1. 引言

所有的金融类文献都承认了交易者具有异质性,并且异质性会影响资产定价。异质性就是行为的不同,比如风险厌恶的不同,但更明显的是信念(期望)的不同。早期的例子是Lintner (1969) [1] 研究发现金融市场中投资者的交易策略和表现各不相同,典型的HAMs也高度重视期望的不同,但是同经典的资产定价模型相比,它不同于理性预期和单一代理概念,应用了有限理性交易者,这一概念由Simon (1957) [2] 提出,当然这对金融学家来说是极具挑战的,这是由于有限理性行为的范围太广,而理性预期的结果却是唯一的。Cutler et al. (1991) [3] 发现了理性交易者和噪声交易者的相互作用呈现正反馈——价格上升时买入,价格下跌时卖出,可以重现市场趋势和均值回归特征。De Long et al. (1990) [4] 发现此模型中的理性交易者通过提高价格,然后卖给图表分析者扰乱市场。

Brock and Hommes (1997, 1998) [5] [6] 提出异质代理模型的关键成分是一类非理性正反馈交易者,也称为图表分析者。图表分析者认为过去价格的变化会一直持续,和基本面者面者形成对比,基本面者基于均值回归策略,认为市场价格会不断回归基础价值,而图表分析者基于技术分析,认为价格会延续历史价格模式。经典框架下基本面者和理性交易者很相似,相比之下图表分析者就像势头交易者。除采用基本面者——图表分析者的区别外,HAMs的特征还有交易者基于过去表现改变策略的灵活性,就如Brock and Hommes (1997) [5] 介绍的那样。在这种机制的支持下,Bloomfield and Hales (2002) [7] 给出了一些实证证据,交易者基于最新实现利润的条件预测不断改变,即使他们明白价格基本过程是服从随机游走的。在过去20年里,有关HAMs的文献明显增多,Zeeman (1974) [8] 首次提出用HAMs解释金融市场动力系统,这篇文献很快被Day and Huang (1990) [9] ,Kirman (1991) [10] ,Chiarella (1992) [11] ,Lux and Marchesi (1999) [12] 进行推广,Brock and Hommes (1997, 1998)介绍了交易者策略转换的概念,而且在金融市场行为的解释方法引发了广泛的兴趣,参见Chiarella et al. (2009) [13] 对相关文献的总回顾中。

He and Li (2007) [14] 发现异质代理、学习过程中的趋势追随调整速度、噪声和基本确定动态的相互作用是幂律分布波动的原因,He and Li (2015) [15] 验证了DAX30指数的幂率行为,并基于Monte-carlo模拟估计模型的幂率衰减指数,(FI) GARCH参数,说明模型可以很好地反映真实市场。

本文利用一些重要方法对前文献进行延拓,例如加入TGARCH模型,我们发现,异质信念模型可以很好地拟合深证综指收益序列,反映出本文所建理论模型具有一定的现实合理性。

2. 模型的建立

2.1. 做市商机制下的市场分数和市场出清价格

本文遵从Brock and Hommes (1997, 1998)的分析框架,考虑一个带有一种风险资产和一种无风险资产的金融市场模型,假定风险资产的弹性总收益为R = 1 + r/K,r表示无风险资产的年利率,K表示年交易频次,一般地,K = 1, 12, 52, 250。本文以金融市场的日收盘价为研究对象,所以K = 250。

记

为t时点风险资产的每股价格(不包括红利),

为随机分红过程,则t + 1时h类投资者财富为

(2.1)

这里,

和

分别表示h类投资者t时点的财富和风险资产持仓量,

和

分别表示基于t时点信息集下h类投资者t + 1时点的条件期望和方差,另

表示t + 1时点的每股超额收益,即

(2.2)

因此2.1和2.2式可以写为

(2.3)

假定市场中h类交易者有相同的风险厌恶效用函数为

,其中

为h类交易者的风险厌恶系数,依据期望效用最大化,h类投资者对风险资产的需求总和为:

(2.4)

考虑到投资者的异质性和信息的不对称性,我们假定市场中仅存在两类交易者,基本面者和图表分析者。假定基本面者和图表分析者的市场分数分别为

和

,风险厌恶系数为

和

,令

。假定外部供应为零,依据式(2.4),投资者的总额外需求为

(2.5)

本文运用的是做市商机制,令

表示做市商的价格调整速度,为了表示突来的市场信息或者噪声者的投机行为,我们引入噪声需求

,

,基于上述假设,市场价格如下:

结合(2.5)式,整理为

(2.6)

2.2. 基本面者

定义

为t时点的一般信息集,我们假定,除一般信息集之外,基本面者对风险资产基础价值

有额外信息,假设其服从平稳随机游走过程

(2.7)

与噪声需求

相互独立,这种模式设定确保厚尾和波动聚集现象不是由基础价值过程产生的。因此,在后面的讨论中,任何风险资产自相关结构的出现将是由交易过程自身产生的。

对基本面者来说,因为他们也意识到了非基本面交易者的存在,例如下面要讨论的趋势追随者,所以他们认为即使股票价格短期会偏离基础价值,但长期来看,最终会收敛到基础价值。我们假定基本面者的条件均值和方差是

(2.8)

这里

是恒定不变的,参数

表示价格向基础价值回归的速度,衡量了基本面者对基础价值的依赖程度。等式表明,基本面者的预期价格是基础价值和最新市场价格的加权平均。

2.3. 趋势追随者

不同于基本面者,趋势追随者是技术型交易者,他们相信未来价格可由不同的模式或者历史价格形成的趋势预测得到,假定趋势追随者通过长期样本平均推断最新价格变化,并且调整他们的方差估计,确切来说,假定他们的条件均值和方差是

(2.9)

这里

,

是常数,

和

是样本均值和方差,他们分别服从某些认知过程,参数

是外推率,参数

的大小反映了趋势追随者外推的强弱,系数

表示样本方差对条件方差的影响。有多种认知过程可以估计样本均值

和样本方差

,本文假设

(2.10)

(2.11)

是常数,当记忆滞后长度趋于无穷大时,样本期望和方差是个几何衰减受限过程。从根本上说,几何衰减概率过程

与历史价格

是相关联的。参数

是几何衰减率。选择这个过程有两点原因:第一,估计样本均值和方差时,交易者倾向于对当前价格附以很大权重,对以前或者更早的价格附以很小的权重;第二,我们相信几何衰减过程可能有确定的自相关结构,甚至是在真实金融市场观察到的长记忆特征,另外,它也有数学处理的优势。

2.4. 完整的随机模型

为了简化计算,我们假设随机红利过程

服从正态分布

,预测长期基础价格为

,价格和红利的无条件方差联系为

,基于式(2.8)~(2.9),有

因此,基本面者的最优需求为

(2.12)

特别的,当

,

(2.13)

同样,基于(2.9)式(应用

),有

这里,

。因此,趋势追随者的最优需求为

(2.14)

将式(2.12)和(2.14)带入式(2.6),我们得到在做市商机制下的价格动力系统,一个4维随机差分系统(SDS):

(2.15)

3. 实证分析与数值模拟

3.1. 深证综指基本统计特征及相关检验

本文以深证综指(399106)日收盘价为基准反映真实金融市场特征,数据来源为深圳财富趋势科技股份有限公司通达信软件,选取上证指数日收盘价作为数据集,共5118个观测值,样本区间为1996.05.10~2017.06.20,记

为t时点的价格指数,

为收益率。

3.1.1. 收益率序列基本统计特征

我们从表1可知

的偏度为−0.627225 < 0,即收益率出现负值得概率大于出现正值的概率。JB统计量非常显著,拒绝正态分布的零假设,峰度大于3,亦表明收益率不服从正态分布,且具有尖峰厚尾特征。

3.1.2. 相关性检验

本文选择Ljung-Box Q统计量对收益率序列的自相关进行检验,零假设为“序列不存在k阶自相关”,具体的Q统计量(Ljung, Box, 1979)表达式为

其中,

为j阶自相关系数,T为向本容量,k是设定的滞后阶数。

检验结果如下:在滞后20期的情况下,Q统计量为77.922,在5%的显著性水平下,拒绝自相关系数联合为零的假设。因此,收益率序列存在自相关。

3.1.3. 平稳性检验

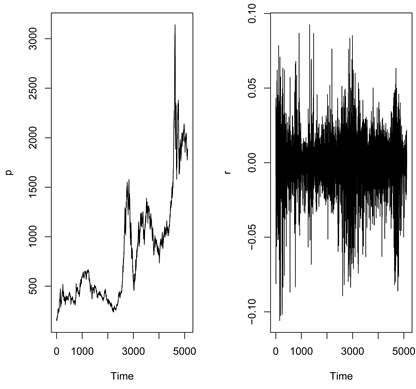

由图1初步判断

序列不平稳而

序列平稳,下面进行序列稳定性检验,

最常用的平稳性检验方法由Kwiatkowski、Phillips、Schmidt和Shin于1992年提出,称为KPSS检验,零假设为“序列为平稳时间序列”,其检验方程为

表1.

的统计特征

Figure 1. Time series of price and return

图1. 上证指数价格和对数收益时间序列图

其中,

包含确定性成分,

是一个可能含有异方差的平稳序列,

是一个随机游走过程。

检验结果如下:KPSS统计量为0.0878,小于5%水平下的临界值0.463,不能够拒绝收益率序列为平稳时间序列的零假设,所以收益率序列为平稳时间序列。

3.2. 收益率的波动聚集性和非对称性分析

金融时间序列常表现出不稳定的特点,Mandelbrot (1983)指出:“大的波动倾向于伴随着大的波动(或正向或反向),而小的波动倾向于伴随着小的波动。”这种现象后来被称为波动的聚集效应,在股市中有为常见。对于股价反向冲击所产生的波动将大于等量正向冲击所产生的波动,这就是所谓的股市波动的杠杆效应。一般认为,当等量的正负冲击对股市波动产生不同的影响时,就称为股市波动的非对称性。

3.2.1. GARCH模型参数估计

作为金融市场收益序列的显著特征,许多变换条件方差经济模型都被用来检验和衡量波动聚集性,本文应用Engle (1982)提出的,Bollerslev (1986)推广的GARCH模型,如果收益率服从AR(1)过程,那么GARCH(p,q)定义如下:

这里L是滞后算子,

,

。定义

,可以改写成一个ARMA(s,p)过程

这里

,表2列出上证指数GARCH(1,1)的参数估计,这里期望过程包含一个AR(1)结构。从表2可以看出

接近于1,说明序列具有长记忆特征。

3.2.2. TGARCH模型参数估计

描述杠杆效应的一种常用模型是门限GARCH模型,又称为TGARCH模型,它是由Zakoian (1994)、以及Glosten、Jaganthan和Runkle (1994)分别独立提出来的,在TGARCH模型中,条件方差方程的形式为:

其中,

被称为杠杆效应系数。

本文建立TARCH(1,1)模型拟合收益率序列,这里期望过程包含一个AR(1)结构。拟合结果如表3所示,可以发现,拟合的非对称系数为0.0284,且在5%的水平下显著异于零,其符号为正号,说明深证综指对利好消息的反映小于利空消息。

3.3. 金融市场幂率行为分析

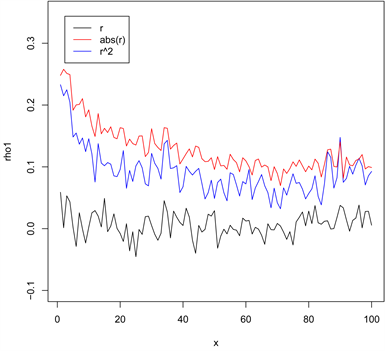

我们分别画出深证综指的收益率、平方收益和绝对收益的自相关系数图,结果如图2所示,从图中我们发现,收益的自相关系数不显著,而绝对收益和平方收益的自相关系数显著,衰减缓慢且绝对收益自相关系数大于平方收益自相关系数,自相关系数的这种特征表明波动具有长记忆性或者说是幂率行为特征。

除了从图形上初步判断rt、

和|rt|的自相关结构外,我们也可以构造模型来估计自相关衰减率,Geweke and Poter-Hudak (1983)提出基于对数谱坐标回归,用半参数法估计分数差分参数d,其中谱坐标为

,GPH估计法如下所示:

其中假设

。如果纵坐标

满足

,

且

表2. 深证综指GARCH(1,1)参数估计

表3. 深证成指TGARCH模型参数估计

(a)

(a) (b)

(b)

Figure 2. The ACs of the returns, the squared returns and the absolute returns

图2. 深证综指rt、

、|rt|自相关图

,则OLS估计满足以下极限分布:

这里我们分别估计

时的

值,结果如表4所示。

我们发现收益率序列的d值在任意显著性水平下均不显著,而绝对收益和平方收益的

值在任意显著性水平下均显著,这说明平方收益和绝对值收益具有幂率行为特征,而且绝对收益率的持续性比平方收益率强。

3.4. SDS模型的有效性讨论

以上主要讨论验证了真实金融市场收益率的一些特征,下面我们对应讨论模型的有效性。基于Monte-Carlo模拟统计检验,模拟独立运行1000次,每次生成4000个观测值。根据He and Li (2015),参数选取如下所示:

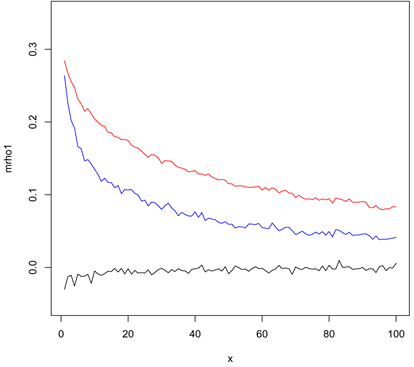

3.4.1. 模型收益率的自相关结构

首先,我们看SDS模型的自相关结构,想知道模型是否能够复制真实市场的一些结论,模拟独立运行1000次,对每一次模拟,我们估计收益率、平方收益和绝对收益的自相关系数,然后取均值,结果如图3所示,通过比较图2,我们可以看到rt、

、|rt|的自相关函数的衰减模式很类似,为了观察模型的拟合效果,在图4中我们Newey-West修正标准差画出深证综指收益率、平方收益和绝对收益的置信区间,清楚发现SDS模型自相关系数基本落在深证综指自相关系数置信区间内,说明本文所建理论模型具有一定的现实合理性。

表4. 深证综指及模型d值估计

Figure 3. The ACs of the returns, the squared returns and the absolute returns for model

图3. SDS模型rt、

、|rt|及自相关图

Figure 4. The ACs of the returns, the squared returns and the absolute returns for model and the composite

图4. SDS模型rt、

、|rt|自相关图 深证综指的置信区间

Table 5. GARCH(1,1) estimates for model

表5. SDS模型GARCH(1,1)参数估计

Table 6. TARCH(1,1) estimates for model

表6. SDS模型TGARCH(1,1)参数估计

3.4.2. 模型GARCH和TGARCH参数估计

同样的方法用于估计GARCH、TGARCH模型参数,这里,我们继续计算估计参数的均值,结果如表5、表6所示。由表5可看出

接近于1,说明模型序列具有强的波动持续性,由表6得到模型TGARCH的非对称系数为0.1255,其符号为正号,说明模型序列对利好消息的反映小于利空消息。综上分析,本模型可以很好地反映收益序列的波动聚集性和非对称性。

3.4.3. 模型幂率衰减指数估计

本小节继续运用GPH方法估计模型幂率衰减指数,并计算估计参数均值,结果如表4最后一列所示,从表中我们发现,平方收益和绝对收益序列估计d值均在深证综指估计d值的95%置信区间内,说明模型合理有效。

4. 结束语

在Xue-Zhong He and Youwei Li (2015)模型的基础上,本文对基于深证综指的异质信念模型进行了数值模拟。结果显示本文模型可以很好拟合真实金融序列的波动聚集性、非对称性和长记忆性。最后,本文没有考虑交易者在交易期转换投资策略的情况,因此建立加入实变市场分数的异质信念模型,并对其进行模拟和实证检验,也是未来研究的一个重点方向。