摘要:

本文研究多资产期权确定最佳实施边界的问题,建立了多维Black-Scholes方程在多维区域

Ω≅{(s,t)|s∈R+ m,t∈(0,T)} 具有奇异内边界函数向量s=s(t)=(s1(t),...,sm(t)),

0∠t∠T 的数学模型,期权价格函数为未知函数。应用矩阵理论和广义特征函数法获得了期权价格函

数的精确解 u(s,t)。并获得了奇异内边界的指数函数向量表达式

(s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t)) 。证眀了:当任意t∈(0,T) ,数学模型

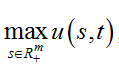

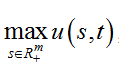

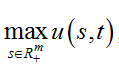

的解u(s,t)在奇异内边界取区域R+ m:0∠Sj∠∞,j=1,...,m 中的最大值,即

u(s(t),t)= t∈(0,T) ;同时获得了 Black-Scholes方程的自由边界问题A和自由

t∈(0,T) ;同时获得了 Black-Scholes方程的自由边界问题A和自由

边界问题B的精确解和其自由边界的指数函数向量表达式

(s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t)) ,问题A和问题B的自由边界与奇异内边界

重合。从而指数函数向量表达式

s(t)=(s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t)) 为最佳实施边界。指数函数向量

(s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t))

满足条件 ,

,

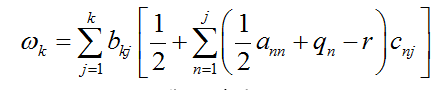

k=1,...,m;且有ωk 的计算公

式 ;公式表明ωk,k=1,...,m 由多维

;公式表明ωk,k=1,...,m 由多维

Black-Scholes方程中出现的所有参数akj ,qj ,r 唯一确定。

Abstract:

In this paper, we study the problem of determining the optimal implementation boundary

of multi- asset option, and establish a mathematical model of multidimensional Black-Scholes

equation with singular inner boundary function vector

s=s(t)=(s1(t),...,sm(t)),0∠t∠T , In multi-dimension region Ω≅{(s,t)|s∈R+ m,t∈(0,T)}

the option price function is an unknown function. The exact solution u(s,t) of the mathem-

atical model is obtained by using the matrix theory and the generalized characteristic function

method. And the exponential function vector expression of the singular inner boundary is ob-

tained (s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t)) . It is demonstrated that: when any

t∈(0,T) ,the maximum value  of the solution u(s,t) of the region

of the solution u(s,t) of the region

R+ m:0∠Sj∠∞,j=1,...,m is obtained on the singular boundary, namely u(s(t),t)= .

.

The free boundary problem A and free boundary problem B of Black-Scholes equation are solved.

The free boundary of problem A and B is expressed by the function vector

R+ m:0∠Sj∠∞, j=(s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t))1,...,m .

The free boundary of the problem A and problem B coincides with the singular inner boundary. So

the vector expression of the exponential function is the best implementation of the boundary. The

exponential function vector (s1(t),...,sm(t))=(θ1eω1(T-t),...,θmeωm(T-t)) satisfies

the condition ,k=1,...,m; and ωk is calculated

,k=1,...,m; and ωk is calculated

by ; the formula shows that ωk is only determined by all

; the formula shows that ωk is only determined by all

the parameters appearing in the multidimensional Black-Scholes equation.

1. 引言

期权是风险管理的核心工具,姜礼尚 [1] 对期权定价理论作了系统深入的阐述,利用偏微分方程理论和方法对期权理论作深入的定性和定量分析,特别对美式期权展开了深入的讨论。美式期权合约中具有提前实施的条款,因此最佳实施边界的确定对于美式期权具有特殊意义。在美式期权定价研究中,姜礼尚 [1] 建立了Black-Scholes方程的自由边界问题,对最佳实施边界 作了很多深入的研究,得到很多重要的结论。其中包括

作了很多深入的研究,得到很多重要的结论。其中包括 的位置,

的位置, 的单调性,

的单调性, 的上下界以及

的上下界以及 的凸性等,并给出了

的凸性等,并给出了 在

在 附近的渐近表达式。这些结果增加了对最佳实施边界的认识,对美式期权定价的数值计祘产生了重要的影响。期权定价问题历来是金融经济学中的重要研究课题之一 [1] - [8] ,多年来,众多经济学者与研究人员对这一问题进行不断深入的研究,但是这些研究大多是围绕具有单个资产的期权进行的。多资产期权在现代金融交易市场中占有重要的地位,研究多资产(或单个资产)期权定价模型大多是围绕数值解法进行的 [9] - [21] ,姜礼尚 [1] 建立了关于期权价格函数

附近的渐近表达式。这些结果增加了对最佳实施边界的认识,对美式期权定价的数值计祘产生了重要的影响。期权定价问题历来是金融经济学中的重要研究课题之一 [1] - [8] ,多年来,众多经济学者与研究人员对这一问题进行不断深入的研究,但是这些研究大多是围绕具有单个资产的期权进行的。多资产期权在现代金融交易市场中占有重要的地位,研究多资产(或单个资产)期权定价模型大多是围绕数值解法进行的 [9] - [21] ,姜礼尚 [1] 建立了关于期权价格函数 的多维Black-Scholes方程

的多维Black-Scholes方程

(01)

(01)

其中矩阵 为实对称非负矩阵。研究关于方程(01)的多资产期权的数学模型。

为实对称非负矩阵。研究关于方程(01)的多资产期权的数学模型。

由于

(02)

(02)

故方程(01)可改记为

(03)

(03)

本文研究多资产期权确定最佳实施边界的问题,建立了多维Black-Scholes方程在多维区域 具有奇异内边界函数向量

具有奇异内边界函数向量 的数学模型,期权价格函数

的数学模型,期权价格函数 为未知函数。应用矩阵理论和广义特征函数法获得了数学模型的精确解

为未知函数。应用矩阵理论和广义特征函数法获得了数学模型的精确解 。并获得了奇异内边界的指数函数向量表达式

。并获得了奇异内边界的指数函数向量表达式 。证眀了:当任意

。证眀了:当任意 ,数学模型的解

,数学模型的解 在奇异内边界取

在奇异内边界取 中的最大值,即

中的最大值,即 ;同时获得了Black-Scholes方程的自由边界问题A和自由边界问题B的精确解和其自由边界的指数函数向量表达式

;同时获得了Black-Scholes方程的自由边界问题A和自由边界问题B的精确解和其自由边界的指数函数向量表达式 ,问题A和问题B的自由边界与奇异内边界重合。从而指数函数向量表达式

,问题A和问题B的自由边界与奇异内边界重合。从而指数函数向量表达式 为最佳实施边界。指数函数向量

为最佳实施边界。指数函数向量 ,满足条件

,满足条件 ;且有

;且有 的计算公式

的计算公式 ;公式表明

;公式表明 由多维Black-Scholes方程中出现的所有参数

由多维Black-Scholes方程中出现的所有参数 ,

, ,

, 唯一确定。

唯一确定。

2. 主要结果

2.1. 多资产期权的数学模型I的研究

引入记号

数学模型I (多维Black-Scholes方程具有奇异内边界的终值问题):

数学模型I是关于多资产期权的数学模型,它是多维Black-Scholes方程在区域 具有奇异内边界

具有奇异内边界 ,

, 的终值问题,未知函数

的终值问题,未知函数 为期权价格函数。

为期权价格函数。

其中:方程的自由项为

(4)

(4)

为狄拉克

为狄拉克 -函数;

-函数; 为

为 维狄拉克

维狄拉克 -函数;

-函数; ,

, 为实对称非负矩阵。

为实对称非负矩阵。

数学模型I.1 (多维Black-Scholes方程的终值问题):

(5)

(5)

数学模型I.2 (多维Black-Scholes方程具有奇异内边界和齐次终值条件的终值问题):

(6)

(6)

2.1.1. Black-Scholes方程数学模型I的求解

记偏微分算子

(7)

(7)

先考虑m维Euler方程在半无界区域 的特征值问题I

的特征值问题I

为求解特征值问题I我们建立了引理1.1~引理1.6。

引理1.1:设 为正定矩阵,则存在正线下三角矩阵

为正定矩阵,则存在正线下三角矩阵 满足

满足 且分解是唯一的;且有

且分解是唯一的;且有

1) 正线下三角矩阵 的行列式

的行列式 ,

, ;

; ;

;

2) 由 唯一确定

唯一确定 ;由

;由 唯一确定

唯一确定 ;

;

3) 记 ,则

,则 为正线上三角矩阵,

为正线上三角矩阵,

;由

;由 唯一确定

唯一确定 ;

;

4) 记 ,

, ;则当

;则当 时,有

时,有 。从而当

。从而当 ,

, ,有

,有 ;

; ,有

,有 。

。

证明:由矩阵理论 [22] 即知存在正线下三角矩阵 满足

满足 且分解是唯一的。由

且分解是唯一的。由 有

有 。

。

正线下三角矩阵 ,正线下三角矩阵

,正线下三角矩阵 的行列式

的行列式 ,且

,且 ;

; 的转置矩阵

的转置矩阵 为正线上三角矩阵。

为正线上三角矩阵。 的逆矩阵

的逆矩阵 为正线上三角矩阵。

为正线上三角矩阵。 。

。

下证4)由于 为正线上三角矩阵,即有

为正线上三角矩阵,即有 和

和 ;从而有

;从而有

为列向量,应用分块矩阵的乘法运算即有

为列向量,应用分块矩阵的乘法运算即有

从而有

(10)

(10)

由于 即有

即有

(11)

(11)

为正定矩阵,则

为正定矩阵,则 为正定矩阵,

为正定矩阵, 为正定二次齐式,从而有

为正定二次齐式,从而有

(12)

(12)

(13)

(13)

由 的任意性,分别令

的任意性,分别令 ,

,

其中 。

。

由(13)式即有

即

从而

(14)

(14)

再记 ;有

;有 和

和

(15)

(15)

由(14),(15)两式即有:当 ,

, ,有

,有 ;显然也有:当

;显然也有:当 ,

, ,有

,有 。引理证毕。

。引理证毕。

记 ,作

,作 到

到 的线性变换

的线性变换

(16)

(16)

记 (17)

(17)

引理1.2:若 ,则有

,则有

(18)

(18)

其中 为向量变系数偏微分算子。

为向量变系数偏微分算子。

证明(16)式即

(19)

(19)

由(17)式即有

(20)

(20)

由复合函数的求导法则

(21)

(21)

从而

即(18)式成立。引理证毕。

m维Euler方程在半无界区域 的特征值问题II

的特征值问题II

其中 ,

, (24)

(24)

引理1.3:若 ,则特征值问题I中方程(8)与特征值问题II中方程(22)等价。

,则特征值问题I中方程(8)与特征值问题II中方程(22)等价。

证明:由 ,有

,有

(25)

(25)

(26)

(26)

记 ,由引理1.1矩阵

,由引理1.1矩阵 为正线上三角矩阵。

为正线上三角矩阵。

由(18)式有

(27)

(27)

由矩阵乘法

(28)

(28)

从而

(29)

(29)

(30)

(30)

由于 为正线上三角矩阵有

为正线上三角矩阵有

记

(31)

(31)

即有

(32)

(32)

由(26),(32)两式即知方程(8)与方程(22)等价。引理证毕。

引理1.4:特征值问题II的特征值

(33)

(33)

所对应的特征函数为

(34)

(34)

且有

(35)

(35)

证明:容易求解特征值问题II:由分离变量法令

(36)

(36)

(37)

(37)

再令

(38)

(38)

(39)

(39)

(40)

(40)

(41)

(41)

(42)

(42)

若(42)式成立则(41)式成立;特征函数

不恒为零,由(42)推出

(43)

(43)

(44)

(44)

(45)

(45)

(46)

(46)

(47)

(47)

(48)

(48)

由(48)式即有(23)式成立。引理证毕。

由(16)和(17)式换回原变量即得特征值问题I的特征函数

(49)

(49)

且

(50)

(50)

(51)

(51)

由(51)式即有(9)式成立。于是得到

引理1.5:特征值问题I的特征值

(52)

(52)

所对应的特征函数为

(53)

(53)

引理1.6:特征值问题I的特征函数系 是半无界区域

是半无界区域 带权函数

带权函数 的完备正交系;正交关系即

的完备正交系;正交关系即

(54)

(54)

证明:由于

(55)

(55)

引入变量代换

(56)

(56)

由于行列式

即有变量替换的雅可比行列式

(57)

(57)

由多重积分变量替换公式,即有

(58)

(58)

(58)式即(54)式。引理证毕。

由引理1.5与引理1.6的结论可以引入广义特征函数法 [23] [24] 求解 数学模型I。

不妨设解 ,将其表为特征函数的积分形式

,将其表为特征函数的积分形式

(59)

(59)

将上式两边乘以 再关于变量

再关于变量 在

在 积分,利用正交关系(54)则有

积分,利用正交关系(54)则有

(60)

(60)

得到

(61)

(61)

将方程中的自由项 也表为特征函数的积分形式

也表为特征函数的积分形式

(62)

(62)

由(61)即有

(63)

(63)

应用 -函数的积分性质即得

-函数的积分性质即得

(64)

(64)

含参变量积分与算子 的运算交换次序即有

的运算交换次序即有

(65)

(65)

(66)

(66)

由(2)即有

(67)

(67)

(68)

(68)

将(62),(65),(66)代入方程(1)即有

(69)

(69)

由特征函数系的完备正交性即有 ,再由(68)式即得

,再由(68)式即得

非齐次常微分方程的终值问题

(70)

(70)

用常数变易法得到非齐次常微分方程的终值问题的解为

(71)

(71)

将上式代入(59)式即得

(72)

(72)

将 的表达式(52),(53)代入(72),并记

的表达式(52),(53)代入(72),并记

(73)

(73)

(74)

(74)

(75)

(75)

其中 由(68),

由(68), 由(64)确定。

由(64)确定。

由(74)式即有

于是有

(76)

(76)

将 的表达式代入(64)式,化简即得

的表达式代入(64)式,化简即得

(77)

(77)

将(77)代入(75)式,并化简

即得

(78)

(78)

定理1 (数学模型I解的存在定理):若

1) 为正定对称矩阵,

为正定对称矩阵, ;

;

2) 为充分光滑的单调函数;

为充分光滑的单调函数;

3) 。

。

则数学模型I有精确解:

(79)

(79)

(80)

(80)

(81)

(81)

且数学模型I.1的解 由(80)式给出,数学模型I.2的解

由(80)式给出,数学模型I.2的解 由(81)式给出。

由(81)式给出。

2.1.2. 多维Black-Scholes方程奇异内边界 的确定

的确定

数学模型II (多维Black-Scholes方程确定奇异内边界的终值问题):

求 ,使其满足

,使其满足

定理2 (数学模型II解的存在定理):若

1) 为正定对称矩阵;

为正定对称矩阵;

2) 为充分光滑的单调函数;

为充分光滑的单调函数;

3) 。

。

则数学模型II有连续有界的精确解

数学模型II有解的相容性条件是

(89)

(89)

其中

(90)

(90)

(91)

(91)

(92)

(92)

(93)

(93)

证明:由定理1(数学模型I解的存在定理)的结论,(81)式给出的 已满足条件(82) (83) (85)三式,让

已满足条件(82) (83) (85)三式,让 满足条件(84)式去确定奇异内边界

满足条件(84)式去确定奇异内边界 。

。

将(81)式 记为

记为

(94)

(94)

由(94)式对 关于自变量

关于自变量 求偏导,由复合函数的求导法则有

求偏导,由复合函数的求导法则有

(95)

(95)

若令

(96)

(96)

则

即有

(97)

(97)

将(97)式代入(95)式即有

(98)

(98)

下面建立引理2.1~引理2.4来完成定理2的证明。

引理2.1:条件(96)成立,则有

(99)

(99)

和

(100)

(100)

证明:若条件(96)成立,则有(98)成立。由(98)式易知(100)式成立。

由(98)即得到対任意 有

有

1) 当 有

有

由引理1.1的结论4)即有即有:当 ,有

,有 成立,从而

成立,从而

(101)

(101)

2) 当 有

有

由引理1.1中结论4)即有:当 ,有

,有 成立,从而

成立,从而

(102)

(102)

从而(99)式成立。引理证毕。

引理2.2:条件

(103)

(103)

成立的充要条件为

(104)

(104)

证明:1) 必要性,若(103)成立,由 即有

即有

(105)

(105)

记

(106)

(106)

由(105)式有

(107)

(107)

让 即有

即有

(108)

(108)

干是有(104)式成立。

2) 充分性,若(104)式成立,即有

即(103)成立。引理证毕。

引理2.3:当条件

成立时,则条件(96)成立,从而有 。

。

证明:由(109)式则有

(111)

(111)

再由(110)式即有

(112)

(112)

即条件(96)成立,由引理2.1即有 成立。引理证毕。

成立。引理证毕。

引理2.4:未知数 的线性方程组(110)的解为

的线性方程组(110)的解为

(113)

(113)

证明:线性方程组(110)写成矩阵形式即为

(114)

(114)

由 矩阵的定义即有

矩阵的定义即有 ,从而

,从而

(115)

(115)

(116)

(116)

由矩阵乘法即得线性方程组(110)的解由(113)式给出。引理证毕。

记

(117)

(117)

由引理2.1~引理2.4即知:当(117)成立时,有解 其中

其中 由(94)给出,

由(94)给出, 。由(117)式即有(96)成立,由引理2.1即有

。由(117)式即有(96)成立,由引理2.1即有 和

和 成立。

成立。

由(117)式即有(97)式成立,将(97)代入(94)即有:

(118)

(118)

再将(117)式代入(118)式,即有

(119)

(119)

引入记号: ,再由(119)即得到

,再由(119)即得到 由(87)给出。由(87)式给出的解

由(87)给出。由(87)式给出的解 满足条件(84)式和(85)式。从而满足数学模型II,即(87),(88)两式给出了数学模型II的解。由(87)式即知数学模型II有解的相容性条件是(89)式。定理证毕。

满足条件(84)式和(85)式。从而满足数学模型II,即(87),(88)两式给出了数学模型II的解。由(87)式即知数学模型II有解的相容性条件是(89)式。定理证毕。

引入记号

多维开区间 ,多维闭区间

,多维闭区间 。

。

函数的支集 ,支集的闭包

,支集的闭包 ,记函数集合

,记函数集合 。

。

记

(120)

(120)

(121)

(121)

定理3(数学模型I.1解的性质定理):若 为正定矩阵,

为正定矩阵, ;则

;则

1) 当 ;数学模型I.1的解

;数学模型I.1的解

(122)

(122)

满足

(123)

(123)

和

(124)

(124)

其中

(125)

(125)

2) 当 ,则数学模型I.1的解

,则数学模型I.1的解

(126)

(126)

且解 满足

满足

(127)

(127)

3) 当 ,数学模型I.1的解

,数学模型I.1的解

(128)

(128)

且解 满足

满足

(129)

(129)

证1): 数学模型I.1的解由定理1的(74)式给出,由 有

有

(130)

(130)

应用多维狄拉克 -函数的积分性质即得

-函数的积分性质即得

(131)

(131)

引入记号 即有

即有

(132)

(132)

由于 线性方程组(110)的解,由(110)即有

线性方程组(110)的解,由(110)即有

(133)

(133)

由(112)式即有

即有

(134)

(134)

由(132)和(134)两式即有

(135)

(135)

由于

(136)

(136)

从而

(137)

(137)

故 。由(132)对

。由(132)对 关于

关于 求偏导得到

求偏导得到

(138)

(138)

(139)

(139)

由(134),(139)即得(124)。

证2):数学模型I.1的解由定理1的(74)式给出。任意 即有

即有 。

。 ,故

,故 ,

, 。于是(74)式中积分的积分区域由

。于是(74)式中积分的积分区域由 变为

变为 。则数学模型I.1的解

。则数学模型I.1的解

(140)

(140)

由(140)关于 求偏导

求偏导

(141)

(141)

当 有

有 ;积分变量

;积分变量 ,有

,有 ;

;

(142)

(142)

又

(143)

(143)

记

;由(142),有

;由(142),有 ,引理1.1的结论4)即有

,引理1.1的结论4)即有 ;

;

从而由(143)有

(144)

(144)

再由(141)即有当 ,

,

(145)

(145)

当 ,

, ,从而有

,从而有 成立。

成立。

证3):当 ,由数学模型I.1的解(74)式即有(128)成立。由(128) 式对

,由数学模型I.1的解(74)式即有(128)成立。由(128) 式对 关于

关于 求偏导即有

求偏导即有

(146)

(146)

当 ,有

,有 ,

,

引理1.1的结论4)即有

由(146)即有:当 ,

, 。当

。当 ,

, ,从而有

,从而有 成立。定理证毕。

成立。定理证毕。

2.2. 关于多维Black-Scholes方程的自由边界问题的研究

由

即有

即

即

下面分别讨论关于多维Black-Scholes方程在 的自由边界问题A和在

的自由边界问题A和在 的自由边界问题B。

的自由边界问题B。

自由边界问题A (关于多维Black-Scholes方程在 的自由边界问题):求

的自由边界问题):求 ,使其满足

,使其满足

定理4 (自由边界问题A多解性定理):若

1) 为正定矩阵;

为正定矩阵;

2) ;

;

则自由边界问题A的有解 ,自由边界为

,自由边界为

(152)

(152)

具有多解性,第一解:

具有多解性,第一解:

(153)

(153)

有解的相容性条件

第二解:

(156)

(156)

有解的相容性条件

(159)

(159)

证明:当 由定理2的(87)式给出的解滿足齐次方程(147),故由(153)式和(156)式给出的解滿足齐次方程(147)。再由定理2,定理3的结论即知定理4成立。由(112),(152)两式即有

由定理2的(87)式给出的解滿足齐次方程(147),故由(153)式和(156)式给出的解滿足齐次方程(147)。再由定理2,定理3的结论即知定理4成立。由(112),(152)两式即有

(160)

(160)

推证相容性条件(158),由(141),(160)两式即得。定理证毕。

附注1:定理4中的笫二解对在函数集合 任意给定的

任意给定的 都有由(156)式给出的解

都有由(156)式给出的解 与之对应,即得到了一个解族

与之对应,即得到了一个解族 。

。

自由边界问题B (关于多维Black-Scholes方程在 的自由边界问题):求

的自由边界问题):求 ,使其满足

,使其满足

定理5 (自由边界问题B多解性定理):若

1) 为正定矩阵;

为正定矩阵;

2) ;

;

则自由边界问题B有解 ,自由边界为

,自由边界为

(166)

(166)

具有多解性,第一解:

具有多解性,第一解:

(167)

(167)

有解的相容性条件

第二解:

(170)

(170)

有解的相容性条件

(171)

(171)

(172)

(172)

其中

(173)

(173)

证明:当 由定

由定

理2的(87)式给出的解滿足齐次方程(161),故由(167)式和(170)式给出的解滿足齐次方程(161)。再由定理2,定理3的结论即知定理5成立。推证相容性条件(172)由(146) (160)两式即得。定理证毕。

附注2:定理5中的笫二解对在函数集合 任意给定的

任意给定的 都有由(170)式给出的解

都有由(170)式给出的解 与之对应,即得到了一个解族

与之对应,即得到了一个解族 。

。

2.3. 数学模型III与自由边界问题A和问题B的关系

数学模型III (多维Black-Scholes方程确定奇异内边界的终值问题):

求 ,使其满足

,使其满足

定理6 (奇异内边界与问题A和B的自由边界三线合一定理一):若

1) 为正定矩阵;

为正定矩阵;

2) ;

;

3) ;

;

4) ;

;

5) 。

。

则数学模型III与问题A和问题B有相同表达式的解

有解的相容性条件

(181)

(181)

其中

(182)

(182)

数学模型III的奇异内边界与问题A和问题B的自由边界三曲线重合成同一指数函数向量 ;数学模型III的解函数是问题A和B的解函数的共同连续开拓,即

;数学模型III的解函数是问题A和B的解函数的共同连续开拓,即

(183)

(183)

定义2:若 ,

, 由(183)定义,称

由(183)定义,称 为数学模型III与问题A和问题B的一致相容解。

为数学模型III与问题A和问题B的一致相容解。

定理7 (奇异内边界与问题A和B的自由边界三线合一定理二):若

1) 为正定矩阵;

为正定矩阵;

2) ;

;

3) ;

;

4) ;

;

5) 。

。

则数学模型III与问题A和问题B的一致相容解

有解的相容性条件

(186)

(186)

(187)

(187)

定理8 (奇异内边界与问题A和问题B的自由边界三线合一定理三):若

1) 为正定矩阵;

为正定矩阵;

2) ;

;

3) ;

;

4) ;

;

5) 。

。

则数学模型III与问题A和问题B的一致相容解

有解的相容性条件

(190)

(190)

其中

(191)

(191)

由定理6,定理7,定理8给出的一致相容解 满足条件

满足条件

(192)

(192)

即一致相容解 在任意时刻

在任意时刻 在

在 取

取 中的最大值

中的最大值 ,从而称

,从而称 为最佳实施边界。

为最佳实施边界。

定理9 (多资产期权最佳实施边界定理): 为正定矩阵,则期权价格函数

为正定矩阵,则期权价格函数 在任意时刻

在任意时刻 在

在

取

取 中的最大值

中的最大值 ,多资产期权最佳实施边界为指数函数向量

,多资产期权最佳实施边界为指数函数向量

(193)

(193)

满足

(194)

(194)

且有 的计算公式

的计算公式

(195)

(195)

公式(195)表明 由多维Black-Scholes方程中出现的所有参数

由多维Black-Scholes方程中出现的所有参数 ,

, ,

, 唯一确定。

唯一确定。

证明:由定理6,定理7,定理8即知期权价格函数 在任意时刻

在任意时刻 在

在

取

取 中的最大值

中的最大值 ,从而多资产期权最佳实施边界为指数函数向量(193)。关于

,从而多资产期权最佳实施边界为指数函数向量(193)。关于 的计算公式(93)式代入

的计算公式(93)式代入 的计算公式(92)式即得

的计算公式(92)式即得 的计算公式(195),由引理1.1即知

的计算公式(195),由引理1.1即知 皆由

皆由 唯一确定,从而

唯一确定,从而 由多维Black-Scholes方程中出现的所有参数

由多维Black-Scholes方程中出现的所有参数 ,

, ,

, 唯一确定。定理证毕。

唯一确定。定理证毕。

3. 结论

指数函数向量 为多资产期权的最佳实施边界,满足条件

为多资产期权的最佳实施边界,满足条件 ;且

;且 由多维Black-Scholes方程中出现的所有参数

由多维Black-Scholes方程中出现的所有参数 ,

, ,

, 唯一确定。

唯一确定。