品交易量,由图所得,十年间,全球金融衍生产品增长率为61%,其中主要贡献来自于如巴西、中国、俄罗斯和印度等新兴市场。尽管由于各国期货加强期货市场的监管,使得期货交易下滑,但期货交易量在市场的比例依旧不容小觑。

2.2. 全球期货市场的发展历程

13世纪开始,现货商品交易获得了广泛发展,许多国家都形成了中心交易场所、大交易市场以及无数的定期集贸市场。集贸商品交易市场的建立,为远期合约交易奠定了基础。1570年英国伦敦就开设了第一个皇家交易所,1730年日本大阪也创办了“米相场”,荷兰、比利时也开设了农产品交易所。

1825年,美国中西部的交通运输条件发生了惊人的变化,货物运价大为减少,于是西部农业区农民生产的粮食大量流入芝加哥,以便卖个好价钱。但往往由于供过于求,粮食价格并没有农民预期的那样直线上升。这时,产生了一种新兴的合约交易,即预先签订买卖合约,到期运来交实货的想法和交易方

数据来源:中国统计局。

数据来源:中国统计局。

Figure 1. Global derivatives trading volume

图1. 全球衍生品交易成交量

式。这个新兴的交易方式的产生,使得农产品交易量大增,芝加哥粮食商能够很好的储存大量粮食,因而促使了远期农产品合约的发展。

作为最早也是最基本的远期合约交易,农产品远期合约交易的出现促使商人们在1848年建立起了美国第一家中新交易所,即芝加哥交易所。芝加哥交易所采用严谨的交易规则条款,进行规范化的合约交易,使得远期合约交易更加规范。这样的商品交易为以后期货合约的产生创造了有利的条件。

然而,经济全球化使得世界期货市场在20世纪70年代发生了重大转折。人们不再满足于单纯的商品交易,而金融期货在此时出现,使得全球金融交易量“爆炸性”的增长。1972年,在上述商品期货交易有成效的发展的启迪下,美国芝加哥商业交易所开始实行了第一笔金融期货交易—外汇期货合约的交易,进行英镑、加拿大元、德国马克、意大利里拉、日元、瑞士法郎和墨西哥比索等币种同美元的汇率期货合约的交易。后来,其它期货交易所也接着开展了金融期货交易,先后不断推出抵押证券期货、国库券期货、股票指数期货等金融工具期货合约的交易。据统计,1986年金融期货交易量占总的期货交易量的70%以上。

一般商品的期货交易经历了一二百年的发展才到今天的规模,而金融期货交易只经过短短的十几年便一举成型。

2.3. 我国期货交易发展现状

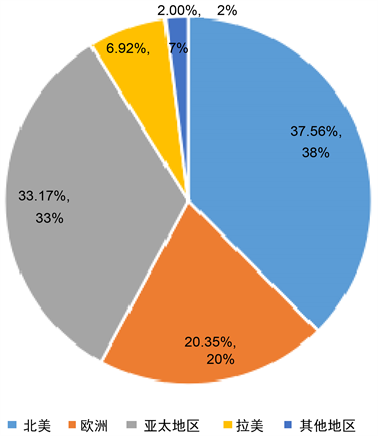

如图2,2014年,亚太地区和北美地区的期货交易量占据全球期货交易量大部分份额。亚太地区凭着中国市场的快速发展,2012年一度超过北美地区,跃上榜首。虽然2014年亚太地区的交易有小幅回落,但其总体交易量占全球交易量的33.17%,仅次于北美市场。

中国大陆地区的4家交易所、香港交易所以及台湾期货交易所均实现了较大增长。

然而,其他亚太地区交易所则呈现另一番景象。印度国家交易所虽然仍位列全球第四,2014年成交量却减少11.6%至18.8亿手,主要是由于外汇合约成交的萎缩;排名前二十的交易所中,韩国交易所、日本交易所、澳大利亚证券交易所集团在2014年的成交量均出现不同程度的下滑。

数据来源:中国统计局。

数据来源:中国统计局。

Figure 2. Regional distribution of global futures and other floor derivatives turnover in 2014

图2. 2014年全球期货及其他场内衍生品成交量地域分布

尽管我国期货交易市场发展时间较短,相对于发达国家期货市场不够完善,但从目前来看,中国期货交易量带动了亚太地区期货市场的发展。

2.4. 我国期货市场发展历程

表1是我国期货市场发展大事件。

我国期货发展较晚,1990年郑州粮食批发市场的成立标志着我国农产品期货远期合约的初步成型。由于我国在引入期货交易机制以后,没有明确的主管部门,期货市场配套法律法规严重滞后,使得短时间内,国内出现大量非法期货经营机构。我国期货市场的盲目发展让期货市场价格变得扭曲,使得期货交易者承受了巨大损失。

2008年全球金融危机爆发后,国际经济波动日益剧烈,国际国内市场大都价格最多时曾暴跌50%左右,因此越来越多的企业开始利用市场转移风险。一些企业在美洲购买大豆原料的同时,在大连期货市场卖出大豆期货等相关品种,有效对冲了风险,避免了企业的灭顶之灾。期货市场的存在,已经对部分国际大宗产品价格产生了影响。

3. 货币流量分析

3.1. 经典理论

货币流通理论主要分为古典学派、凯恩斯货币需求理论和现代货币主义。

3.1.1. 古典学派理论

货币数量论又称费雪理论,是由著名的经济学家费雪第一个揭示了通货膨胀率预期与利率之间关系

Table 1. Breaking news of futures market in China

表1. 我国期货市场发展大事件

的一个发现,它指出当通货膨胀率预期上升时,利率也将上升。如果一年内的实际国内生产总值为Y,价格水平为P,流通中的名义货币量为M,那么就有:

这就是货币数量论的方程式,其主要是说明了物价水平和货币量之间的关系。但是这个理论是基于一个非常理想的经济环境中,即货币的流通速度长期保持稳定,这在经济环境中是不可能实现的,特别是在发展中国家。马歇尔剑桥方程由剑桥大学教授庇古在《经济学季刊》上发表的《货币的价值》中首次提出。马歇尔剑桥方程以费雪理论为基础,但与费雪方程强调货币量与物价水平的关系不同,剑桥方程强调了货币需求量的决定,其方程是:

其中,Md为货币需求量,k是货币量与国内生产的比率。

剑桥方程式其实是费雪方程的一个拓展,其可以变形为

,该方程中k为马歇尔比率,为常

数,所以货币需求与收入水平同方向变动。

3.1.2. 凯恩斯货币需求理论

凯恩斯主义货币需求理论是货币经济理论中最显著的发展之一,他是对古典货币需求理论的一个完善和深化。和古典货币需求理论不同,凯恩斯货币需求理论考虑了货币持有者的交易动机、谨慎动机和投机动机。

在市场均衡的情况下,货币的需求等于货币流通量,因此,可以将货币需求函数带入费雪方程中,可以得到:

这个方程中表明货币流通速度可以用实际国民收入和实际货币需求的函数来表示,同样,利率水平影响货币流通速度,即:利率上升,货币需求量减少,导致货币流通速度上升 [2] 。

凯恩斯货币需求理论颠覆了古典货币需求理论,推翻了古典货币需求理论中“货币流通速度不变”的假定,并且在古典货币需求理论的基础上,重新分析了影响货币流通速度的原因。

3.1.3. 现代货币主义

现代货币主义是在美国经济学家米尔顿·弗里德曼的大力倡导下,以芝加哥大学为发源地和大本营,于二十世纪五六十年代在美国兴起并逐渐传播到世界各地的西方经济学流派。

弗里德曼的货币需求函数可以写为:

其中,Md表示名义货币需求量,P表示物价水平,Y表示名义恒久收入,w表示非人力财富占总财富的比例,Rm表示货币的预期名义收益率,Rb表示债券的预期收益率,Re表示股票的预期收益率,gP表示物价水平的预期变动率,也就是实物资产的预期收益率,u表示影响货币需求的其他因素。

现代货币主义认为,居民的恒久收入是影响货币需求量的主要因素。由于居民恒久收入是处于相对稳定增长的,所以,货币需求量同样处于稳定增长。

现代货币主义是古典货币理论和凯恩斯货币理论的发展,相对于古典学派认为货币流速不变,现代货币主义和凯恩斯货币理论都认为货币流通速度是变化的。但是凯恩斯主义认为影响货币流通速度的是利率变动与价格变化,而现代货币主义认为恒久的收入水平才是影响货币流通速度的原因。

尽管古典货币数量论、凯恩斯理论和现代货币主义给予了货币理论不一样的理解和考察角度,但是它们都让货币流通速度成为经济研究的基础。

3.2. 关于我国货币流通速度的分析

货币流通速度是现代货币理论和货币政策制定中的一个重要变量。近年来,我国经济发展较快,银行银根放松,货币供给量不断增。一般来讲,货币流通量可以看成是由货币当局就控制的,而货币流通速度在一定程度上是货币当局不能控制的 [3] 。

我们将费雪方程左右取微分,得

,用g表示增长率,原式等于gm + gv = gp + gy,

即货币的供给量增长率加上货币的流通速度增长率等于物价的增长率加上国民收入的增长率。

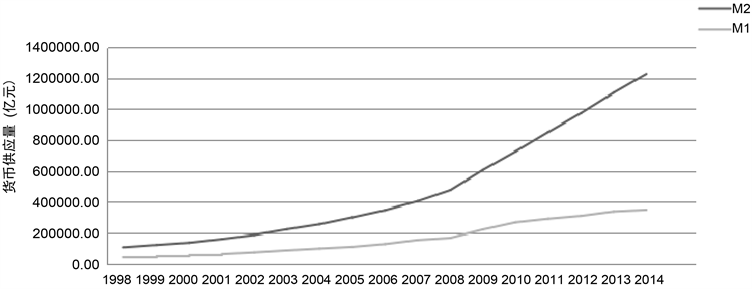

由图3可知,1998年至2014年间,V1、V2皆处于相对下降状态。gm + gv = gp + gy中,货币流通速度下降gv < 0,因此gm > gp + gy,也就是说,货币流速下降,意味着大量资金撤出交易市场,居民交易、消费倾向下降,更多居民倾向将资金储存。这在一定程度上导致我国货币增长率大于物价上涨率和国内生产总值增长率之和,意味着经济领域中实际发挥作用的货币数量下降 [4] 。

尽管如此,根据图4显示,1980年V2约为2.6,2000年V2约为0.6。1999年,全国基本工资上调,

数据来源:国家统计局。

数据来源:国家统计局。

Figure 3. Trend of money supply in China from 1998 to 2014

图3. 1998年~2014年我国货币供应量M1和M2变化趋势

Figure 4. Trend of money supply velocity in China from 1998 to 2014

图4. 1998年~2014年我国货币供应速度V1和V2变化趋势

使得货币流通速度相对上升,虽然没有改变社会总需求、生产能力依旧过剩的情况,但在一定程度上遏制了货币流通量的下降。

3.3. 关于我国货币流通黑洞分析

“流动性黑洞”这个概念是指金融市场在短时间内骤然丧失流动性的一种现象。当金融机构从事市场交易时,由于外部环境变化、内部风险控制的需求以及监管部门的要求,会在某些时刻出现金融产品的大量抛售,而交易成员由于具有类似的投资组合、风险管理目标和交易心态,会同时存在大量抛售的需要,此时整个市场只有卖方没有买方,市场流动性骤然消失,被抛售资产的价格急速下跌与卖盘持续增加并存,又会进一步恶化流动性状况,最终出现流动性好像被市场和机构中瞬间吸收殆尽一样,这种现象就被形象地称为“流动性黑洞” [5] 。

流动性是一种将其他资产转换为中央银行货币的能力。投资组合、交易主体以及风险管理目标的过度集中与趋同,极易导致交易行为的趋同,从而引发流动性黑洞。根据有效市场假说,中国证券市场目前所处的阶段是无效率的市场或者是弱式有效的市场,噪声交易者和“羊群行为”充斥。流动性黑洞产生的本质原因是市场预期的归一化,这是由于各个投资者对市场不同的看法在一定时间内演化成为同一种意见,这也就是上文所提及到的“羊群行为”。这样的市场交易使得我国交易市场的流动性瞬间丧失,价格的下跌并不能出现更多的买者,反而会出现更多的卖者,“羊群效应”使得众多的卖者出现,这样一来,原先的市场流动性将会被打破,短期流动性交易蒸发殆尽,交易活动大量减少 [3] 。在过去的几个月里,我国金融市场一度暴跌。流动性最强的证券市场突然陷入流动性黑洞,近20万亿的市值灰飞烟灭。这使得我国股市陷入到了一场从未有过的危机当中,正因如此,我国金融监管部门已出台政策,以求恢复金融市场流动性。

4. 我国期货市场交易量与货币流通速度的关系

关于“影响货币流动性的因素的研究”从来不是一个新话题,比较主流的看法是经济的货币化和超量的货币发行。同样,在股票市场中,货币的流通速度会随股票交易活跃程度反响变动。但从以前学者的研究来看,都没有明确的提及股票交易对货币流通的具体影响。但是毫无疑问,货币流通的速度会影响到金融资产的交易。

对于我国来说,我国货币的流动性与货币政策息息相关。宽松的货币政策意味着货币市场流动性宽裕,市场上货币供给量增加,货币量的增加意味着企业和个人更容易融资、投资活跃;紧缩的货币政策意味着货币市场流动性紧张,市场上货币供给量减少,货币量的减少意味着企业和个人融资贷款较为困难、投资减少。

同时,费雪方程式:MV = PY说明商品价格的变动,会带来货币数量的变动,也就是说,当P变动时,M作同比例的变动。由于衍生品市场的发展,不少学者将费雪方程式的含义进行了延伸,认为P所代表的不仅仅是鲜活商品的价格,还包括了资本品和衍生品市场的价格。

这样一来,货币的流动性对市场交易活动的关系更为明确,当投资者适时调整手中期货持有量的原因,交易就产生了。关于投资者调整商品持有量的原因有很多,包括传统理论例如个人流动性需求的变化、生命周期阶段转变等。但事实上,影响期货交易量的原因都是由潜在的不可测的原因(例如货币流通)决定的。货币流动性宽裕,企业和个人才有足够的资金进入市场,增加投资,市场商品价格包括期货价格自然上涨。相反,货币流动性紧张,企业和个人得到资金渠道困难,市场投资不活跃,市场商品价格下降 [6] 。

在1998~2014年间,我国执行了“先松、后紧、再松”的货币政策。我国为应对1997年的亚洲金融危机,开始下调基准利率。1998年~2002年,面对通货紧缩,我国增加货币供应量,实行宽松的货币政策。此后,2003年~2007年,为控制经济增长过快,央行多次上调存款准备金率,到2007年为止,基准利率上升至7.47%。2008年金融危机使得央行将基准利率下调至5.31%,最终,我国货币流动性由紧缩逐渐放松。

按照上文所说,货币流动性宽裕是否与市场商品价格(如期货)有影响,价格直接与交易量相关。对照上述时间段,结合图5、图6可以发现:1998~2002年,货币流通性宽裕,期货交易量小幅上升;2003~2007年,虽然我国实行了紧缩货币政策,但由于“时滞”现象,货币流动性还是相对宽裕的(因为若流动性紧张,那么基准利率不会持续提高),因此,期货交易量持续上升;2008年次贷危机使得前期的紧缩货币政策得到了体现,期货交易量下降,尽管基准利率不断下降,但是在“时滞”的影响下,货币流通性依旧紧缩 [7] 。

从以上分析中可以得出,当货币流动性相对宽裕时,我国期货交易量上升;当货币流动性相对紧张时,我国期货交易量下降。这仅仅只是理论上的结论,以下将会用实证方法证明 [8] 。

数据来源:中国人民银行官网、中国期货交易网。

数据来源:中国人民银行官网、中国期货交易网。

Figure 5. Chinese central bank benchmark interest rate from 1998 to 2014

图5. 1998年~2014年我国央行基准利率

数据来源:中国人民银行官网、中国期货交易网。

数据来源:中国人民银行官网、中国期货交易网。

Figure 6. Chinese futures trade volume from 1998 to 2014

图6. 1998年~2014年我国期货交易量

5. 实证分析

5.1. 研究方法和数据说明

上文分析中可以得出,货币流通量是货币流动性的代表。因此,本文以M2为指标代替货币流通量,其数据来源于中国国家统计局。由于我国期货交易尚短,直至1998年才有相关的正规数据,因此,本文选取的时间段,以1998年至2014年。

再者,为了克服异方差,降低短期波动性,本文对货币流通量M2指数、期货交易量进行对数处理,并用LNM2、LNVOLUME表示M2指数和期货交易量的原始数据。

5.2. 货币流动性与期货交易量的关系

5.2.1. 相关性分析

货币流通量M2指数与期货交易量的相关系数为0.955311,证明两者高度正相关。

5.2.2. 单位根检验

对货币流通量M2以及期货交易量VLOUME进行ADF检验,如表2所示,LNM2、LNVOLUME表示原始的时间序列。

根据ADF检验可知,在5%显著性水平下,货币流通量M2与期货交易量VOLUME的时间序列均为非平稳序列,而两者二阶差分序列平稳,即货币流通量M2与期货交易量均是二阶平稳数列。

5.2.3. 协整关系检验

首先,建立VAR模型确定滞后期。根据VAR模型选择表以及AIC、SC最小原则,确定VAR模型最佳滞后期为1。如表3。

VAR(1)模型如下:

两个模型R2 = 0.976076,修正R2 = 0.966506,说明VAR模型高度拟合。

表2. ADF检验结果

Table 3. Results of cointegration test

表3. 协整关系检验结果

5.2.4. 格兰杰因果检验

如表4,结果表明,“期货交易量不是货币流通量M2的格兰杰原因”被显著接受,“货币流通量不是期货交易量的格兰杰原因”被显著拒绝,即:在滞后期为1时,货币流通量是期货交易量的格兰杰原因,有明显的单项传导性。

5.2.5. 方差分解

利用Eviews对VAR(1)模型进行方差分解,LNVOLUME对LNM2的贡献逐渐增加,最后逐渐趋于10。

5.3. 小结

从以上定性和实证分析可以看出,我国期货交易量对货币流通速度能够产生一定影响,二者在变动走势中始终保持基本一致的变化,证明了上文提及到的“当货币流动性相对宽裕时,我国期货交易量上升;当货币流动性相对紧张时,我国期货交易量下降”的结论。但是期货交易量并不是引起我国货币流通速度变化的最主要的因素。从差分分解结果来看,我国期货交易量对货币流通速度影响贡献率仅有10%,说明其他因素更能影响到货币流通速度,例如经济的货币化程度、超量的货币发行、通货紧缩局面及其造成的心理预期、货币传导机制存在的障碍以及我国经济体制的约束。货币流通速度反过来可以解释我国GDP的变化,由于我国期货市场交易发展较晚,相对于股票等传统金融产品交易,作为新型金融产品,期货交易在我国发展不充分,其对我国GDP影响较为有限,加上期货市场启动资金较大,小额投资者较难入市 [9] ,因此,得出此结论基本上是意料之中。

6. 结论

从以上理论和实证分析可以得出,我国的期货交易量会对我国货币流动性产生影响,其影响不大,

Table 4. Results of granger causal relation test

表4. 格兰杰因果检验结果

并不能成为影响货币流动性的关键因素。从差分分解的结果可以看到,期货交易量对货币流动性的影响仅有10%。以货币流通量为代表的货币流动性与我国期货市场交易之间存在长期的协整关系和因果关系,期货交易虽然对货币流通存在一定的影响,两者在变动走势中始终保持趋势基本一致的变化,但是期货交易并不是引起货币流动性变化的最主要因素。

我国货币流通速度在近几年来处于下降状态这是我国发展必须经历的一个阶段,但是,在我国,货币流通速度下降既反映了我国市场化程度逐步提高从而对货币量的需求增加等正常因素,也在一定程度上反映了我国经济运行中的一些深层次问题。我国从1995年起,长期实行扩大总需求的宏观经济政策刺激经济增长。政府通过拉动居民的消费需求,扩大政府的支出等多种措施,刺激社会总需求。我们也看到,近几年来,我国GDP都保持7%以上的增长率,但这也发映出了很多的问题。例如寻租行为引起的各式各样的腐败现象屡禁不止;资本市场的不健全使得民间融资风险扩大。

新《国九条》中,对期货行业的核心影响概括为“一个变化,两个方面” [10] 。“一个变化”即期货行业格局将发生变化;“两个方面”表现为:一方面,期货行业整体面临着大发展、大变革,未来的期货行业将呈现与当前完全不同的行业格局;另一方面,牌照制打破了期货行业的准入壁垒,其他金融机构将进入衍生品市场,从而形成新的竞争格局。这意味着未来我国期货市场将有大的变革,加上互联网金融的日益普及,今后期货市场的发展将会更加完善,其对货币流动的影响将会日益增加 [1] 。