1. 引言

税收是国家财政收入和公共支出的主要来源,同时为国家执行公信力和权力提供资金支持。在税收的组成成分中,企业所得税所占的比例越来越大,因此对于企业所得税的研究显得越来越重要。对企业所得税进行有效的规避,从而实现企业价值最大化,这已经成为众多企业高管必须关注的问题。

现代企业的重要特征之一是“所有权与经营权的分离”,在现代企业中,由于“委托-代理关系”的存在,所有者会设计相关的激励薪酬,使企业管理者与自己的利益函数趋于一致,从而促使管理者采取更多有利于所有者利益的避税决策,最终影响企业的避税。与此同时,管理人员在进行避税决策时也会受到企业当前所采用的商业战略的影响,因此,不同的商业战略会影响管理者对风险和不确定性的态度,并最终影响企业的所得税避税程度。

本文首先从不同高管激励(即货币激励和股权激励)的角度研究高管激励对企业所得税规避程度的影响,然后,基于商业战略的角度,研究在不同商业战略的背景下,高管激励与企业所得税避税间的关系。

2. 文献综述

2.1. 高管激励与企业所得税避税关系的研究

高管激励与企业所得税避税程度关系的研究在最近十几年开始兴起,外国学者的研究得出了不同的结论。Gupta和Swenson(2003)[1] 研究发现,给予管理者的激励薪酬越高,管理者在公司里采取的避税措施也会越多,从而增加企业的税后收益。Phillips(2003)[2] 研究发现对业务部经理给予的薪酬激励能增加企业所得税规避的程度。Erickson等(2006)[3] 认为,高额的高管激励会对企业的避税行为造成显著的正向影响。也有学者研究得出了不同的结论。Desai和Dharmapala(2006)[4] 研究发现,高管人员获取的激励报酬越高,对公司的避税行为造成的影响越大,在高管避税行为与管理者寻租行为正相关的情况下,高管人员获得的激励报酬与公司避税行为呈反比关系。

由于我国经济存在着特殊性,国有经济占有很大的比例,因此国内学者在进行研究时充分考虑了企业所有权的影响。宋佩君(2009)[5] 发现,增加高管持股比例将会显著降低企业的所得税避税水平,同时,在不同的股权结构下,民营控股上市公司比国有控股上市公司的这种负效应会更加显著。张天敏(2012)[6] 认为,公司所有者给予管理者的股权激励越高,管理者在企业中进行的所得税避税决策也会越多。同时,在非国有控股企业中,股权激励对管理者的激励效用更强。

2.2. 商业战略的研究

波特认为商业战略是一系列包括。Miles等(1978)[7] 首次提出了商业战略模型的理论框架,他们提出了四种不同的商业战略模式:防御者、分析者、探索者和反应者。Hambrick(1983)[8] 对Miles等的商业模型理论框架作了验证和拓展,研究发现,在当期盈利和现金流方面,采用防御者战略的企业比采用探索者战略的企业表现得更好;采用探索者战略的企业拥有更高的市场份额,但这仅仅局限在新兴产品市场上。Higgins等(2011)[9] 从避税的角度研究了商业战略,研究发现,采用探索者战略的企业避税更积极,而采用防御者战略的企业避税更加消极。

商业战略在国内是一个较新的研究领域,因此国内目前关于商业战略的研究较少。吕伟等(2011)[10] 研究发现,采用探索者战略的企业的避税行为更积极,采用防御者战略的企业对于避税行为的态度更加消极。吕伟等(2012)[11] 从产权的角度对商业战略和避税的关系进行了更进一步的研究。研究发现,由于产权安排导致的避税激励差异,商业战略对于避税行为的影响主要存在于国有企业。

3. 商业战略理论和研究假设

3.1. 商业战略理论

波特认为,商业战略包括一系列财务政策、组织结构等活动,制定恰当的商业战略是一个公司在自己所处行业中获得可持续竞争优势的最佳方法。Miles等于1978年首次提出了商业战略模型的理论框架。他们认为一个组织在成长过程中旨在解决下面三个问题:创业问题、工程问题和管理问题。公司为了解决这三大问题,所采取的措施便形成了四种商业战略模式:防御者、探索者、分析者和反应者。

防御者(Defenders)战略的理念是建立一个稳定的组织形式,其在解决创业问题时的工作重心是保证组织所需的稳定性;在工程阶段,防御者会投入大量的资源,以提高生产产品和分配服务的效率;在管理阶段,防御者通过设计一种“机械”的管理系统,从而保持对组织机构的严格控制以确保效率。稳定性和效率是防御者企业赢得市场竞争的关键因素。

探索者(Prospectors)战略与防御者注重效率和稳定性不同,探索者更重视创新。在创业阶段,探索者的任务是寻找以及发展新的产品和市场;在工程阶段,探索者需要设计出灵活的技术以适应多元化的产品;在管理阶段,探索者需要将资源部署和协调给大量分散的单位和项目,而不是集中规划和控制整个组织的运作。对探索者而言,创新和灵活是其成功的关键。

分析者(Analyzers)战略是防御者和探索者的组合,兼有防御者和探索者的特点,但相比较上述两种战略其特点显得不够鲜明。分析者在解决三大问题时既要注重企业的稳定性,同时还得在稳定的基础上进行适当的创新。分析者最大的特点是平衡和中庸。

反应者(Reactors)战略与其他三种战略不同,反应者只能被动地根据外界环境做出反应,其响应外界环境的模式既矛盾,又不稳定。因此,与前三种商业战略相比,反应者战略是一种失败的战略。

Miles等认为公司在试图适应其竞争环境时的战略可以形成一个战略链条,链条的一端是防御者,另一端是探索者。采用不同战略的公司对成本和风险态度的差异会导致企业不同的避税行为。

3.2. 研究假设

货币激励中包含与企业当期绩效挂钩的年终奖励,公司高管采取更多避税措施在短期内能够明显提高企业的当期绩效,从而增加自己获得的与企业当期绩效挂钩的货币薪酬,这正是公司高管短期内所关注的。由此提出假设一:

H1:高管货币激励与企业所得税避税程度呈正相关关系。

在长期范围里,激进的避税行为会形成代理成本,并增加企业被税务机关检查的概率,因此避税并不一定会使企业价值得到提升,甚至有可能使企业价值降低。在这种情况下,为了使自己持有的股票达到价值最大化,企业高管会减少避税措施的施行。由此提出假设二:

H2:高管股权激励与企业所得税避税程度呈负相关关系。

Higgins等(2011)认为,采用探索者战略的公司更侧重于新产品的研发和新市场的开拓,更愿意接受结果的不确定性和承担高风险。因此,采用探索者战略的企业往往更愿意实行激进的避税策略。由此得出假设三:

H3:采用探索者战略的企业更倾向于规避企业所得税。

防御者战略的核心要求之一是稳定性,而激进的避税方案会与防御者战略的稳定性要求产生巨大的冲突,这将严重影响防御者企业的市场竞争力。因此,采用防御者战略的企业在面对避税方案时会更加的谨慎。由此得出假设四:

H4:采用防御者战略的企业其所得税避税行为更消极。

4. 研究设计

4.1. 变量选取

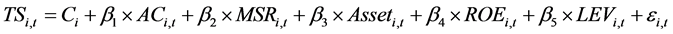

本文的变量分为被解释变量、解释变量和控制变量三类。其中被解释变量为剔除盈余管理后的会计–税收差异(TS);解释变量为公司所有者给予高管的激励,包括高管货币收入总额(AC)和高管持股比例(MSR)这两个指标;控制变量则包括公司总资产(Asset)、净资产利润率(ROE)以及公司的资产负债率(LEV)。

表1为各变量的定义。

4.2. TS的衡量标准

本文借鉴了Desai和Dharmapala(2006)的方法,通过计算会计–税收差(BTD)和企业盈余管理引起的会计–税收差(TA)来度量企业所得税避税程度。

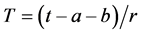

会计–税收差异为企业当期会计利润与企业当期应纳税所得额的差异。企业的会计利润通过翻阅公司年报得到,而企业应纳税所得额则需要通过计算得到。假设企业适用的企业所得税率为r,企业当期缴纳的企业所得税为t,企业当期递延所得税负债增加额为a,企业当期递延所得税资产减少额为b,那么企业当期应纳税所得额为: 。

。

Table 1. The variable definitions

表1. 各变量定义

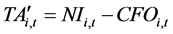

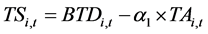

计算得到的会计–税收差异还需要剔除企业盈余管理的影响部分,剩下的部分即可用于对企业避税程度的衡量。盈余管理的度量公式如下:

(1)

(1)

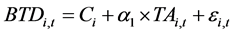

式中TA'为盈余管理活动造成的会计–税收差异;NI为企业的净利润;CFO为企业的经营活动现金流量净额;i为企业的序号;t为年份。在计算出企业的盈余管理程度后,再建立如下的模型:

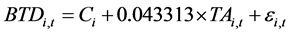

(2)

(2)

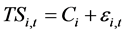

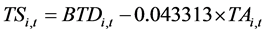

式中BTD为企业的会计–税收差异与公司总资产的比值;TA为企业盈余管理活动造成的会计–税收差异与公司总资产的比值。模型中会计–税收差异剔除由盈余管理活动造成的影响后剩下的部分Ci + εi,t即能够用于衡量企业避税程度TSi,t,即 或

或 。

。

使用Eviews 7.2和面板广义最小二乘估计法(Pooled EGLS),对模型2进行回归,得到的结果如下:

从表2可以看出,BTD和TA之间的系数为0.043313,p值在0.001的水平上显著,两者之间呈显著正相关关系。相应的回归方程为:

由此可以得到企业的所得税规避程度TS:

。

。

4.3. 商业战略模式的度量标准

Hambrick(1983)研究发现,采用探索者战略的企业拥有更高的研发费用支出和销售费用;采用防御者战略的企业则拥有更高的资本密集度和更高的员工生产力。本部分将结合Hambrick(1983)的研究,提出以下四个衡量商业战略模式的维度(表3):

同时,参考吕伟等(2011)的方法,对R&D、EA和SA分别按年份进行从大到小排序,对FA按年份从小到大排序,前四分之一的公司得4分,次一级的公司得3分,以此类推。然后将同一家公司三年的数据加总,各公司的总分取值范围是[12, 48]。然后选取总分为[36, 48]的公司为采用探索者战略的公司,选取总分为[12, 24]的公司为采用防御者战略的公司。

4.4. 回归模型和研究方法

根据前文的假设和变量定义,本文提出模型3对高管激励与企业所得税避税之间的关系进行检验:

(3)

(3)

本文选取了平衡面板数据,采用固定效应变截距模型。在分析方法上,选择面板广义最小二乘估计法。在研究工具方面,使用了Excel 2013表格和Eviews 7.2统计软件。

5. 实证研究

5.1. 数据选取

本文选取了2010~2012年中国沪深两市所有A股上市公司的数据。为了提高研究结果的精确性和数据的有效性,在excel 2013表格上按照下述顺序对原始数据进行了整理:

1) 剔除数据残缺不全的样本;

2) 剔除本年度股票带有ST和*ST的公司样本;

3) 剔除金融类企业的样本;

Table 2. Regression results of BTD

表2. BTD的回归结果

Table 3. The four dimensions to measure business strategy

表3. 衡量商业战略的四个维度

4) 剔除所得税税率为0(即免税)的公司样本;

5) 剔除经过计算得出的企业当期应纳税所得额小于0的公司样本;

6) 剔除会计–税收差异小于0的公司样本;

7) 剔除只有一年或两年数据的公司样本。

结果得到的平衡面板数据包含140家公司共420个样本。选取总分为[36, 48]的公司为采用探索者战略的公司,包括28家公司共84个样本;选取总分为[12, 24]的公司为采用防御者战略的公司,包括34家公司共102个样本。

5.2. 总样本的实证研究

5.2.1. 描述性统计

总样本的描述性统计如表4所示:

根据表4可以得到:总样本中公司高管层的货币激励整体差距较大;我国上市公司高管持股比例从整体上看比国外上市公司低;而在公司规模、净资产收益率和资产负债率方面,不同企业间的差距也很大。

5.2.2. 实证研究

总样本回归的结果如表5所示:

根据回归结果可以得知:

1) 高管货币激励AC与企业所得税避税程度TS的回归系数为0.001820,p值为0.0078,在0.01的水平上显著。这表明公司高管货币激励与企业所得税避税程度呈显著正相关关系。回归结果与前文分析是一致的,从而证明了假设一。

2) 高层股权激励MSR与企业所得税避税程度TS的回归系数为−0.011094,p值为0.0008,在0.001的水平上显著。这说明公司高管股权激励与企业所得税避税程度呈显著负相关关系。假设二得到了证明。

Table 4. Descriptive statistics of the total sample

表4. 总样本的描述性统计

Table 5. The regression results of the total sample

表5. 总样本的回归结果

5.3. 不同商业战略样本的实证研究

5.3.1. 描述性统计

探索者战略的公司样本和防御者战略的公司样本的描述性统计如表6和表7。

对比表6和表7可以发现:从整体水平上看,采用不同商业战略的公司对本公司高管给予的货币激励从整体上看相差不大;采用探索者战略的公司更重视对本公司高管的股权激励;在企业规模和资产负债率方面,采用防御者战略的企业从整体上看更高;而在净资产收益率方面,采用探索者战略的公司表现得更好。

5.3.2. 实证研究

探索者战略样本的回归结果如表8所示

根据回归结果,可以得到:

1) 高管货币激励AC与企业所得税避税程度TS的回归系数为0.025506,p值为0.0001,在0.001的水平上显著。这表明在采用探索者战略的企业中,高管人员获得的的货币激励越高,其进行避税活动的

Table 6. Descriptive statistics of the prospector strategy sample

表6. 探索者战略样本的描述性统计

Table 7. Descriptive statistics of the defender strategy sample

表7. 防御者战略样本的描述性统计

Table 8. The regression results of the prospector strategy sample

表8. 探索者战略样本的回归结果

意愿越强烈。

2) 高层股权激励MSR与企业所得税避税程度TS的回归系数为0.044144,p值为0.0484,在0.05的水平上显著。这表明在采用探索者战略的企业中,公司高管人员持有的公司股份越多,其进行避税活动的的意愿越强烈。

综上所知,在采用探索者战略的企业中,公司所有者对公司高管人员的货币激励和股权激励均能促使管理人员进行避税活动。因此,采用探索者战略的企业更倾向于企业所得税避税。假设三由此得到证明。

接下来对防御者战略样本进行回归分析。回归结果如表9所示:

根据回归结果,可以得到:

1) 高管货币激励AC的p值为0.0636,略大于0.05。这表明在采用防御者战略的公司中,高管人员获得的货币激励与企业避税程度没有显著关系。

2) 高层股权激励MSR的p值为0.9488,远大于0.05。这表明在采用防御者战略的公司中,高管人员获得的股权激励与企业避税程度没有显著关系。

综上所述,在采用防御者战略的公司中,公司所有者对公司高层管理人员的货币激励和股权激励与企业所得税避税程度之间均没有显著的关系。因此,采用防御者战略的企业在企业所得税避税上显得更消极。假设四由此得到证明。

6. 研究结论

根据前文的研究,本文得到如下的结论:

1) 公司高管货币激励与企业所得税避税程度呈显著正相关关系;公司高管股权激励与企业所得税避税程度呈显著负相关关系

公司所有者给予公司高管的货币激励具有短期效应,往往与公司当期的绩效有关。在短期内,避税带来的正效应要大于负效应,公司高管为了获取更高的货币薪酬,必然会加强公司避税活动,提高公司当期绩效,从而使自己的短期效益最大化。因此,公司所有者给予公司高管的货币激励越高,公司高管越有可能进行企业所得税避税活动。

与货币激励不同的是,股权激励具有长期效应,与公司的长期市场价值有关。在长期范围,由于避税成本和税务机关检查风险等避税负效应的存在,高管采取避税措施并不一定会提高公司的价值,甚至

Table 9. The regression results of the defender strategy sample

表9. 防御者战略样本的回归结果

有可能会降低公司的价值。在长期范围内,公司高管会减少避税活动,使公司的市场价值最大化,从而最大化自己的长期效益。因此公司所有者给予管理者的股权激励能显著抑制企业所得税的规避程度。

2) 采用探索者战略的企业更倾向于企业所得税避税

相比采用防御者战略的公司,采用探索者战略的公司更加侧重于新产品的研发和新市场的开拓,更愿意接受结果的不确定性和承担高风险。因此,采用探索者战略的企业往往更愿意实行激进的避税策略,即这些企业的所有者给予高管人员的货币激励和股权激励均会促进高管人员采取避税措施,减少企业所得税税负。

3) 采用防御者战略的企业其所得税避税行为更消极

防御者战略的核心要求是稳定性,而激进的避税方案会给防御者带来较大的结果的不确定性和被税务部门检查的高风险性,因此激进的避税策略会严重影响防御者企业的市场竞争力。与此同时,参与激进的避税活动也会给公司造成声誉上的巨大损失,对防御者的产品销售造成巨大的影响。因此,采用防御者战略的企业在面对避税方案时会更加的谨慎,其避税行为也会更加消极。

本文的研究结果可以对我国企业所有者关于高管薪酬激励计划的设计和权衡提供理论上的帮助;本文研究的不同商业战略下高管激励对企业所得税避税的影响也能给税务监管部门的税收征管提供一定的理论支持。

NOTES

*通讯作者。