1. 引言

诱因与奖酬合约选择向为管理会计领域关注的课题;而薪酬给付方式,亦为雇主与求职者共同关切的课题。薪酬的给付方式有许多种,除了基本的固定给付薪酬外,许多企业还会透过绩效基础的薪酬合约(performance-based contract),奖励制度的方式吸引高技术人才(Banker et al., 2000)[1],藉以提高公司生产力,并进而产生更多的盈余。而员工也会依据本身能力之水平,进行绩效基础薪酬合约的自我选择(self-selec-tion)(Baiman, 1982[2]; Baiman, 1990[3])。

Chow(1983)[4]曾进行自我选择的研究,结果发现受测者在对其自身能力有较完整认知的情况下,能力高的受测者会倾向于选择绩效奖酬的合约,能力低的受测者则倾向选择非绩效奖酬的合约。后续的研究,如Shields and Waller(1988)[5]、Farh et al. (1991)[6]及Bonner et al. (2000)[7]的研究都支持此一观点;亦即个人能力与奖酬合约的选择有相当程度的关联性。

前述的研究(如Namazi, 1985[8]; Waller, 1994[9]; Young and Lewis, 1995[10]; Bonner and Sprinkle, 2002[11])都是基于受测者认知完整的情形下,所得到的研究结论。研究中亦都假设受雇者能正确认知其工作能力,故都能选择与其能力相配的工作合约。然而在现实生活中,受雇者是否能够正确的认知其工作能力,是否存在认知偏误(cognitive bias)的问题,都可能干扰其正确工作合约的选择。

然相关的研究显示,个人对于自我能力的认知可能不完整,如在不确定自身能力的情况下,往往会出现过度自信的倾向(Heath & Tversky, 1991[12]; Russo and Schoemaker, 1992[13]; Graham, Harvey & Huang, 2006[14]);而Baiman(1982)的研究也发现个人可能高估亦可能低估其工作能力,而Griffin and Tversky(1992)[15]的研究也发现,人们会低估强度低而发生频率高的事件;会高估强度高而发生频率低的事件。Hyatt and Taylor(2008)[16]的研究则显示,当个人在面对与自身利益高度相关的工作合约时,将较容易有过度自信的倾向,导致他们选择错误的薪酬合约。这些研究都显示个人可能出现偏误的认知,并导致错误的工作合约选择。Ferraro(2010)[17]的研究则认为这种自我能力认知(competence self-awareness)的不完全,常会伴随着过度自信(overconfidence),并导致个体的自我选择偏误。

再者,信念形成不仅与个人过去经验及人格特质有关,也会影响决策行为。如Hvide(2002)[18]曾探讨信念与经理人过度自信行为的关系;Siebenmorgen and Weber(2004)[19]则提出投资者抱有均值回归1的信念,导致他们认为长期投资的风险较短期投资为低。而个人的信念强度不同,亦可能导致受雇者对原有信念的深信不疑,并影响工作契约的选择。

2. 文献探讨

薪酬合约是雇主与求职者之间,协调劳资双方权利与义务的工具。虽然企业需耗费成本以建立和维持薪酬制度,但薪酬制度确有其存在的经济价值(Demski and Feitham, 1978[21])。企业提供薪酬合约一方面可避免受雇者的道德危机(moral-hazard problems)与逆选择(adverse-selection problems)问题产生;再者,企业善用财务诱因,不仅可促使员工在工作上尽力(Campbell, 1990[22]),亦可以吸引更多具生产力的员工(Banker et al., 2000)。换言之,薪酬合约是企业吸引所需技能人才的主要手段;而透过薪酬合约,企业得以衔接与求职者之间的不同需求。亦即劳资双方的薪酬合约决定,其实是求职者根据本身的能力水平,进行自我选择后的结果(Baiman, 1982; Namazi, 1985; Baiman, 1990)。

Chow(1983)曾透过实验设计(experimental task)的方式进行有关绩效薪酬工作合约与自我选择之关联性的研究,该实验设计要求受测者在预备阶段时(pretest section)先进行第一次的英文字母译码测验,并于进行第二次译码测验前,告知每位受测者他们第一次测验的成绩,然后让部分的受测者进行奖励制度(固定给付或以绩效为基础)的选择。研究结果显示,成绩较好的受测者倾向选择绩效基础的薪酬合约,而表现较差的受测者则多半选择不含财务诱因的固定薪酬合约。而尔后数个延伸Chow(1983)之实验结果的文献,基本上皆采用同一实验设计进行研究,且亦发现一致的结果(WaIler and Chow, 1985[23]; Shields and Waller, 1988; Dillard and Fisher, 1990[24]; Bonner and Sprinkle, 2002)。

Waller and Chow(1985)认为个人工作合约的选择决策,取决于个人特质与薪酬合约的配适程度,并据此提出作为后续研究的参考架构。亦即每位工作者皆有其特质,如特殊技能、偏好的风险、成就和补偿形式等;一份有效的工作合约亦有其特质,如奖励方式(固定给付或绩效基础给付)、绩效标准以及衡量绩效的方法等。故当个人在选择工作合约时,会去比较自己本身的个人素质与各工作合约之素质的配适程度,并选择能让两种特质契合程度最高的工作合约,使其主观预期效用(Subjective Expected Utilities)极大化。

Waller and Chow(1985)的观念架构,衍生出一个“主观认知”与“客观事实”是否一致的问题,亦即受雇者对于个人特质、工作能力的认知,与客观的实际状态是否相符的问题。受雇者基于其对个人的认知,制定薪酬合约选择的决策;此一认知却未必符合个人实际的状态。然而过去多数相关的研究,却常以“受雇者对于其工作能力拥有较为完整的信息”之假设作为推论基础(Namazi, 1985; Waller, 1994; Young and Lewis, 1995; Bonner and Sprinkle, 2002)。研究中,他们让受测者在选择薪酬合约前先行完成一项测验,并告知他们测验的成绩,并藉此假设受测者已拥有较为完整的个人能力认知。惟在现实生活中,受雇者多半不会拥有如此完整的个人能力认知,他们对于自己本身之能力可能仅有部分的了解,导致产生了认知上的偏误(cognitive bias),并对工作合约的选择造成影响。而Griffin and Tversky(1992)的研究也发现,人们会低估强度低而发生频率高的事件;会高估强度高而发生频率低的事件。而Ferraro(2010)的研究认为,决策者通常对自我能力的认知是不完全的;而这种认知的不完全,常会伴随着决策者出现的过度自信,导致个体的自我选择出现偏误。

对于这种偏误,不同理论观点的解释互异。如传统期望效用理论仅涉及报偿的机率分配,假定机率分配与偏好二者独立,亦与个体在机率分配上的信心无关(Graham, Havey & Huang, 2006)。故从经济理论的观点来看,决策个体能够正确认知自我的状态与能力,并进行经济决策上的自我选择;而个体所出现的能力认知偏误与过度自信,通常只是母体的随机偏误(Bernardo and Welch, 2001[25]; Gervais and Odean, 2001[26])。然由于经济领域并不直接测量心理现象,只能间接假设决策个体的心理认知,加上市场的参与者无法观察到个体的状态与能力,故难以避免信息不对称的现象出现。

对于前述的观点,展望理论(Kahneman and Tverskey, 1979[27])提出不同的看法。展望理论的观点认为,由于人们的效用价值函数为S形的函数,在面对利得时为凹函数,损失为凸函数。因此,不同参考点下的财富变动效用不同,较为重视相对参考点(reference point)财富变动的效用,而非最终财富的预期效用;且个人对于机率很小的偶发事件会过度重视,对于发生机率较大的例行事件,却常常忽略其重要性。由于通常不能充分了解自己所面对的状况,因此在事情的处理上会有认知上的偏误,并常以经验法则或直觉作为决策的依据。

而心理学的观点则认为,个体常有过度自信的现象,故信心与偏好二者通常并不独立。过度自信常会以不同的方式呈现,如Hvide(2002)认为,过度自信表现在两方面,一是个体会高估本身的能力,二是个体会轻忽达成目标的困难度。而Glaser and Weber (2003)[28]则提出三种过度自信的型态,分别是准度错估(mis-calibration)、高人一等(above-than-average)及控制幻觉(illusion-of-control)2。而Graham, Havey & Huang (2006)的研究也发现,人们能力愈强,通常愈愿意运用他们的判断;亦即能力较强的个体,通常比较相信自我的判断,而能力较差的个体,则较为依赖环境事件出现的机率。

从自我评价的观点来看,个人的能力认知会受到环境的影响(Russo et al., 2001[29]; Neufeld et al., 2006[30]),系由个人与环境的互动中学习而得的心理印象。在Koszegi(2006)[31]的研究认为决策者重视自我形象(self-image),故对讯息与工作会有不同的处理模式;其于决策过程中通常会透过自我形象保护或自我形象提升以管理自我形象。因此,过去有较多成功经验的决策者,通常会有较佳的自我形象(如考上研究所的学生相较于大学生,通常会有较高的自我形象);而在该群体中个人能力相对较差的决策者,便可能出现个人能力认知与实际能力之间的较大偏差。亦即过度自信的产生常与个人能力、群体环境有着密切的关系;基于前述,本研究提出第一个假说:

假说一:个体常会出现自我能力认知偏误的过度自信现象;且在相对成功的群体中,成员中自我能力较差的受测者,会出现较为严重的过度自信现象。

Gervaris, Heaton & Odean(2002)[32]、Pallier(2002)等人[33]的研究都认为过度自信是决策个体认为自己知识的准确性,比客观事实更高的一种现象(准度高估),且常会对自己所重视的信息,赋予比客观事实上更高的权重(控制幻觉),故其显示的也是个人主观机率的不精确程度3。过度自信是一种决策者并不察觉的认知偏差,亦为一普遍存在的非理性行为。过去研究如De Bondt(1993)[34]、Odean(1999)[35]、Hoffrage (2004)[36]及Chang, Fuh & Hsu(2008)[37]等,都发现这种决策认知上的偏误现象。因此,过度自信的个体,常会高估自己拥有之信息的正确性与解释信息的能力,低估决策的风险,夸大个人在事件上的控制能力,进而产生价值的误判并制定错误的决策。

过度自信被认为是关于判断心理方面最禁得起考验的发现(De Bondt and Thaler 1995[38]),故常被用以解释各种非理性行为和传统财务理论无法解释的心理与市场现象。虽然过度自信不仅与判断的正确性有关,亦与决策者的个人特质有关,过去的研究发现,过度自信除受到性别(Barber & Odean, 2001[39])、专业背景(Griffin & Tversky, 1992[40])以及经验(Locke and Mann, 2001[41])等因素影响外,亦会被各种环境因素左右;如在不确定性高的情况下个人对其能力较容易过度自信(Heath & Tversky, 1991[42]);困难度高的问题较容易使人过度自信(Kahneman and Riepe, 1998[43]; Yoram, Anat & Liat, 2001[44]);人们在面对与自身利益高度相关的事件时较容易有过度自信的倾向(Hyatt and Taylor, 2008)。Hvide (2002)曾对经理人的工作机会(若选择离职,有多少企业会提供经理人工作合约),及其拥有能力之间的关系进行探讨;结果发现,经理人对其外来机会通常存有过度自信的倾向。在专业领域中,专家若过度依赖理论模型,亦将较新手更容易产生过度自信。至于过度自信与人格特质之间的关系,是否会影响到个人的认知能力,Pallier, et al.(2002)则认为仍属未定。

学者亦曾探讨过度自信的成因,如周宾凰等人(2002)[45]采从认知失调的观点,认为过度自信肇因于个体犯了“先前假说偏误”4 (prior hypothesis bias)与“选择性暴露”5 (selective exposure)。而Hilary and Menzly (2006)[46]认为过度自信主要肇因于:1) 人们以为自己本来就有很强的能力,且一直持续不变;2) 自我归因错误,即个人会将成功归因于自己的能力,而将失败归咎于外部因素。

过度自信会影响决策行为,如Siebenmorgen and Weber(2004)在探讨投资期间长短、风险知觉、期望报酬和投资组合关系时,发现投资者在短期投资与长期投资上,愿意承担的投资风险有显著地不同。如Malmendier and Tate(2005)[47]曾以美国1980至1994年的477家大型企业,以验证经理人并购方面的表现。结果发现,过度自信的经理人通常会提出高于被并购公司价值的并购价格,虽可促成并购成功的机率,但也造成了企业价值的减损,导致市场反应不佳。而Ishikawa & Takahashi(2010)[48]的研究中则发现经理人过度自信与公开市场的筹资行为之间有着密切的关系。

就工作合约来看,由于合约内容与受雇者之利益息息相关,除可从中赚取的固定薪酬可维持基本生计外,若获得额外的红利奖金,更可满足他们的欲望并提升其生活质量。如果个人在面对与自身利益高度相关的工作合约时,出现过度自信的倾向,则可能会导致他们出现有损自身利益的错误行为(即事实上他们较适合一份固定薪酬的工作合约,却选择了含有财务诱因的工作合约)。基于前述,本研究提出第二个假说:

假说二:过度自信的受测者会选择一份不利的、有财务诱因的工作合约。

过去相关的研究,均可发现个体的过度自信与信念有相当密切的关连(如Gervaris, Heaton & Odean, 2002[47]; Pallier, et al. 2002; Glaser & Waber, 2003)。从贝式机率理论的观点来看,信念是个人在不确定情境下,主观上认为事件发生的先验机率(prior probability);故当事件发生时,个体对于事件判断的主观先验机率高于客观机率时,则会呈现出过度自信的现象。就本质而言,信念是人们根据自身之观察与接收外来的信息汇整为经验,经由推论后而形成对事物的态度与看法;信念也是人们行为的参照架构,故信念也会经由过度自信,进而影响受雇者工作契约的选择。一般而言,信念可分为核心信念(core beliefs)与倾向信念(dispositional beliefs)两种型态,这两种信念左右大部分的行为与决策;前者系指经过积极思考而得到的信念,而后者则是未经思考,但可透过其它概念直接归因而得到的信念(蓝雪瑛,1995[49];颜铭志,1996[50];吴正成,2004[51];Bell, Halligan & Ellis, 2006[52])。因此,在某些领域相对成功的个人,也会在其它方面展现出类似的态度。信念与学习经验也有相当密切的关系,如Russo and Schoemaker(1992)、王恭志(2000)[53]、王美华(2006)[54]及Rowley(2007)[55]的研究都认为信念具有演化的特性;亦即随着新的生活经验不断扩展,个人的信念也会持续改变。

信念是有强度的,然回顾过去在过度自信的研究,不难发现学者通常是将主观先验机率高于客观机率的现象,视为过度自信,并未进一步区隔过度自信与信念强度之间的关系(如Waller and Chow, 1985; Gervaris, Heaton & Odean, 2002; Hyatt and Taylor, 2008等人)。信念强度或可称为“信念的信念”(belief of belief),也就是个体的主观先验机率;而个体的信念强度不同,出现的决策与选择结果可能互异。信念水平高的个体与信念水平低的个体(或如深信不疑与犹疑不定的决策者)都可能出现过度自信,但其决策选择却未必相同。一般而言,当个人认为事件发生的主观机率愈高,则其信念愈强,不仅决策上将愈为果决,态度上也将愈为坚定(较不可能改变)。故有成功经验、能力较强者的个体,即使遭遇困难、面对负面的讯息,仍可能坚持个人原有的判断;相对的,对个人能力的比较没有把握的个体,则较易受负面经验与负面信息的影响。故面对工作合约的选择决策,决策者虽然可能会出现过度自信的现象,但对于信念强度不同的个体,结果却未必相同。

而信念程度高低不同的个体,其过度自信与工作选择本不尽相同。就信念强度高的个体来说,其虽仍可能出现过度自信,但其信念能够膨胀的范围有限;但对于信念强度低的个体,其可能出现的过度自信,则可能有较大的膨胀范围。故信念强度也可以透过过度自信,影响受测者的工作合约选择。基于此,本研究提出第三个研究假设:

假说三:受测者的信念强度会影响其工作合约选择;且信念强度也会结合的过度自信态度,共同影响受测者工作合约选择。

3. 研究设计

3.1. 研究流程

本研究之施测流程,首先会让受测者了解能力测验的型态与方式,接下来会提供三份工作合约予受测者选择:之后会要求他们预估文字游戏测验获得的测验成绩(即答题正确数),并让受测者实际执行文字游戏测验,及评估前项合约选择与成绩预估的把握程度。

3.2. 变项操作性定义

3.2.1. 工作合约设计

Wailer and Chow (1985)于实验研究中曾设计出一套薪资结构,尔后广受学者采用(Dillard and Fisher, 1990; Hyatt and Taylor, 2008),本研究亦采用此一薪资架构进行研究。研究中的薪资结构设计,系由固定薪资与绩效薪资共同构成,其格式为:p = f + b(x − s),其中f为固定薪资,b为绩效因子,x为实际绩效,s为绩效标准。在此薪资结构下,受测者有三种选择,分别是不论绩效优劣的固定型工作合约、部分固定部分绩效的混合型工作合约及100%绩效型合约。受测者先了解能力测试的型态,自行评估本身的能力状态,选择一份对其最有利的工作合约,以期能获致最大的工作利益。在选择工作合约后,接下来就进行个人的能力测试。研究中共提供三种工作合约,分别是:

1) 固定型工作合约:支付固定薪酬700元,不论绩效优劣。

2) 混合型工作合约:除支付固定薪酬350元外,若绩效高于标准值,则每超过一单位另支付30元的绩效奖金。

3) 绩效型工作合约:不支付固定薪酬,仅提供绩效奖金,若绩效高于标准值,则每超过一单位另支付60元的绩效奖金。

受测者可以根据对自身能力的判断,选择固定型工作合约、混合型工作合约或是绩效型合约。研究中共测验50题,采用的绩效标准为25题,受测者只要自认为可以答对超过25题,便可考虑选择混合型、绩效型的工作合约;受测者只要自认为可以答对超过37题(>74%),便可考虑选择绩效型的工作合约。

3.2.2. 个人能力认知与过度自信

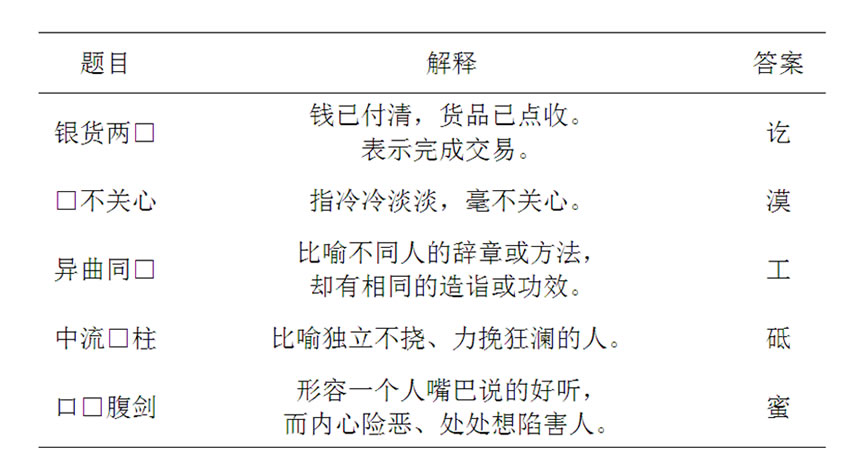

为了解受测者的能力,必须进行一连串冗长的测验。由于Koszegi(2006)与Benoit & Dubra(2011)[56]均认为工作复杂程度会影响过度自信与自我印象,故研究中需将工作复杂程度纳入控制。而商管领域范围甚广,若问卷题项专注于某一特定专业领域,恐影响受测者的回答意愿;加上本研究仅在受测者能力认知与自信程度的心理状态,过去研究建议,测验的内容通常选择能够作答常识题(Moore and Cain, 2006[57])或有客观正确答案的题目(Russo and Schoemaker, 1992),较能够达到预期的研究目的。故研究中参考Chow(1983)以“成语测验”来衡量受测者的个人能力高低及其是否存有过度自信之倾向。在进行文字测验前,会先提供此测验样本予受测者参考(如表1所示),让他们对测验的内容与填答方式有一定程度的了解,随后即限制受测者在15分钟的时间内尽可能地去解答总共60题文字游戏的测验,并以测验成绩作为个人能力的测量结果。至于过度自信的测量,则以受测者文字测验的预估成绩减去实际成绩,所得之差异数字作为过度自信之替代变量(Hyatt & Taylor, 2008)。

3.2.3. 信念强度

研究中采用李克特尺度,将100%转换为10点尺度(1~10),以测量个人的信念强度;而Dawes (2008)[58]研究指出5点尺度、7点尺度与10点尺度,数据转换后的平均数、变异数、偏态和峰度并没有太大的差别。信念强度则请受测者,勾选合约选择与成绩预估的把握程度(10%~100%)。

3.3. 研究样本

本研究的研究对象,需选自一个相对成功环境下的受测者(假说一),故研究中选取国内三所大学商学相关研究所的硕士生(相对于大学部学生,其成功经验较高),共计90名作为受测者;在剔除10份题目漏填之无效问卷后,有效问卷共80份,问卷有效回收率为90%。研究问卷以纸本问卷的方式进行。

Table 1. Illustration of word test

表1. 文字测验范例

4. 实证结果与讨论

4.1. 问卷的叙述性统计

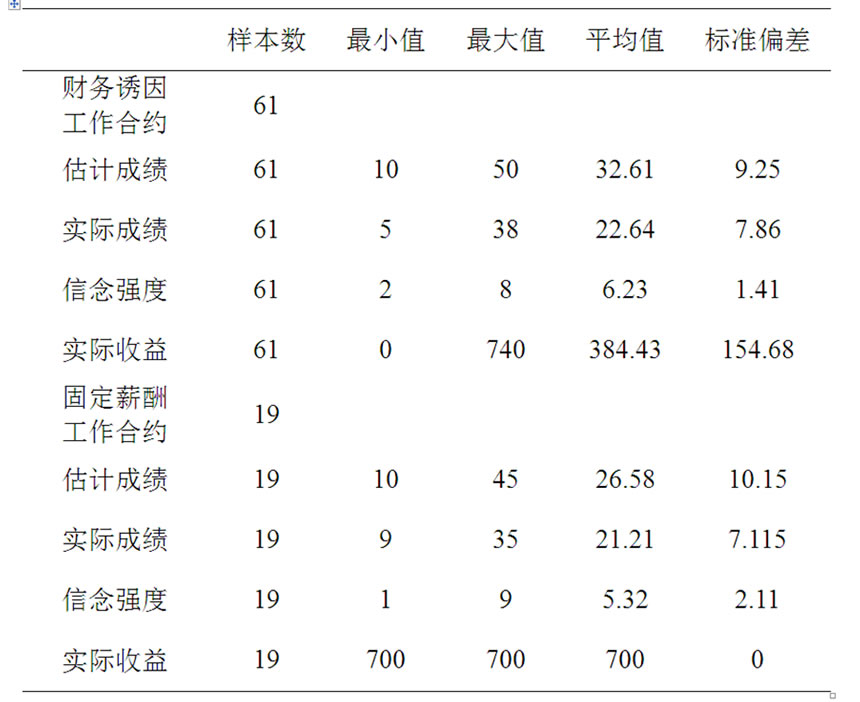

在工作合约选择上,由于混合型工作合约本身已引进绩效因子,故为简化表格,此处将其纳为绩效型合约进行编码,不另区分混合型工作合约。表2显示80份有效问卷中,61位受测者填选含有财务诱因的工作合约,其中受测者“估计成绩”的最小值为10题,最大值为50题,平均值为32.61题;受测者“实际成绩”的最小值为5题,最大值为38题,平均值为22.64题;受测者“信念强度”的最小值为2,最大值为8,平均值为6.23;受测者可获得之“实际收益”的最小值为0元,最大值为740元,平均值为384.43元。

另有19位受测者填选支付固定薪酬的工作合约,中受测者“估计成绩”的最小值为10题,最大值为45题,平均值为26.58题;受测者“实际成绩”的最小值为9题,最大值为35题,平均值为21.21题;受测者“信念强度”的最小值为1,最大值为9,平均值为5.32;受测者可获得之“实际收益”的最小值为700元,最大值为700元,平均值为700元。

4.2. 假设检定

4.2.1. 个人能力与过度自信

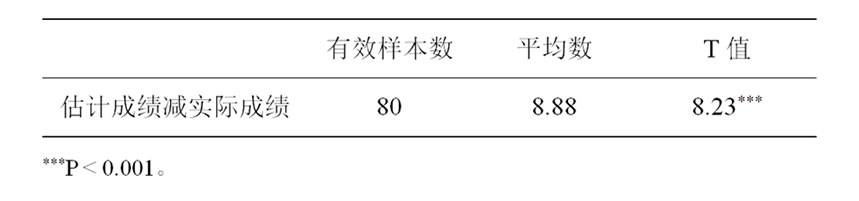

假说一认为受测者对其自身能力的认知并不完备,常会存有过度自信的现象。为验证此假说,研究

Table 2. Descriptive statistics

表2. 样本的叙述性统计

中以受测者的估计测验成绩与实际测验成绩之差异数,进行过度自信的T检定。结果如表3所示,在全体样本中,受测者的估计测验成绩与实际测验成绩相减后之平均数(8.88)显著地大于零(P < 0.001),显示示受测者对其自身能力认知确有过度自信的现象。

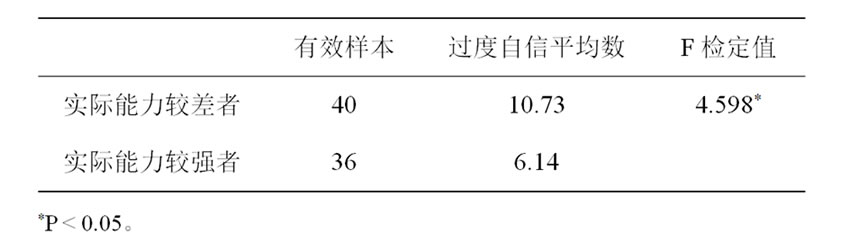

研究中进一步全体样本按照“实际测验成绩”区分,分为实际成绩高与实际成绩低的两群样本,并检定两群样本的自我认知。结果如表4所示,在剔除中位数的4个样本后,显示不论实际成绩高低,两群样本均会出现高估的现象,且高估答对题数(过度自信程度)之平均数分别为6.14题及10.73题;在单因子变异数检定下,F为4.598(P < 0.035)。若将中位数样本纳入,则两群样本之平均值分别为6.7题及11.05题,F值为5.573(P < 0.021),均达到差异的显著水平。此一结果证实了假说一,显示过度自信除普遍存在于全体样本之外,能力较差的受测者,其对个人能力认知的过度自信,也显著高于较能力较佳的受测者。

4.2.2. 过度自信与工作合约选择

假说二认为,受测者会高估本身的能力,而合约设计中,绩效标准为25题,而受测者自认为只要答对全部50题中的37题(>74%即可),便可选择100%绩效型工作合约,以提升其工作利益。不过前述的薪资结构设计亦有陷阱,乍看之下,薪资结构设计可依受测者的答对题数(低于25题,介于25题与37题,及高于37题),而分为三种不同适用的合约型态。但实际深究,则不难发现受测者答对题数低于37题者,以固定薪资的工作合约利益最大;而答对题数高于37题时,则以100%绩效合约的工作利益最大。换言之,

Table 3. T test of overconfidence—total samples

表3. 全体样本过度自信T检定

Table 4. Degree of capability and overconfidence

表4. 实际能力高低与过度自信

混合型的工作合约根本无法让受测者达到工作利益的最大化。在答对37题以下时,混合型工作合约的工作报酬虽会高于100%绩效型的工作合约,但却较固定型的工作合约报酬为低;当受测者答对题数超过37题时,混合型的工作合约得到的工作报酬虽高于固定型的工作合约,但却较100%绩效型的工作合约为低。故混合型工作合约其实只能提供受测者表象上的安慰,让受测者在工作合约选择上寻求一种基本的保障;而选择混合型工作合约的受测者,应该也是对自我能力的不确定。

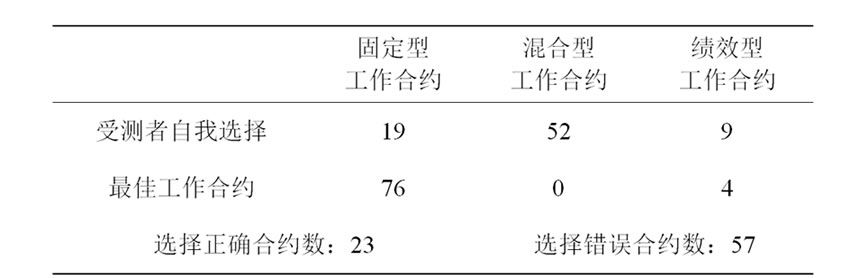

表5显示受测者的合约选择类型与最适合约类型,其中选择固定型工作合约有19人,选择混合型工作合约的有52人,而选择绩效型工作合约的有9人,而根据受测者的实际测验结果显示,如要根据能力选择最适合、并能达到最大的工作利益的合约,应有76人选择固定型工作合约,有4人选择绩效型工作合约,选择混合型工作合约的受测者应为0人。整体来看,正确选择工作合约者有23人(28.75%),而选择错误工作合约者有57人(71.25%),二者之间的比率差距非常悬殊。

由于混合型工作合约本身已引进绩效因子,故本研究将其视为绩效型合约并进行编码;研究中也将过度自信重新排序,并加以区分为高低两群。然由于研究中系以预估成绩减去实际成绩,作为过度自信的替代变量,但实际测量结果除可能出现正值的过度自信现象,也可能出现负值的自信不足现象。鉴于研究中旨在探讨过度自信程度较高者,在工作合约上的类型选择;故我们以过度自信的平均数作为区隔点,将过度自信数值大于平均值的视为高过度自信群,而将数值低于平均值的低过度自信与自信不足样本,并为低过度自信群以进行比较。

表6显示过度自信倾向高低两群样本,在固定型工作合约与绩效型工作合约上的选择。表中不难发现

Table 5. Contract selection and its accuracy

表5. 工作合约选择与正确程度

Table 6. Overconfidence and types of contract

表6. 过度自信与工作合约类型

选择绩效工作合约的受测者(61人,占76.25%),远高于选择固定工作合约的受测者(19人,占23.75%),如采Chi-Square检定工作合约选择,则其卡方值为22.05(P < 0.001);而采用过度自信与工作合约交叉样本进行检定,其Chi-square检定值为3.382(P < 0.057),显示二者之间可能存在着互动的关系。

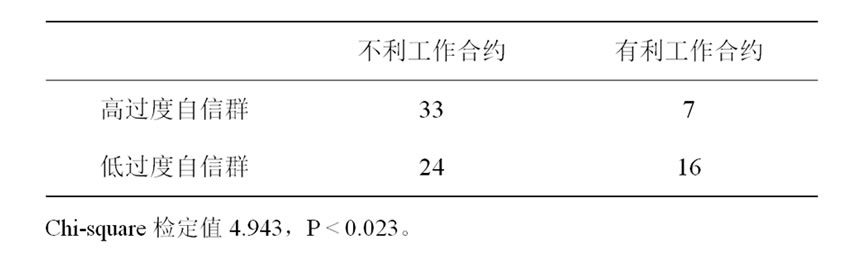

表7显示过度自信与工作合约有利与否之间的卡方检定结果,结果发现在有利的23份工作合约中,低过度自信群占了其中的16份,而高过度自信群则仅占有7份合约。在不利的57份工作合约中,高过度自信群则占了33份,低过度自信群则仅有24份。以交叉样本进行检定,Chi-square检定值为4.943(P < 0.023),显示过度自信程度愈高,愈可能导致受测者选择较差的工作合约。

由于研究中已让受测者自行选择能够配适其工作能力的薪酬合约型态,为测量薪酬合约的不利程度,研究中计算三种数值,做为合约选择价值的参考依据。第一种数值是受测者选择的工作合约与最佳工作合约(配适其工作能力工作利益最大的合约型态),二者在工作所得之间的差距。由于此处是以最佳合约所得做为比较依据,故我们只会得到工作损失的数值;亦即是如果选错工作合约,可能出现的损失有多少。第二个数值则结合机会成本与机会收益的概念,计算出如果不选现在的合约,改选另一个较佳(较差)的工作合约,会得到何种工作报酬。此时我们便可计算相对利得与相对损失;亦即选错(对)工作合约的受测者,和另一个较佳(差)的工作合约比较,会产生多少的机会损失(利得)。而第三个数值则是结合机会损失(利得)的概念,以比较现行合约与最佳(最差)合约的机会损失与机会利得。透过这三种数值的比较,我们更可清楚的了解过度自信对工作利益的冲击。

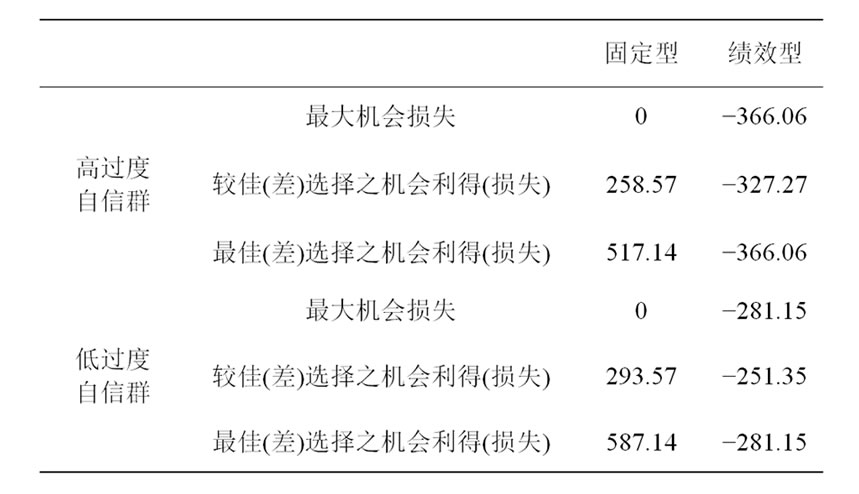

表8显示过度自信、工作合约其机会得(损失)三种数值的计算结果。表中不难发现无论在固定型工作合约或是绩效型工作合约下,过度自信高低都会影响

Table 7. Overconfidence and contract favorability

表7. 过度自信与工作合约有利与否

Table 8. Overconfidence and average opportunity gain or loss of different contract

表8. 过度自信与合约选择的平均机会利得(损失)

其机会损失(利益),且二者之间平均值的差异亦相当明显。自信程度高低与三种机会数值的检定,也发现在第一种最大机会损失检定上的F值为8.784(P < 0.004),第二种较佳(差)选择之机会利得(损失)检定上的F值为7.769(P < 0.007),第三种最佳(差)选择之机会利得(损失)检定上的F值为6.282(P < 0.014),均达到统计上的显著水平。故综合表4至表7的结果,显示受测者多数未能依其工作能力选择一份适合自己的工作合约,加上过度自信的影响,导致其盲目地追求看似可赚取较高报酬的财务诱因合约,不知固定薪酬合约才是真正与其实际能力较为契合的,结果招致有损实际收益的负向效果,故假说二亦得到证实。

4.2.3. 信念强度、过度自信与工作合约选择

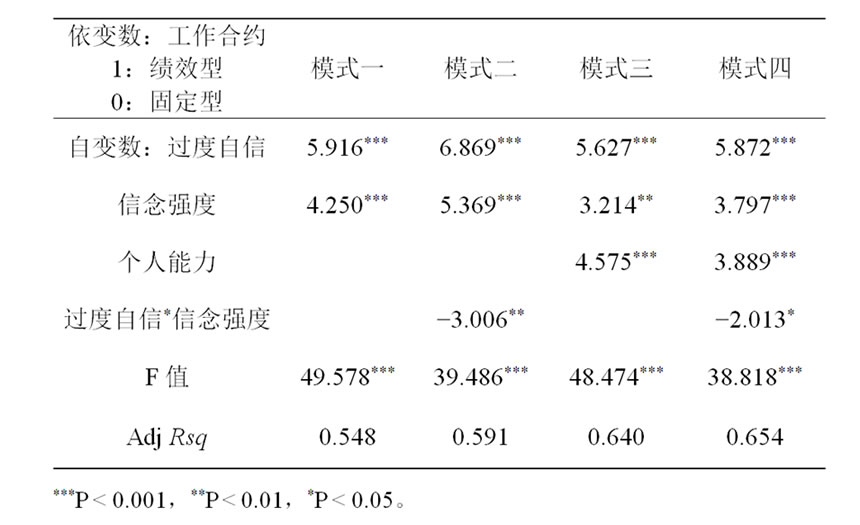

假说三认为,信念强度与过度自信态度会影响受测者的工作合约选择,并提升其选择财务诱因工作合约的可能性。表8显示全部以虚拟变量回归建构出的四个模式(均移除常数项),模式一仅包含信念强度与过度自信两个预测变量的模式;模式二除包括前述两预测变量外,再增加二预测变量的互动关系。而模式三将个人能力的变项纳入,模式四则在模式三的基础上,增加过度自信与信念强度二者互动的变项。

表9的模式一显示,信念强度与过度自信确会正

Table 9. Strength of belief, overconfidence and contract selection

表9. 信念强度、过度自信与工作合约选择

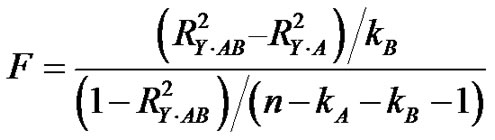

向的影响受测者的工作合约选择;亦即受测者的过度自信愈高或是信念强度愈强,都比较可能选择绩效型的工作合约。而模式二中则进一步将过度自信与信念强度之间的互动纳入,结果发现二者之间的互动,确实也会影响工作合约的选择,也出现预期的反向影响关系。模式一的解释能力为0.548,而纳入互动效果的模式解释能力为0.591。由于新增的互动变量已达显著水平,故研究中仅需针对是否具有新增的模式解释能力进行验证,研究中进一步对两个模式采用F检定,以验证两模式间Rsq增量(ΔRsq)的显著性:

其中 表示第二个回归式的解释能力;

表示第二个回归式的解释能力; 表示第一个回归式的解释能力;n为样本数;kA、kB分别表示第一个回归与第二个回归式的自变项数目。两模式的检定结果,ΔRsq的F值为0.0005,未达增量解释能力的显著水平;显示“过度自信*信念强度”变项,虽在模式二中得到显著性的验证,但就模式一与模式二的模式增量解释力来看,并未达到显著的结果,故此一变项对模式二并无解释能力上的实质贡献。

表示第一个回归式的解释能力;n为样本数;kA、kB分别表示第一个回归与第二个回归式的自变项数目。两模式的检定结果,ΔRsq的F值为0.0005,未达增量解释能力的显著水平;显示“过度自信*信念强度”变项,虽在模式二中得到显著性的验证,但就模式一与模式二的模式增量解释力来看,并未达到显著的结果,故此一变项对模式二并无解释能力上的实质贡献。

模式三将个人的能力水平纳入,结果发现过度自信、信念强度与工作能力都会正向的影响工作合约选择,模式的增额解释能力较模式一增加0.092的解释能力(0.640~0.548);而模式四则将过度自信与信念强度的互动项纳入,结果发现整体的解释能力可增加到0.654,但相对于模式三的解释能力,增量的解释能力则仅增加0.004。如以“模式三/模式一“及“模式四/模式三”的增量解释能力比较结果来看,不难发现,个人能力变项的解释能力,应较“过度自信”与“信念强度”二者互动变项的解释能力为高。而表八的结果也显示,信念强度会影响受测者的工作合约选择,但过度自信与信念强度之间的互动,则未必会影响受测者的工作合约选择,亦即假说三得到部分支持。

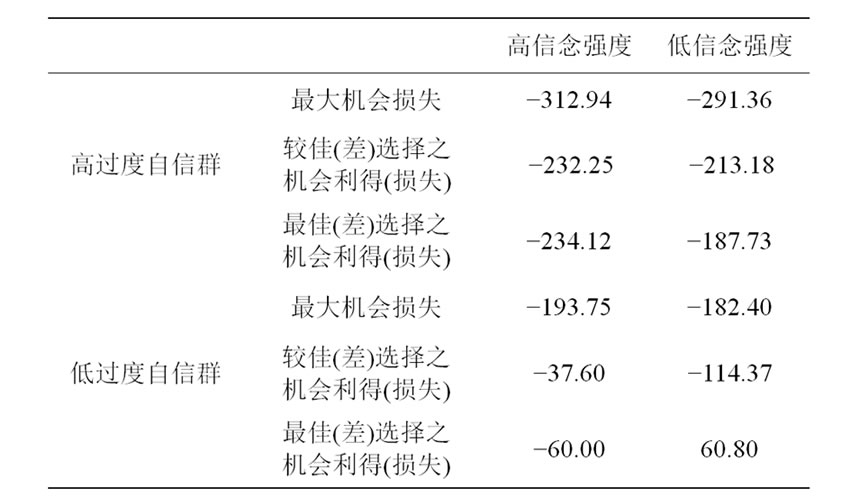

研究中也进一步比较自信程度高低与信念强度高低下,三种机会利得(损失)之间的差距(如表10所示)。表10显示,在高度自信的情况下,受测者如也抱持高的信念强度,则其无论在最大机会损失或其它机会利得(损失)的比较结果下,都较低信念强度的结果为差(−312.94 vs. −291.36; −232.25 vs. −213.18; −234.12 vs. −187.73)。但在低过度自信群中,信念强度高低,在三种不同的机会利得(损失)计算下,得到的结果并不相同。换言之,无论在何种机会利得(损失)的计算下,信念强度对高过度自信受测者的影响应属确定,但对低过度自信群的受测者,信念强度的影响性,则仍须视计算实行的方式而定。

5. 结论与建议

工作合约选择与工作能力之间的配适向为管理会计中重视的课题。薪酬合约是企业吸引所需技能人才的主要手段;而透过薪酬合约,企业得以衔接与求职者之间的不同需求;故劳资双方的薪酬合约决定,也是求职者根据本身的能力水平,进行自我选择后的结果。

研究中采用能力测验的方式,以探讨受测者在自我能力认知、信念强度、工作契约选择及机会工作利益(损失)之间的关系。研究中发展出三个假说,分别1) 探讨工作能力与过度自信的关系;2) 过度自信与

Table 10. Overconfidence, strength of belief and average opportunity gain or loss

表10. 过度自信、信念强度与平均机会利得(损失)

机会工作利益(损失)的关系;及3) 信念强度与工作合约选择之间的关系,以及信念强度是否会结合过度自信,共同影响受测者工作合约选择。结果发现,有关过度自信、机会工作利益(损失)与信念强度与工作合约选择之间的假设关系,均获得统计上的支持,唯一信念强度与过度自信共同影响工作合约选择的部分,并未获得支持。研究结果显示个人的确对其自身能力的认知不完备,且常会呈现过度自信的状态,此结果会导致个人选择错误的工作合约时,并造成实质收益的负面影响。而信念强度也会影响受测者工作合约的选择,但在对于过度自信的影响上,则可能会影响高过度自信的受测者,但却未必会影响低过度自信的受测者。

NOTES

1均值回归是金融学的一个重要概念,系指股票价格无论高于或低于价值中枢(或均值)都会以很高人一等,是个体认为自己的知识的概率向价值中枢回归的趋势(宋玉臣,2006)[20]。

2所谓“准度错估”是个体误认为其所拥有的知识与信息,要比实际的知识或信息更为精确;“高人一等”是个体认为自己的知识与能力比一般人为佳;“控制幻觉”是个体主观认为成功的机会高于客观事实的机会。

3如Lichtenstein,Fischhoff and Philips(1982)发现,当他们询问受访者一些问题时,受访者会倾向于高估他们答对的机率,即便受访者确信他们的答案绝对正确,但通常答对的机率却仅有80%。

4先前假说偏误系指个体受限于其先前既有的想法,会倾向去寻找证实其想法的信息,忽视与其想法相反的信息;而个体为避免认知失调,会高估确认其想法的信息价值,低估相反信息的价值。

5选择性暴露是指个体仅会注意到调和的认知,而忽视非调和的认知,以避免认知失调,例如:当自己考詴成绩不佳时,会以“题目很难,大家都考不好”来避免认知失调。