1. 引言

2017年1月15号,广东省发改委、省经信委、省环保厅三部门联合印发《广东省节能减排“十三五”规划》,明确提出到2020年,广东省万元GDP能耗比2015年下降17%,全省能源消费总量控制在3.38亿吨标煤,全省21个市能源消费净增加量不超过3700万吨标煤。为给政府科学合理的制定节能减排政策提供依据,有必要利用科学的方法对一些节能减排措施的效应及影响进行定量的评估,可计算一般均衡(CGE)模型作为国际通用的经济分析及政策模拟方法,已被广泛应用于分析碳税、碳交易、产业结构等节能减排政策的模拟分析上,但是还鲜有分析产业投资结构与能源消费和经济增长的关系,鉴于此,本文应用CGE模型来综合评价产业投资结构变动对广东省能源消费和GDP的影响,以此评估该政策对广东省十三五节能减排目标实现的促进作用。

投资结构是指投资总体内部各组成部分之间的相互联系及数量比例关系,它表现为投资投向什么地方,投入多少。产业投资结构是指投资在国民经济各个产业部门之间的分配及数量比例关系,它的变动直接影响并决定产业结构的变动,进而影响各产业部门的能源消费以及经济产出。

不少学者分析了产业投资结构与产业结构之间的密切联系,郭宝华等 [1] 从投入产出角度得出了投资结构决定产业结构,而产业结构制约着投资结构;杨秀芝等 [2] 提出:要促进产业结构的优化升级必须从调整投资结构入手;范德成等 [3] 认为:产业结构是由产业投资结构决定的,产业结构的调整和升级依赖于产业投资结构的优化;陈婧 [4] 的研究认为:任何现有的产业结构都是由过去的投资形成的,而未来的产业结构又是由现在的投资结构所决定的,产业结构的高级化离不开产业投资结构的优化和调整。

还有许多学者研究了产业结构与能源消费和宏观经济之间的关联性,如许秀川等 [5] 通过建立计量模型考察了三次产业发展与三次产业能源消费之间的关系;张传平等 [6] 基于统计数据发现山东省能源消费、产业结构和经济发展间存在着长期均衡的协整关系;肖萍 [7] 的研究发现:能源消费、产业结构和经济增长三者之间相互作用、相互支持、相互制约;林景伟 [8] 的研究表明:能源与经济发展之间有着不可分割的密切关系,同事产业结构的不断调整变动也影响着能源消费及其消费结构。

从上面不同学者们的研究中我们发现,产业投资结构的变动决定了产业结构的变动,而产业结构的变动最终又影响了能源消费和经济增长,那么,产业投资结构与能源消费和经济增长之间必然存在着某种内在联系,基于此,本文考虑从产业投资结构的变动入手,分析其对广东省能源消费和经济增长的影响程度,以此评估其政策效果。

2. 模型方法

CGE模型为本文研究的核心方法,已被广泛应用在国际贸易 [9] 、税收政策 [10] 、气候变化 [11] 、环境问题 [12] 等领域。本文所使用的广东两区域动态CGE模型是由中国科学院广州能源研究所和日本国立环境研究所共同开发,两区域即为广东和中国其他地区。Wang [13] 和Dai [14] 对模型的技术参数、模型特征等进行了具体的描述。

2.1. 行业划分

广东两区域动态CGE模型是以2007年国家投入产出表和广东省投入产出表为基础数据,为了凸显广东省能源消费和碳排放的情况,将高耗能行业如电力、水泥、石化、钢铁等单独列出,对能源消费较低的行业,如金融、地产、商贸等均视为服务业,将行业部门集成为33个部门投入产出表,如表1所示。

2.2. 参数设定

本模型中,影响未来经济增长和能源消费的主要数据为:GDP增长率、全要素生产率(TFP)、能源效率改进参数(EEI)、人口增长率(POP),如表2所示。

广东省“十三∙五”国民经济发展规划将GDP增速设定为7%,同时,权威人士多次在人民日报发文称中国未来的经济增长不会是短期的V型反弹,而是L型走势,综合以上信息,本文将2020~2030的GDP的增长率设定为6%。

徐家杰 [15] (中国全要素生产率估计1978~2006)通过测算得到中国在1978~2006年间的平均TFP在3.25%左右,李善同在2001年发表的《中国宏观经济形势报告》中明确指出:中国经济20年内潜在增速可达7.3%,全要素生产率保持年均增长2.5%~3%是基本前提。即,2001~2020年期间,中国的全要素生产率应该保持在3%以上。2020年以后,全要素生产率可能会出现适当的下降,综合上面的情况,本文设定广东2015~2020年的全要素生产率为:3.25%,2020~2030年则设置为2%。

2015~2020年的人口增长率参考《广东省国民经济与社会发展第十二五个五年规划纲要》以及广东省人口增长历史数据设定0.5%的年均增速。广东省人口发展研究院院长董玉整在接受南方日报采访时,给出了放开二胎之后广东省人口的年均增长速度是0.46%。此外,参考广东省人口就业处的黄映川在《未来广东人口发展前景展望》一文中预测的2030年广东常住人口将介于1.15~1.25亿人口,设定广东省2015~2020年的人口增长速度为0.5%,2020~2030年的人口增长速度为0.46%,到2030年广东省人口为1.165亿,介于1.15~1.25之间。

关于能源效率改进参数的设置,不同学者有不同的设置范围,Fujimori [16] 设置到2050年的EEI为

Table 1. Guangdong two regional dynamic CGE model of the various industrial sectors

表1. 广东两区域动态CGE模型各产业部门

Table 2. Baseline scenario settings

表2. 基准情景参数设置

1%~3%;Zhang [17] EEI为2.21%~3.6%,Dai [18] 设置中国到2020年EEI为2.5%,考虑到政府短期内受强度目标的限制,本文将广东省气体燃料和电力的EEI设置为3%,将固体和液体燃料的EEI设定为5%和4%。

2.3. 数据处理

广东两区域动态CGE模型是以折合成33部门后的投入产出表和能源平衡表为数据基础,以产业部门生产、分配、流通和消费中的产品物质量和价值量平衡来建立动态模型。其中价值量平衡所采用的是资金流量表和国际贸易数据,然后将现价统一折算为2007年为基准的价格。由于统计年鉴中各个行业的能源消费数据采用实物量进行统计,而投入产出表则是以价值量计算,考虑到价格因素的影响,我们以能源平衡表中各个行业的数据为准,校核33部门SAM表中行业能源数据,最后用交叉熵法平衡SAM表。

2.4. 模型校核

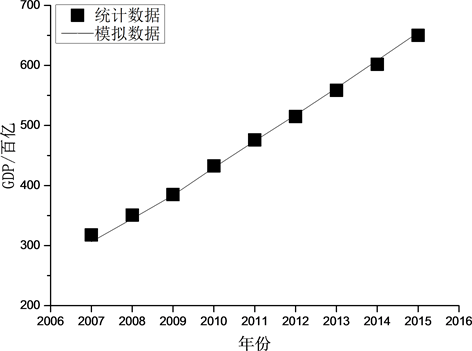

本文以2007年历史数据为基准,对2008~2015年的历史数据进行模拟预测,然后和2008~2015年的统计数据进行对比,模拟结果如下图所示:

图1是模型模拟的2008~2015年GDP的模拟值和统计数据的对比,在过去七年里,GDP模拟量的总和与统计数据的误差只有0.136%。

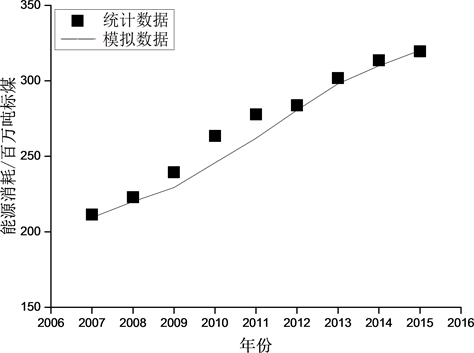

图2是模拟的能源消费数据与统计数据的对比图,从图中我们可以看到,模拟曲线很大程度上与

Figure 1. GDP statistics and simulation data comparison

图1. GDP统计数据与模拟数据对比

Figure 2. Comparison of energy consumption statistics and simulation data

图2. 能源消费统计数据与模拟数据对比

实际统计数据相吻合,除了2009~2011年的统计数据稍大于实际数据外,其他年份的数据基本一致。

综合GDP和能源消费的模拟数据,我们的模拟结果具有一定的可靠性,因而在下面的分析中,我们将用校核后的模型对未来广东的GDP的能源消费情况进行模拟预测。

2.5. 情景设置

为实现GDP照常增长的前提下实现能源消费的下降,本文试图在保持投资总量不变的前提下,通过改变高耗能行业的投资分布量来改变原有的产业投资结构,进而对经济增长和能源消费情况进行新的梳理和分析。为此本文设置了四种情景:BaU、GINV1、GINV2、GINV3,如表3所示。

其中对高耗能行业的定位主要为以下九大行业:矿物开采业(包括煤炭、石油、天然气开采业和采矿业)、纺织业、造纸业、石油化工业(包括石油及核燃料加工业、炼焦业、化工业)、非金属矿业(包括水泥制造业、玻璃及玻璃制品制造业、陶瓷制品制造业、其他非金属矿物制造业)、有色金属加工冶炼、黑色金属加工冶炼(包括钢铁业和金属制品业)、电力热力燃气水的生产和供应业、交通业(包括道路运输业、水上运输业和航空运输业)。

3. 结果分析

3.1. 基准情景分析

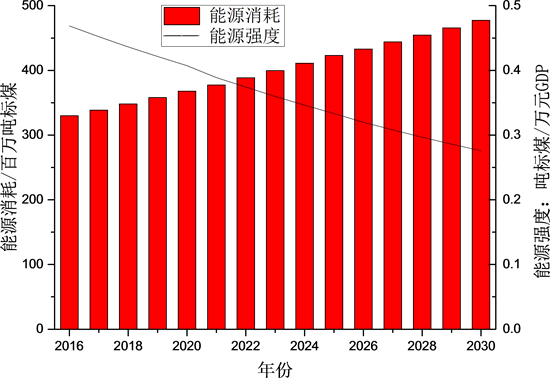

3.1.1. 能源消费和能源强度的变动分析

从图3可以看出,如果没有外部干扰,广东省的能源消费将继续保持增长态势,不过增速将逐渐放缓。能源强度则保持下降趋势,从2015年0.489吨标准煤/万元GDP下降到2020年的0.407吨标准煤/万元GDP,能源强度下降16.70%。同一时期,根据《广东省节能减排“十三五”规划》,到2020年能源强度实现17%的下降目标,也即是说,如果按照现在的速度,则略微低于规划中17%的下降要求。此外,根据该规划,广东省十三五期间的能源消费净增量将不超过3700万吨,即到2020年能源消费总量不超过3.38亿吨标准煤。该规划立足于广东省2015年能源消费3.01亿吨标准煤的基础之上,广东省调整了2013年后的能源数据,2020年的总量控制目标为3.56亿吨标准煤,基准情景下模拟出来的结果是3.68亿吨标准煤,也即是按照当下的发展势头在2020年并不能完成《广东省节能减排“十三五”规划》的预计目标。

3.1.2. 人均GDP和人均能源消费的变动分析

图4所示为广东省2016~2030年间预测的人均GDP和人均能源消费数值,其中广东人均GDP从2015年的6.04万元增长到了2030年的14.86万元,增长了2.46倍。广东省2020年的人均GDP为8.12万元,相比2010年4.12万元的人均GDP,增长了1.97倍,略微低于国家十三五规划所要求的2020年人均收入比2010年翻一番的要求。广东省人均能源消费从2015年的2.95吨标准煤增长到了2030年人均4.10吨

Table 3. Introduction to four scenarios

表3. 四种情景介绍

Figure 3. Energy consumption and energy intensity from 2016 to 2030 in the baseline scenario

图3. 基准情景下2016~2030年能源消费和能源强度

Figure 4. Per capita energy consumption and per capita GDP in 2016~2030

图4. 2016~2030年人均能源消费和人均GDP

标准煤,依然低于发达国家现在的能源消费水平。

3.1.3. 九大高耗能行业能源消费和GDP变动分析

图5为基准情景下预测的2015、2020、2030年九大高耗能行业(备注:此处为CGE模型中合并后的产业)的能源消费对比图,图6则为2015、2020、2030九大高耗能行业的GDP对比图。2015年,耗能最高的行业是电力热力燃气水的生产和供应业,其能源消费为3925万吨标准煤,紧随其后的是石油化工业的3602万吨标准煤和黑色金属加工业的3470万吨标准煤;GDP最高的行业则是石油化工业,其工业增加值为5787亿元,位列其后的是黑色金属加工业和交通业,其工业增加值分别为2647亿元和2418亿元。

Figure 5. Comparison of energy consumption in key years for nine high energy consumption industries

图5. 九大高耗能行业关键年份能源消费对比图

Figure 6. Comparison of key GDP in nine high energy consumption industries

图6. 九大高耗能行业关键年份GDP对比图

到了2020年,能源消费最高的行业则变为了黑色金属加工业,其能源消费为4858万吨标准煤,电力热力燃气水的能源消费紧随其后,为4404万吨标准煤,石油化工业依然位居第三位,能源消费为4271万吨标准煤;GDP最高的行业依然是石油化工业,工业增加值是8095亿元,黑色金属加工业和交通业的产值为3898亿元和3684亿元,其中增长幅度最高的行业是有色金属加工业,相比较于2015年的增幅是55.29%;2030年,能源消费最高的行业依然是黑色金属加工业,其能源消费为8563万吨标准煤,排名第二位的是石油化工业,能源消费为5801万吨标准煤,第三位的是交通业的5702万吨标准煤,电力热力燃气水的生产和供应业则滑落到第四位,能源消费总量为5283万吨标准煤;GDP最高的行业还是石油化工业,为14,744亿元,第二位的则是交通业的8036亿元,第三位是黑色金属加工业的7870亿元,相比较于2020年,增幅最大的行业依然是交通业,其增长幅度为118.10%。

从能源消费总量上看,九大高耗能行业的能源消费总量一直呈增长态势,从年均增速来看,九大高耗能行业的年均增速如图7所示:黑色金属加工业从2015~2030年的年均增速为6.21%,交通业、有色金属加工业和石油化工业紧随其后分别为3.87%、3.65%、3.23%,年均增速最慢的行业则为纺织业的0.25%,其次则为非金属矿物业的1.08%。需要注意的是,基准情景下的模拟结果是在不加以任何政策干预的前提下模拟出来的,其并不能代表未来的实际情况,只是便与和其他情景做对比而设置的一种特定情景。

3.2. 四种产业投资结构的对比分析

上面分析了在基准情景下能源消费总量和GDP的变动情况,以及九大高耗能行业的能源消费变动情况,下面将对比分析基准情景(BaU)、减缓情景(GINV)、滞涨情景(GINV2)和限制情景(GINV3)下的能源消费总量及GDP的变动情况,以及九大高耗能行业能源消费变动情况。

Figure 7. 2016~2030 nine high energy consumption industry average annual growth rate

图7. 2016~2030年九大高耗能行业年均增长率

3.2.1. 能源消费总量对比分析

图8所示为四种情景下能源消费总量逐年变动图,从图中可以清楚的看到,到2030年,基准情景的能源消费总量最高,其他三种情景在一定程度上使得能源消费总量得到了下降。其中GINV2 (滞涨情景)的能源消费下降程度最低,GINV3 (限制情景)的能源消费下降程度最高,GINV (减缓情景)的能源消费下降处于两者的中间。从能源消费总量上来看,BaU (基准情景)下,2030年的能源消费总量为4.77亿吨标准煤,GINV、GINV2和GINV3情景分别在此基础上下降了1737万吨、929万吨、2589万吨标准煤。GINV3 (限制情景)的降耗力度最大,主要源自于九大高耗能行业的投资呈负增长态势,投资的下滑导致该行业的能源消费水平随之下滑;GINV2 (滞涨情景)的降耗力度之所以低于GINV (减缓情景)是由于在基础情景下,电力、石化、水泥、玻璃、有色等高耗能行业的年均增速不足2%,减缓情景下其投资量逐年呈负增长态势,相比较而言,GINV2 (滞涨情景)的投资额则一直保持在2015年的水平,最终导致GINV (减缓情景)的能源消费下降力度高于GINV2 (滞涨情景)。通过设置三种对比情景调整九大高耗能行业的投资额,发现,投资与能源消费增长之间保持一定的正向作用,通过减少高耗能行业的投资额,可以降低该行业的能源消费水平,进而减少总体的能源消费。

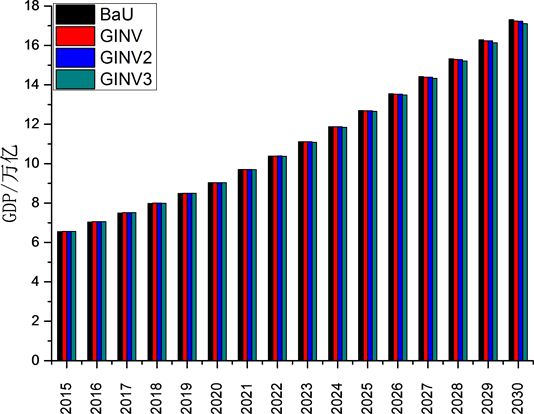

3.2.2. GDP总量对比分析

图9为2015~2030年四种情景下广东省GDP的变动情况。从图中可以直观的看到,基准情景(BaU)的GDP最高,限制情景(GINV3)的GDP最低,减缓情景(GINV1)和滞涨情景(GINV2)的GDP介于两者之间。到2030年,相比较于基准情景而言,减缓情景(GINV1)、滞涨情景(GINV2)、限制情景(GINV3)的GDP分别下降了899亿、786亿、2017亿,下降幅度为:0.52%、0.45%、1.17%。此时,三种对比情景的能源消费量相比较于基准情景分别下降1909万吨、929万吨、2589万吨,下降幅度为4.00%、1.95%、5.43%。根据能源消费量下降数据和GDP损失数据,计算可得减缓情景(GINV1)、滞涨情景(GINV2)、限制情景(GINV3)的降低能耗成本分别为0.47、0.85、0.79万元/吨标准煤。

Figure 8. Comparison of energy consumption in four scenarios

图8. 四种情景下能源消费对比图

Figure 9. Comparison of GDP changes in four scenarios

图9. 四种情景下GDP变动对比图

3.2.3. 能源强度对比分析

我们在前面的分析中提到,如果按照BaU (基准情景)发展,广东省十三五期间的能源强度下降水平将不能达成17%的既定目标。那么,三种对比情景能否完成这个目标呢?请看图10。

从图10我们可以直观的看到,四种情景下能源强度一直呈下降趋势。2020年,四种情景下的能源强度相比较于2015年而言,其下降幅度分别为:16.70%、17.41%、16.83%、17.45%,也即是说GINV (减缓情景)和GINV3 (限制情景)下单靠改变投资结构便能够完成广东省十三五能源强度下降17%的目标。此外在2020年,四种情景下能源消费总量分别为:3.68亿吨、3.65亿吨、3.68亿吨、3.65亿吨,可见距离3.56亿吨的既定标准依然有一定的差距,也即是仅靠投资结构的变动并不能达成能源消费总量控制的既定目标,还需要配合有其他措施。

3.2.4. 九大高耗能行业能源消费对比分析

图11所示为2030年四种情景下九大高耗能行业的能源消费情况。对于不同的行业,四种情景下能源消费变动情况各不相同。对能源消费最高的黑色金属加工业而言,BaU (基准情景)的能源消费最高,次之是GINV (减缓情景),再其次是GINV2 (滞涨情景)和GINV3 (限制情景)。GINV3 (限制情景)的能源消费相比较于BaU (基准情景)下降了1070万吨标准煤,也即为限制黑色金属加工业的投资额可以有效地降低该行业的能源消费水平,不过由于该行业与其他行业之间的关联作用,所以仅依靠限制投资并不能达到限制该行业能源消费增长的目的,还必须配合其他政策措施一同使用,方能达到最佳效果。

限制石油化工业和纺织业的投资,对其能源消费下降有较大的促进作用,GINV3 (限制情景)相比较于BaU (基准情景)而言,石油化工业和纺织业的能源消费水平分别下降了646万吨、247万吨标准煤,下降幅度为11.13%和32.34%;同样的措施对于交通业的影响则十分有限,虽然能源消费出现了下降,不过下降幅度非常不明显,也即是通过限制交通业投资的办法并不能达到能源消费大幅下降的目的。

由于BaU (基准情景)下电力行业的投资就是呈下降趋势,所以GINV (减缓情景)比GINV3 (限制情景)

Figure 10. Four scenarios of 2015~2030 energy intensity

图10. 四种情景下2015~2030年能源强度

Figure 11. 2030 years under the four scenarios of nine high energy consumption energy consumption

图11. 2030年四种情景下九大高耗能行业能源消费

对能源消费的抑制作用更为明显。而对于非金属矿物业,GINV (减缓情景)和GINV2 (滞涨情景)的能源消费高于BaU (基准情景)的能源消费,只有GINV3 (限制情景)的能源消费略微低于BaU (基准情景),也即表明,减少非金属矿物业的投资并不必然导致非金属矿物业能源消费量的减少,也即是该行业的投资额与能源消费水平之间并不呈现显著相关的关系。

4. 结论

依据上面的分析,通过调整九大高耗能行业的投资增速,虽然可以实现在较少GDP损失的基础上降低能源消费总量的目的,但是仅依靠投资结构的改变,并不能完成既定的调控目标,还需要结合其他调控政策。

对于黑色金属加工业、石油化工业、纺织业、造纸业、有色金属加工业,通过限制并逐年降低其投资额度的方式,可以较大程度降低其能源消费量;对于电力热力燃气水的生产和供应业,适当减缓投资增速,便能达到较好的结果;对于交通业、矿物开采业,限制投资的效果并不明显;对于非金属矿物业,限制投资反而会适得其反,并增大其能源消费量。

我们在制定投资政策时,必须考虑到不同行业对投资敏感程度的差异性,以及不同行业的能源消费与投资之间的相关程度,有针对性的制定与本行业相适应的投资政策,通过合理的政策安排,使其在满足能源消费总量控制的前提下,达到资本的最佳配置,协调GDP增长与能源消费总量控制这一矛盾,实现在较小GDP损失的基础上达成能源消费总量下降的目标。

致谢

本研究感谢国家自然基金《基于经济–技术–空间集成能源模型的电力系统低碳化路径研究》(71603248)、广东省科技厅科技计划软科学项目《城市产业转型及引导政策研究——以广东21地级市为例实证》(2015A070704038)、广东省低碳发展专项资金“结合主体功能区规划的广东省低碳发展研究”(批准号:ZHC201607)的支持。