1. 引言

证劵投资基金是一种风险共担、利益共享的投资理财方式,其特点是投资者把资金交给基金公司,由基金公司负责专业理财。自从2001年9月4日第一只开放式基金——华安创新诞生以来,国内开放式基金行业高速发展。截止2010年,我国投资基金公司已有61家,他们管理着600多只、净资产值总和超过2.4万亿的开放式证券投资基金产品[1] 。基金公司与证券公司、保险公司、银行共同构成了我国金融体系的四大支柱。但基金业的蓬勃发展并不意味着基金业绩的稳定增长,国内各基金公司存在着良莠不齐的运作状况。多数基金公司在长时期内无法保持其业绩稳定,盈利只能发生在短期内。例如,2007年国内基金整体盈利1.17万亿元,而到了2008年整体亏损3289亿元,2011年国内基金几乎没有一只盈利,整体亏损额达5004亿元[2] 。在这种市场背景下,如何从长期角度客观地评价一只基金的运营业绩,进而为基金投资者做出合理的投资决策具有重大的现实意义。

国内外学者曾对开放式基金业绩做了广泛而深入的研究,这主要分为两个研究层面:1) 基金业绩评价的度量指标。即利用传统的风险收益指标(夏普指数、特雷诺指数[3] 等)或者加以创新改进的业绩指标来对样本基金做综合直观的风险收益评级,简明直接地实证评价基金的历史业绩。2) 基金业绩来源的深层研究。这一方面主要是量化研究与评价影响基金业绩表现的基金经理的资产运作能力。基金经理的资产运作能力主要包括选股能力和择时能力:选股能力即选择“好股票”的能力,是指基金经理在证券市场上识别并买入价值被低估的证券、识别并卖出价值被高估的证券的能力。择时能力是指基金经理对大盘走势的把握能力。具有该项能力的经理人能理智地在牛市到来前降低现金头寸提高股票资产头寸;在熊市到来前提高现金头寸降低股票资产头寸。Treynor和Mazuy[4] 很早就研究了基金经理的择时择股能力。他们构建的T-M模型已成为目前常用的传统实证模型,它被我国学者广泛使用。张婷,李凯[5] 选取1999年5只老牌开放式样本基金,采用传统的风险收益指标和T-M模型进行实证分析,结论是5只样本基金的业绩都超过市场水平,基金经理具有较好的择时择股能力。周晓华[6] 用T-M模型研究了2000年的多支样本基金的业绩表现,结论是基金经理不具备显著的市场时机选择能力。汪光成[7] 的研究结论表明,中国的基金缺乏市场时机把握能力,但具有一定的证券选择能力,不过对基金收益的贡献并不显著。除此之外,还有许多国内学者就T-M模型进行了大量的实证研究。以上这些研究有如下特点:

1) 有些研究主要是沿用T-M传统模型。而该模型在长期的基金业绩考察中存在很大缺陷。它以假设的时间序列变量 作为评价基金经理择时能力的主要解释变量,进行一次性的整体回归,一般情况下,其回归拟合度极差,从而回归模型十分不可靠,由此得出的结论可能是错误的。

作为评价基金经理择时能力的主要解释变量,进行一次性的整体回归,一般情况下,其回归拟合度极差,从而回归模型十分不可靠,由此得出的结论可能是错误的。

2) 有些研究主要是短期的实证分析,即,研究者只针对基金在单一的牛市或熊市中的运作能力进行分析。但是,现实中,基金短期赢利而长期却是亏损的实例很多。这种短期实绩的研究对基金在股市长期投资中的客观表现而言意义不大。

3) 有些研究沿用传统评价指标夏普指数和特雷诺指数。这些指标大都采用多期收益率相加再取平均的做法,而这种算法对评价基金长期业绩存在很大的问题(见本文实例)。

基于以上认识,本文在第1章结合实例,按计量经济学原理分析了T-M模型与传统指数在评价基金长期业绩时存在的缺陷。在第2章,我们引入“分时段虚拟变量”,设计基金业绩数据回归模型。在此基础上提出了“胜负链统计法”,用以评价基金长期的业绩表现。文章第3章选用国内10只老牌开放式基金7年的历史数据,用新的模型与方法对其进行了实证检验,并由实证结论对国内开放式基金的运营状况做了中肯评价。第4章中,我们对新模型与方法的优效性做了总结。

2. 传统模型的缺陷分析

2.1. 基本定义与变量解释

要对样本基金的长期业绩进行考察,首先我们以一个交易月(或季度)为单位,将数年来基金的整个交易时间划分为 个小的考察期:

个小的考察期: 。然后令

。然后令 、

、 分别代表基金第

分别代表基金第 期的实际收益率与无风险收益率,

期的实际收益率与无风险收益率, 、

、 分别代表市场基准组合第

分别代表市场基准组合第 期的实际收益率与无风险收益率,从而有:

期的实际收益率与无风险收益率,从而有:

基金超额收益率 (Fund returns):基金超额收益率

(Fund returns):基金超额收益率 表示基金第

表示基金第 期超出无风险收益率的实际盈利部分,它是一个比

期超出无风险收益率的实际盈利部分,它是一个比 更具体的基金盈利指标。

更具体的基金盈利指标。

市场基准组合超额收益率 (The benchmark returns):市场基准组合超额收益率又叫大盘超额收益率,它可以用来反映证券市场大盘的收益表现。“市场基准组合”是国内通用的评估基金业绩的重要参考基准。如果某基金的超额收益率超过了市场基准组合,那就意味着这只基金“战胜了市场”,反之就是“落后于市场”。具体而言,本文的市场基准组合收益率由比较权威且影响较大的沪深300指数收益率(80%占比)和中证债券指数收益率(20%占比)构成。

(The benchmark returns):市场基准组合超额收益率又叫大盘超额收益率,它可以用来反映证券市场大盘的收益表现。“市场基准组合”是国内通用的评估基金业绩的重要参考基准。如果某基金的超额收益率超过了市场基准组合,那就意味着这只基金“战胜了市场”,反之就是“落后于市场”。具体而言,本文的市场基准组合收益率由比较权威且影响较大的沪深300指数收益率(80%占比)和中证债券指数收益率(20%占比)构成。

另外注意:本文的无风险收益率并没有选用国外通用的国债收益率,而是根据国情(我国的国债市场处于分割状态,不像国外市场一样交易所和银行处于有效的连通)选择跟踪当期银行的一年期存款利率作为无风险收益率。即: 。

。

2.2. 对传统T-M模型的批判

美国人Treynor和Mazuy较早地研究了基金经理的择时择股能力,他们构建的T-M回归模型已成为评价基金经理择时择股能力的传统实证模型,目前已被国内学者广泛使用。首先我们引入该模型,其表达式为[8] :

(1.1)

(1.1)

其中, 表示基金第

表示基金第 期的超额收益率,

期的超额收益率, 表示市场基准组合第

表示市场基准组合第 期的超额收益率,

期的超额收益率, 代表基金经理的选股能力指标,

代表基金经理的选股能力指标, 代表基金经理的择时能力指标。Treynor和Mazuy认为:如果回归方程结果中

代表基金经理的择时能力指标。Treynor和Mazuy认为:如果回归方程结果中 值为正,则可以判断经理具备较好的择股能力,且

值为正,则可以判断经理具备较好的择股能力,且 值越大代表其能力越强,反之越差;如果回归结果中若

值越大代表其能力越强,反之越差;如果回归结果中若 为正,则可以判断经理具备较好的择时能力,且

为正,则可以判断经理具备较好的择时能力,且 值越大代表其能力越强,反之越差。

值越大代表其能力越强,反之越差。

观察可知,相比Markowitz的资本资产定价模型(CAPM模型)[9] ,T-M模型多加入了一个 时间序列变量,他们认为基金的超额收益

时间序列变量,他们认为基金的超额收益 可分归为“从选股能力中获取的收益

可分归为“从选股能力中获取的收益 ”、“从预测行情、把握市场中获取的超额收益

”、“从预测行情、把握市场中获取的超额收益 ”和“从预测行情、战胜市场中获取的高收益

”和“从预测行情、战胜市场中获取的高收益 ”这三部分。该模型主要的论点是:“

”这三部分。该模型主要的论点是:“ 可以反映基金通过预测行情、战胜市场获取的高收益”,

可以反映基金通过预测行情、战胜市场获取的高收益”, 值是真正表示基金经理择时能力的指标,

值是真正表示基金经理择时能力的指标, 值越大代表其能力越强。其实这个断言只是主观臆断、牵强附会的,并无坚实的理论证明。事实上,我们只要把基金业绩的考察跨期拉长,将其熊市业绩表现与牛市业绩表现并列出来,该模型的缺陷与谬误性就暴露了出来。

值越大代表其能力越强。其实这个断言只是主观臆断、牵强附会的,并无坚实的理论证明。事实上,我们只要把基金业绩的考察跨期拉长,将其熊市业绩表现与牛市业绩表现并列出来,该模型的缺陷与谬误性就暴露了出来。

这里,我们选取样本基金华夏成长为例。我们将该基金自成立以来一直到2012年底的超额收益率数据 、同期的市场基准组合收益率数据

、同期的市场基准组合收益率数据 以及T-M模型设计的时间序列数据

以及T-M模型设计的时间序列数据 代人T-M模型(1.1)中,得到回归结果如下:

代人T-M模型(1.1)中,得到回归结果如下:

(1.2)

(1.2)

可以看出,回归结果显示模型可决系数 仅为0.039821,变量

仅为0.039821,变量 的T检验值仅为0.134621。根据统计学回归分析原理,可以判定这是一个无效的回归方程:T检验不过关,解释变量

的T检验值仅为0.134621。根据统计学回归分析原理,可以判定这是一个无效的回归方程:T检验不过关,解释变量 对被解释变量

对被解释变量 无显著影响,说明该解释变量的加入毫无意义;回归方程可决系数

无显著影响,说明该解释变量的加入毫无意义;回归方程可决系数 过低,说明该T-M模型对长期实际数据无法拟合,已严重失真。以上实例说明,在考察基金业绩的长期表现中,T-M模型是失效的,或者说由T-M回归得出的结论是谬误的,不可靠的。

过低,说明该T-M模型对长期实际数据无法拟合,已严重失真。以上实例说明,在考察基金业绩的长期表现中,T-M模型是失效的,或者说由T-M回归得出的结论是谬误的,不可靠的。

另一方面,实际情况是,华夏基金在过去的长期投资中,业绩是中国诸多基金中表现最好的之一。但在以上模型中,代表“高额盈利”的 变量的系数却变成了负值,而一些长期来看,业绩为亏损的基金,其T-M模型中的这一系数却为正值。这个反例亦说明,T-M模型无法在长期牛熊变换的市场中拟合基金业绩实际数据,进而无法真实测量基金经理的运作能力与长期业绩。原因在于,从长期的评价角度来看,

变量的系数却变成了负值,而一些长期来看,业绩为亏损的基金,其T-M模型中的这一系数却为正值。这个反例亦说明,T-M模型无法在长期牛熊变换的市场中拟合基金业绩实际数据,进而无法真实测量基金经理的运作能力与长期业绩。原因在于,从长期的评价角度来看, 变量的加入是没有根据、毫无意义的。

变量的加入是没有根据、毫无意义的。

2.3. 对传统评价指标的批判

评价基金综合业绩的传统模型除了有T-M回归模型外,还主要有三大传统指标,即夏普指数、詹森指数和特雷诺指数,其中夏普指数与特雷诺指数都是采用基金各阶段收益率的算术平均值作为基金的最终收益指标来对基金业绩做综合评价,即用 衡量基金的最终收益表现。

衡量基金的最终收益表现。

实际上,在不断变化的牛熊市场中,样本基金各考察期的收益率往往是存在很大波动的,这种对收益率取算术平均值的传统做法存在很大问题。这里我们举个简单的例子说明,以下是两只基金的业绩运作情况:(注:表1中,最后一列的结果由取算术平均值而得)。

如果按照传统指标的做法将样本基金的每一期收益率相加再取平均,那么甲基金的盈利评价结果显然是不如乙基金的——甲的平均盈利率为10%,乙的平均盈利率为107.5%。

但是,实际上甲基金最终的资产总值为: ,而乙基金最终的资产总值仅为:

,而乙基金最终的资产总值仅为: ,也就是说甲基金实际上是盈利了

,也就是说甲基金实际上是盈利了 ,而乙基金实际上亏损了

,而乙基金实际上亏损了 ,这与传统的基金业绩评价结果(如前所述)是完全相反的。

,这与传统的基金业绩评价结果(如前所述)是完全相反的。

在长期多期业绩评价中,收益比例或者倍数之间的算术平均值是没有意义的。若在牛熊变化的市场中用简单的算术平均值的做法评价基金的长期收益,有可能完全掩盖基金的实际业绩表现:将好的基金

Table 1. Two samples of the fund’s performance

表1. 两只样本基金的业绩情况

评价为差的,将差的基金评价为好的。因此,我们认为传统的夏普指数以及特雷诺指数都仅适用于短期内基金收益业绩的评价,而在长期中并不适用。若一味的沿用该国外传统指标,可能产生极大的谬误。

3. 新评价体系的建立

如何相对客观地衡量基金经理长时期内的业绩表现是本文要解决的中心任务。

本文将摒弃传统的T-M回归模型和传统的指标评价方式,引入虚拟变量回归模型(可以将较长的考察周期分段),在此基础上采用直观简明的“01胜负指标”(可以回避传统指标算术加和的缺陷),设计新的“胜负链统计”评价方法。

我们在利用计量经济学回归分析模型量化描述基金业绩时,一定要注意一个问题:影响被解释变量(例如T-M模型中 )的因素一般会有很多,除了包括一些可以直接认定且容易获取的定量因素(例如T-M模型中的

)的因素一般会有很多,除了包括一些可以直接认定且容易获取的定量因素(例如T-M模型中的 )外,还包括一些本质上为定性因素的影响,如经济周期、宏观政治、经济政策变动、季节与自然灾害等因素。这些因素中许多是不能量化的,但是对实际的模型分析有着不可忽视的重大影响[10] 。这些定性的宏观因素会导致股市的中长期牛熊巨变,从而导致投资基金的业绩巨变。因此,我们在讨论基金的业绩评价模型时,不得不考虑它们。在计量经济学中,我们把上述无法量化的定性因素称为“虚拟变量”。我们将在新模型中引入虚拟变量。

)外,还包括一些本质上为定性因素的影响,如经济周期、宏观政治、经济政策变动、季节与自然灾害等因素。这些因素中许多是不能量化的,但是对实际的模型分析有着不可忽视的重大影响[10] 。这些定性的宏观因素会导致股市的中长期牛熊巨变,从而导致投资基金的业绩巨变。因此,我们在讨论基金的业绩评价模型时,不得不考虑它们。在计量经济学中,我们把上述无法量化的定性因素称为“虚拟变量”。我们将在新模型中引入虚拟变量。

“胜负链统计”评价方法:

1) 虚拟变量回归模型的建立

步骤1:利用历史数据生成时间序列趋势图:

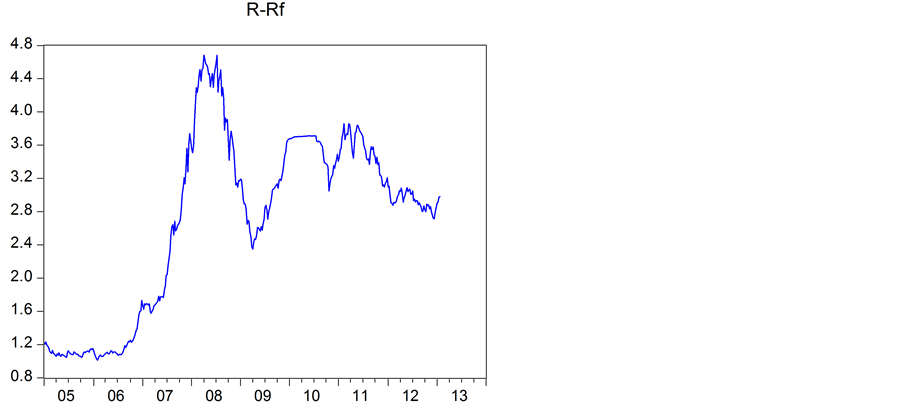

将样本基金的超额收益率数据,即 的历史数据,导入到Eviews 6.0软件[11] ,生成具体的时间序列趋势图(如图1)。例:

的历史数据,导入到Eviews 6.0软件[11] ,生成具体的时间序列趋势图(如图1)。例:

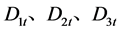

步骤2:观测时间序列趋势图,确立趋势转折点,设置虚拟变量:

仔细观察例图1中数据的大趋势变化,我们发现2008年1之前月 一路上扬、2008年1月至2009年1月

一路上扬、2008年1月至2009年1月 逐渐回落盘整,同样的,我们可以看出在时点2010年12月,

逐渐回落盘整,同样的,我们可以看出在时点2010年12月, 也经历了一个明显的大趋势转折,这说明期间证券市场经历了多次重大的宏观经济事件,它们的相继发生导致牛熊市场上基金业绩相应发生剧烈变化。为了更细致地跟踪描述各只样本基金在不同时段的业绩波动表现,如实反映上述宏观事件(定性因素)的影响,我们引入虚拟变量

也经历了一个明显的大趋势转折,这说明期间证券市场经历了多次重大的宏观经济事件,它们的相继发生导致牛熊市场上基金业绩相应发生剧烈变化。为了更细致地跟踪描述各只样本基金在不同时段的业绩波动表现,如实反映上述宏观事件(定性因素)的影响,我们引入虚拟变量 :

:

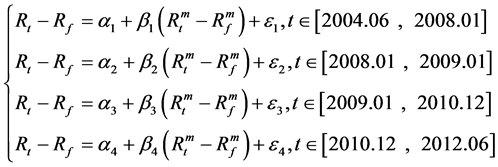

3个虚拟变量 的设置将整个考察期间划分为了4个小的考察时段

的设置将整个考察期间划分为了4个小的考察时段 ,其中

,其中 为2008年1月之前、

为2008年1月之前、 表示2008年1月至2009年1月、

表示2008年1月至2009年1月、 表示2009年1月至2010年12月、

表示2009年1月至2010年12月、 表示2010年12月之后。

表示2010年12月之后。

步骤3:将虚拟变量加入模型,用Eviews 6.0软件运行后得出分段回归方程结果:

在建立虚拟变量回归模型的实际操作中,用加法方式加入虚拟变量,会改变关键时点的被解释变量

Figure 1. Time series of R-Rf

图1. R-Rf的时间序列例图

平均值(截距);以乘法方式加入虚拟变量,会改变关键时点的被解释变量变化速度(斜率)。同时以加法和乘法方式加入虚拟变量,则可同时衡量被解释变量的平均值和变化速度在各时期的具体变化,提高模型对数据变量变化的描述精度[10] 。如公式(3.1)所示,我们将采用“同时以加法和乘法方式加入虚拟变量”的办法,建立新的回归模型如下:

(2.1)

(2.1)

用Eviews 6.0运行该回归模型后我们可以得到分段回归方程结果:

(2.2)

(2.2)

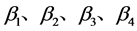

(2.2)中,自变量系数 的具体值代表了该只基金在各个考察期段

的具体值代表了该只基金在各个考察期段 中较于市场基准收益的相对业绩表现,

中较于市场基准收益的相对业绩表现, 值代表的经济意义是:在

值代表的经济意义是:在 期内,市场基准组合的

期内,市场基准组合的 每涨跌1个百分点,样本基金的

每涨跌1个百分点,样本基金的 相应涨跌

相应涨跌 个百分点。下一步我们将依托该系数序列

个百分点。下一步我们将依托该系数序列 建立样本基金的“胜负链表”,进一步综合评价基金的长期业绩。

建立样本基金的“胜负链表”,进一步综合评价基金的长期业绩。

2) 用“胜负链统计法”对样本基金做最终评价

步骤1:构造样本基金的“胜负链”:

在第 期内,我们根据某基金超额收益是否超过市场基准组合超额收益将样本基金在该期的业绩表现判定为“胜”或者“负”,分别用“1”或“0”表示。

期内,我们根据某基金超额收益是否超过市场基准组合超额收益将样本基金在该期的业绩表现判定为“胜”或者“负”,分别用“1”或“0”表示。

在 期内,样本基金收益表现超过或者等于市场基准收益表现时(即当

期内,样本基金收益表现超过或者等于市场基准收益表现时(即当 时,也就是自变量系数

时,也就是自变量系数 时),将其本期业绩记为“胜”,我们用1表示;样本基金收益表现低于市场基准收益表现时(即当

时),将其本期业绩记为“胜”,我们用1表示;样本基金收益表现低于市场基准收益表现时(即当 时,也就是

时,也就是 时),记为“负”,我们用0表示。这样,当我们在长周期内连续考察某只基金的多期业绩时,便可根据虚拟变量回归结果中相应的

时),记为“负”,我们用0表示。这样,当我们在长周期内连续考察某只基金的多期业绩时,便可根据虚拟变量回归结果中相应的 序列得到该基金的一条由0和1构成的“胜负链”。

序列得到该基金的一条由0和1构成的“胜负链”。

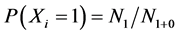

步骤2:由“胜负链”计算样本基金的“业绩胜出概率” 值:

值:

根据统计学原理,我们基于步骤1中的“胜负链”得到指标1出现的频率,进而给出样本基金的“业绩胜出概率” 值的计算公式:

值的计算公式:

(2.3)

(2.3)

其中 代表事件:指标1出现。

代表事件:指标1出现。 代表“胜负链”中1出现的次数,

代表“胜负链”中1出现的次数, 为“胜负链”中1和0一共出现的次数。

为“胜负链”中1和0一共出现的次数。 值大于0小于1,我们用

值大于0小于1,我们用 值最终描述基金的长期相对业绩的概率。

值最终描述基金的长期相对业绩的概率。

按照步骤1中的方式设计的“胜负链”实际是一个符合贝努利过程 的随机序列,若

的随机序列,若 值非常接近0.5,则很难认定基金胜出市场的盈利业绩具有持续性,此时基金业绩的好坏与随机抛一枚均匀硬币猜正反的概念类似,是赌博性质;相反,若

值非常接近0.5,则很难认定基金胜出市场的盈利业绩具有持续性,此时基金业绩的好坏与随机抛一枚均匀硬币猜正反的概念类似,是赌博性质;相反,若 明显大于0.5,则该样本基金盈利表现胜出市场基准盈利表现的次数明显多于失败次数,即倾向于胜出。可以肯定,若某基金的

明显大于0.5,则该样本基金盈利表现胜出市场基准盈利表现的次数明显多于失败次数,即倾向于胜出。可以肯定,若某基金的 值越大,那么它的盈利能力越强,保持优秀业绩的概率越高。基于简明的01指标可以直观的表述样本基金相对于市场基准的相对业绩表现,回避了传统盈利率指标中没有意义的算术加和平均。

值越大,那么它的盈利能力越强,保持优秀业绩的概率越高。基于简明的01指标可以直观的表述样本基金相对于市场基准的相对业绩表现,回避了传统盈利率指标中没有意义的算术加和平均。

综上所述,基于虚拟变量回归分析,我们建立了一个全新的基金长期业绩评价体系。这种将牛、熊期分段,紧随跟踪式的基金相对业绩评价研究更加符合客观实际的原则。我们将在下一章节中利用实证研究检验新评价体系的优效性。

4. 实证检验与结论

要做到客观合理地评价基金的长期业绩,投资者或者分析师需要不断的实际操作与调整尝试,下面我们将采用实际案例来对本文所提出的新评价体系进行实证分析。我们从锐思金融数据库(Resset)选取了诞生最早且持续期最久的国内10只老牌开放式基金作为样本,利用第2章介绍的方法步骤考察了它们从2004年6月到2012年6月的业绩表现,期间中国的金融市场经历了一系列的牛熊轮回的起落周期。

这里我们首先以国内首支开放式样本基金——华安创新为样例:

1) 样本基金虚拟变量回归模型的建立:

步骤1:利用历史数据生成时间序列趋势图。

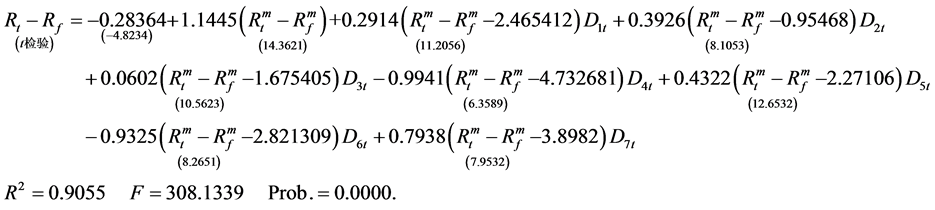

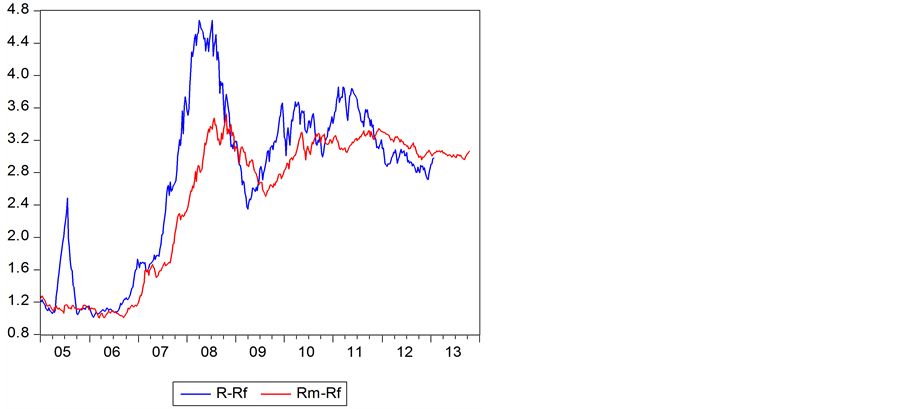

我们将华安创新基金与相应的市场基准组合8年来的超额收益率数据导入到Eviews 6.0中,得到时间序列趋势图如图2。

步骤2:观测时间序列趋势图,确立趋势转折点位置,设置虚拟变量。

如图2所示,我们发现华安创新的超额收益率数据 与市场基准组合的数据

与市场基准组合的数据 从长期来看共同经历了多次涨跌趋势转折,按照第三章介绍的方法我们确立2005年8月、2006年9月、2007年12月、2008年1月、2009年3月、2010年1月、2011年11月这7个时点为具体的转折点,进而据此设置时间段虚拟变量

从长期来看共同经历了多次涨跌趋势转折,按照第三章介绍的方法我们确立2005年8月、2006年9月、2007年12月、2008年1月、2009年3月、2010年1月、2011年11月这7个时点为具体的转折点,进而据此设置时间段虚拟变量 。

。

步骤3:将虚拟变量加入模型,用Eviews 6.0软件运行后得出分段回归方程结果:

Figure 2. Time series of “Hua an chuang xin”

图2. “华安创新”的时间序列图

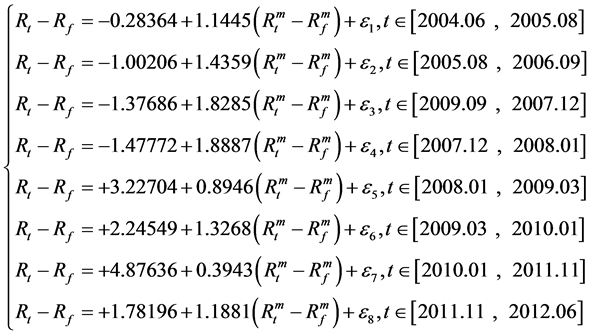

将以上模型以分段函数表达,即:

(3.1)

(3.1)

由(3.1)可知,该分段模型中解释变量的t检验值分别为14.3621、11.2056、8.1053、10.5623、6.3589、12.6532、8.2651、7.9532,它们分别都通过了t参数检验,这说明模型中所有解释变量都对被解释变量有着显著影响。再看该回归方程的F检验值为308.1339,F检验的Prob值为0.0000,方程显著通过了F参数检验,这说明由这8个解释变量组成的回归方程在整体上对实际数据拟合的很好。最后观察回归方程可决系数 为0.9005,这说明方程可决度很高。

为0.9005,这说明方程可决度很高。

由此处的实证回归分析结论我们可以看到,将长周期的考察期具体分段,确实能真实客观的跟踪描述样本基金相对与市场基准的盈利业绩。而单独一次性的T-M回归是无法拟合实际数据的。

2) 用“胜负链统计法”对样本基金做最终评价

步骤1:构造“胜负链表”:

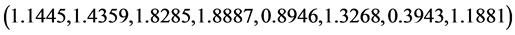

记录分段方程(3.1)中各个自变量的系数值,我们可以得到一个关于华安创新基金的系数值序列 ,即

,即 。

。

由于该序列中

,据此我们按照第3章中“胜负链”的构造方法得到华安创新的“胜负链”:11110101。

,据此我们按照第3章中“胜负链”的构造方法得到华安创新的“胜负链”:11110101。

步骤2:计算“业绩胜出概率” 值,最终评价样本基金的相对业绩:

值,最终评价样本基金的相对业绩:

已知“胜负链”为“11110101”:我们由公式(2.3)计算出该样本基金的业绩胜出概率值 为6/8=75%,这说明华安创新这只基金有75%的概率保持盈利率超过市场基准表现,跑赢大盘。

为6/8=75%,这说明华安创新这只基金有75%的概率保持盈利率超过市场基准表现,跑赢大盘。

综上过程,我们完整的评价了样本基金——华安创新从2004年6月到2012年6月的长期业绩表现,发现华安创新这只基金在多数情况下能够战胜大盘,有75%的可能保持好的业绩。为了详细考察多只基金的不同表现,得到样本基金在行业内各自的相对业绩,我们按照同样的方法处理了全部10只样本基金的数据,得到结果如表2所示。

由表2的胜负链P值结果可以看出:从长期考察来看,10只样本基金中资金运作能力较强者为华夏成长、嘉实增长,他们都有着较大的倾向超过市场基准业绩表现,说明其长期基金业绩较好。而大成价值、申万菱信、海富通精选则显示出较差的业绩持续能力。其中,华夏成长和嘉实增长有0.875的概率在同业中胜出市场基准,而排名靠后的申万菱信、海富通精选仅有37.5%的概率战胜市场,显示出较差的基金运作能力表现。

各只样本基金数据的回归结果中可以看到,不同于传统T-M模型,新的虚拟变量回归模型的可决系数 均到达0.9左右,这说明该回归模型整体上对变量数据拟合的很好。且个样本基金的新模型的T值检验、F值检验都全部通过,解释变量对被解释变量有显著影响。相比传统模型,虚拟变量回归模型中的分段方程更能客观准确地反映市场基准组合超额收益率

均到达0.9左右,这说明该回归模型整体上对变量数据拟合的很好。且个样本基金的新模型的T值检验、F值检验都全部通过,解释变量对被解释变量有显著影响。相比传统模型,虚拟变量回归模型中的分段方程更能客观准确地反映市场基准组合超额收益率 在不同市场环境下对基金超额收益率

在不同市场环境下对基金超额收益率 的实质影响,即从长期角度来看,我们可以做到跟踪考察各只样本基金在不同阶段的表现,新模型更能客观细致的描述样本基金相对于市场基准的业绩变化,我们由此肯定:基于新模型设计的业绩评价新方法——“胜负链统计法”更为客观合理。

的实质影响,即从长期角度来看,我们可以做到跟踪考察各只样本基金在不同阶段的表现,新模型更能客观细致的描述样本基金相对于市场基准的业绩变化,我们由此肯定:基于新模型设计的业绩评价新方法——“胜负链统计法”更为客观合理。

我们由以上实证结果可以得出以下对国内基金市场有实际意义的结论:

1) 某些基金在盈利表现与运作能力表现上比市场基准略胜一筹。虽然国内许多基金经理不能战胜市场,但现实中一些认真管理、积极主动的老牌基金业绩表现却能高于市场。

2) 国内开放式基金运作良莠不齐。利用本文的新方法,可检验出许多国内基金的 的长跨期表现甚至不如

的长跨期表现甚至不如 ,这意味着长期来看,许多基金经理无法战胜大盘。这也为投资人敲响了投资基金的警钟:必须择优汰劣。

,这意味着长期来看,许多基金经理无法战胜大盘。这也为投资人敲响了投资基金的警钟:必须择优汰劣。

Table 2. Empirical conclusions of 10 example funds

表2. 10只样本基金的实证结论

5. 总结

1) 本文指出了传统指标在评价基金长期业绩时可能产生的谬误,揭示了T-M模型中含有无效的解释变量,从而引起“伪回归”现象。它不适用于基金长期业绩的评价。本文设计出的虚拟变量回归模型克服了传统模型无效回归的弊端。新模型可以对基金业绩考察进行分段、细致的长期跟踪研究,结论更加符合实际。

2) 本文设计了新的“胜负链统计法”,可依照市场基准(大盘表现)对基金长期业绩进行相对客观的评价。新方法所依据的虚拟变量模型如实地拟合了基金长期业绩数据,真实地反映了它们的长期投资水平——在此基础上设计的胜负链 值可对基金长期投资业绩战胜大盘的概率做出合理估计,提供了一个全新的评价思路。

值可对基金长期投资业绩战胜大盘的概率做出合理估计,提供了一个全新的评价思路。